Introduction

Expanding your presence in China on the unified NetSuite cloud ERP platform across finance, manufacturing, sourcing, sales, and operations offers a global company previously unheard-of levels of operational efficiency and financial transparency for multinational corporations utilizing Oracle NetSuite. NetSuite is crucial to your company’s ability to comply with China’s legal reporting requirements for business, including tax and regulatory compliance.

China’s tax administration is continuously being digitized. Through intelligent transformation and digitization, the Chinese tax bureau has worked to achieve advanced tax administration. The introduction of Phase IV of the Golden Tax System and the deployment of fully digitalized e-fapiao (e-invoices) are recent initiatives. Businesses face greater tax risks under this trend of tax digitization, as big data technology will enhance the tax bureau’s ability to identify non-compliant tax practices.

China Terminology

Terms used in NetSuite for China-specific business processes:

| Term | Definition |

| China Cash Flow Item 中国现金流量表项 | Accounts Payable and Accounts Receivable transactions. |

| China Cash Flow Statement Report 中国现金流量表 | The China Cash Flow Statement Report shows transactions affecting a company’s cash balance during a selected period. |

| General Taxpayers 增值税一般纳税人 | These entities issue both Special VAT Invoices 增值税专业发票 and Common VAT Invoices 增值税普通发票. |

| Golden Tax System 金税系统 | In China, the Golden Tax System is the only mandated system by the government to issue VAT invoices. |

| Red-Letter Invoice 红字发票 | In China, Red-Letter Invoices are issued for returns and refunds. |

| Small-Scale Taxpayer 增值税小规模纳税人 | These entities issue Common VAT Invoices. |

Installing China Localization

The following topics describe the prerequisites and the installation of the NetSuite China Localization SuiteApp:

- Prerequisites

- Installing the China Localization SuiteApp

To install China Localization in accounts with SuiteTax, see Installing China Localization In Accounts With Suitetax.

Note: The China localization SuiteApp can be installed before or after installing Suite tax Engine. Also continue assigning your China nexuses to your China subsidiaries.

Prerequisites

Following are the prerequisites before installing the SuiteApp:

- Working With Multi-Language Names and Descriptions

- Suite Cloud Features

- GL Impact Locking

- Enabling GL Audit Numbering and Setting Preferences

- Custom Segments

- Accounting Period

- Advanced PDF/HTML Templates

- Expense Reports

To set preferences visit this link.

Overview

NetSuite China Localization offers specific feature capabilities tailored to Chinese business requirements. These include accounting vouchers, localized financial reports, VAT invoices compliant with the new Golden Tax System, as well as localized transaction and entity fields. The features and capacities are described below.

China VAT Integration: NetSuite China Localization enables you to import your VAT invoice data from the China Golden Tax System. The Golden Tax System is a mandated system for auditing companies in China that processes your exported transaction data from NetSuite.

Importing the transactions from the China Golden Tax System will pair those transactions with your existing transactions in NetSuite.

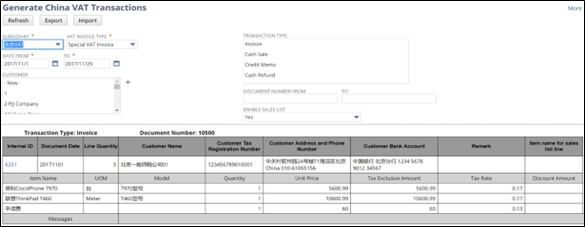

To Import VAT transaction data from the Golden Tax System to NetSuite:

- Go to Transactions > Sales > Generate China VAT transactions.

- Click Import.

- Under File Upload, click Choose File.

- In the dialog box that appears, navigate to the folder and select the file containing the processed VAT invoices from the Golden Tax System.

- Click Open.

- Click Import. The page will refresh, and a confirmation message will appear.

- Go to Setup > China Localization > Configuration.

- Checking the China VAT Integration box enables the ability to export and import China VAT Invoices to the Golden Tax System.

For more information about exporting VAT transactions, see Generating China VAT Transactions.

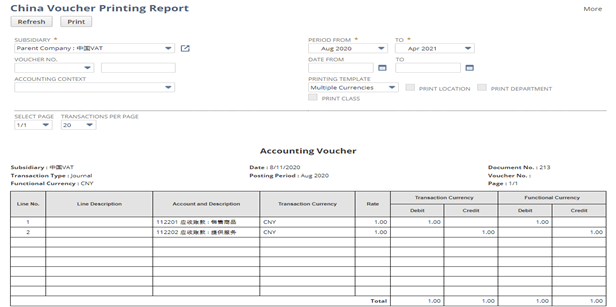

Generating China Voucher Printing Report

NetSuite China Localization enables you to generate accounting voucher printouts in compliance with Chinese accounting tax laws. The accounting vouchers are mandated by the Chinese government for tax authorities to audit companies in China. The accounting voucher printouts show general ledger details of transactions in the required format.

