Co-authored with Pawan Singh

The NetSuite Fixed Assets Management SuiteApp plays an impactful role in automating the company’s management of fixed assets acquisition, depreciation, revaluation, and retirement, as well as maintenance schedules and insurance. You can import new and mid-life assets into NetSuite to track asset depreciation, including the depreciation history of mid-life assets. NetSuite creates new asset records manually or from purchases, expenses, and inventory transfers.

What Benefits Does NetSuite Fixed Asset Management Offers?

Managing fixed assets accurately is a major challenge. Assets are tracked for constant changes throughout their life cycle -acquisitions, disposals, transfers, impairment, etc. Keeping track of all the changes and recording is a lot of manual work, especially in Excel.

- Track your assets seamlessly with ease.

- Depreciation Made Simple and Customizable for Business Needs.

- Efficient Maintenance Tracking

- Seamless and real-time Integration with NetSuite Financials

- Comprehensive Reporting for Informed Decision-Making

- Transparency and Compliance while managing assets for Audits.

- Future-Proof Forecasting and Budgeting

- Efficient Procurement Integration and linking with Purchase transactions.

- Adaptable Multi-Book Accounting

In summary, NetSuite’s Fixed Asset Management empowers businesses with a comprehensive, integrated, and customizable solution for efficient asset tracking, depreciation management, and financial reporting. This suite of features ensures transparency, compliance, and strategic planning for businesses of all sizes and industries.

Use Case Solutioning and Automation Provided by NetSuite Fixed Asset Management

- Asset Acquisition and Recording: NetSuite allows users to record key details such as purchase date, cost, and location for each acquired asset.

- Automation Example: Automated creation of fixed asset records upon approval of purchase orders in the procurement module.

- Use Case: A company purchases new IT equipment, and NetSuite automatically generates fixed asset records as the procurement process is completed.

- Depreciation Management: NetSuite supports various depreciation methods, including straight-line and declining balances.

- Automation Example: Automated calculation of depreciation based on the selected method and automatic updates to the general ledger.

- Use Case: An organization utilizes the double declining balance method for certain assets, and NetSuite automates the depreciation calculations accordingly.

- Maintenance Tracking: NetSuite allows users to record and track maintenance activities for each asset

- Automation Example: Automated reminders for scheduled maintenance based on predefined intervals.

- Use Case: Regular maintenance tasks for machinery are scheduled, and NetSuite sends automated reminders to the maintenance team.

- Integration with Financials: NetSuite’s fixed asset module seamlessly integrates with the financial management suite

- Automation Example: Automatic updates to the general ledger and financial statements with each asset-related transaction.

- Use Case: Asset depreciation expenses are automatically reflected in financial statements for accurate reporting.

- Customizable Depreciation Schedules: Users can create custom depreciation schedules to align with specific business needs

- Automation Example: Custom rules for applying different depreciation methods based on asset categories.

- Use Case: Specialized equipment with unique depreciation rules is efficiently managed through NetSuite’s customization options.

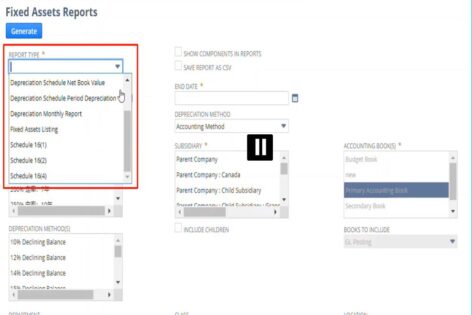

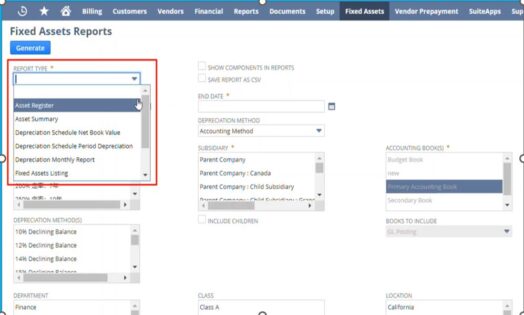

- Comprehensive Reporting: NetSuite provides robust reporting tools for fixed assets, including standard reports and customizable dashboards

- Automation Example: Scheduled, automated generation and distribution of depreciation reports.

- Use Case: The finance team receives automated monthly reports detailing asset depreciation, facilitating financial analysis.

- Audit Trail and Compliance: NetSuite maintains an audit trail for fixed asset transactions, enhancing transparency and compliance

- Automation Example: Automatic logging of all changes to fixed asset records for audit purposes.

- Use Case: During an audit, the organization can provide a detailed audit trail of all fixed asset transactions for compliance verification.

- Forecasting and Budgeting: NetSuite enables users to forecast future depreciation and budget for new asset acquisitions

- Automation Example: Using historical data to automate forecasting future depreciation expenses.

- Use Case: The organization plans to replace aging equipment, and NetSuite aids in forecasting the financial impact of depreciation.

- Integration with Procurement: NetSuite integrates fixed asset management with procurement processes

- Automation Example: Automatic linking of fixed asset records to procurement transactions.

- Use Case: When a purchase order for new laptops is approved, NetSuite creates corresponding fixed asset records for accurate tracking.

- Multi-Book Accounting: NetSuite supports multi-book accounting for managing assets according to different accounting standards

- Automation Example: Automatic generation of entries in multiple books when asset transactions occur.

- Use Case: A global company adheres to both local and international accounting standards, and NetSuite automates the recording of transactions in multiple books.

Remember that the effectiveness of an asset management system will depend on your specific business needs and the features offered by the specific application. Requesting demonstrations, trial periods, and customer references is recommended to make an informed decision based on your organization’s requirements.

Fixed Assets Lease Accounting: Use Cases and Solutions

The lease accounting feature is introduced in the Fixed Assets Management SuiteApp to help businesses efficiently manage leases in accordance with accounting standards such as ASC 842 and IFRS 16.

- Lease Classification: Classify leases as either finance or operating leases based on accounting standards

- Use Case: A retail company leases store spaces and needs to correctly classify these leases for financial reporting.

- Lease Amortization: Automate the amortization of lease liabilities and right-of-use assets over the lease term

- Use Case: An organization leases office equipment, and NetSuite automatically spreads lease costs over the agreed-upon term.

- Expense Recognition: Ensure accurate and compliant recognition of lease expenses over the lease term.

- Use Case: A company leases a fleet of vehicles, and NetSuite helps recognize the associated expenses in a way that aligns with accounting standards.

- Lease Modifications and Termination: Handle modifications and terminations of leases, adjusting accounting entries accordingly

- Use Case: NetSuite adjusts the financial records to reflect these changes if a company modifies the lease terms or terminates it early.

- Comprehensive Reporting: Provide reporting tools for lease-related financials, including balance sheets and income statements.

- Use Case: The finance team generates reports to analyze the financial impact of all leases and presents this information to stakeholders.

In summary, NetSuite’s Lease Management functionality streamlines the management of a variety of leases (Retail Space leasing, Equipment Leasing, Office space leasing, Vehicle Space Leasing), automates critical accounting processes, and ensures accurate financial reporting, providing businesses with transparency and compliance in