Reference: China Voucher Printing

Processing Red-Letter Invoices:

Red-Letter Invoices are reversals of sales in China, where the transactions are entered as negative values in the China Golden Tax System. NetSuite China Localization manages this through customer credit memos and cash refunds, where you can also store the government-issued Information Sheet Number. This information sheet number is required for generating Red-Letter Invoices in the Golden Tax System.

To process a Red-Letter Invoice via Credit Memo:

- Navigate to Transactions > Customers > Issue Credit Memo.

- Complete the Credit Memo form. For detailed guidance, refer to the instructions for Issuing a Customer Credit Memo.

- In the China VAT Subtab, enter a 16-digit value into the Information Sheet Number field. This number must correspond to the Red-Letter Information Sheet Number issued by the government, which is necessary for Special VAT Invoices.

- (Optional) From the China VAT Invoice Type dropdown, choose between Special VAT Invoice or Common VAT Invoice. The selection is automatically based on the China Taxpayer Type in the customer’s record but can be adjusted as required. More information is available in Setting China VAT Taxpayer Types.

- (Optional) In the VAT Split Rule field, select either Split Rate or Split Quantity. Additional details can be found in Override VAT Split Rule.

- Click Save.

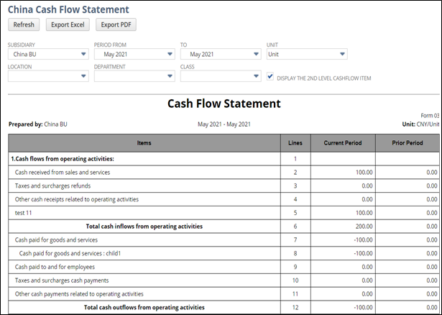

China Cash Flow Statement Report:

The China Cash Flow Statement Report details the activities impacting a company’s cash balance within a specified period. Presented in the Chinese format, it includes the following key information:

- Operating activities

- Investing activities

- Financing Activities

- Net Change in Cash for Period

- Cash at Beginning of Period

- Cash at End of Period

To set up a China Cash Flow Item in your Chart of Accounts (COA):

- Navigate to Chart of Accounts.

- In the China Cash Flow Item field, select the appropriate China Cash Flow classification from the drop-down list.

For more detailed instructions, refer to the Oracle NetSuite documentation.

To set up a China Cash Flow Item for Inventory Items:

- Go to Lists > Accounting > Items.

- Find the item you want to edit.

- Click Edit.

- In the China Cash Flow Item field, select the relevant China cash flow classification from the drop-down list.

Known Limitations of NetSuite China Localization:

- Language Support: NetSuite China Localization supports two languages: Chinese and English (International).

- Data Governance Limits:

- The Generate China VAT Transactions page displays a maximum of 10,000 lines or 200 invoices.

- The Generate China VAT Transactions page can import a maximum of fifty (50) VAT invoices per file.

- The China Subledger Report and the China Cash & Bank Journal Report have a 5,000-transaction line limit for the report display. If the data requested exceeds this limit, the report display will not show any data and will prompt you to download the report in Excel or PDF format.

- Multi-book Feature: The Multi-book feature is not supported in NetSuite China Localization.

- Field-Level Help: Certain Field-Level Help texts are available only in Chinese.

- China Cash Flow Statement Report: The China Cash Flow Statement Report requires the Expense Reports feature to be enabled in order to capture transactions.

- Custom Vendor Prepayment Form: The Custom Vendor Prepayment Form included with China localization cannot be set as preferred and needs to be selected from the custom form drop-down.

For more details, refer to the specific NetSuite documentation related to China Localization features and limitations.

Financial Reports for China

Note: This feature requires the China Localization SuiteApp

NetSuite China Localization provides the following reports for companies operating in China:

| Report | Available In |

| China Balance Sheet Report | China Localization SuiteApp |

| China Cash Flow Statement Report | China Localization SuiteApp |

| China Income Statement Report | China Localization SuiteApp |

| China Account Balance Report | China Localization SuiteApp |

| China Subledger Report | China Localization SuiteApp |

| China Cash & Bank Journal Ledger Report | China Localization SuiteApp |

Conclusion

In conclusion, leveraging NetSuite’s China Localization SuiteApp can significantly enhance your operations in China, ensuring compliance with local tax regulations and maximizing financial transparency across your organization. From generating VAT transactions to managing Red-Letter Invoices and producing compliant financial reports, NetSuite offers robust tools tailored for Chinese business requirements.

Ready to streamline your operations and achieve greater efficiency? Contact us today to learn more about how NetSuite’s China Localization can benefit your company. Whether you’re expanding your presence or enhancing existing operations, our experts are here to support your journey to success in China.

Reach out directly to us if you have any questions. Empower your business with NetSuite’s China Localization SuiteApp and navigate the complexities of Chinese business with confidence.

RSMUS.com

RSMUS.com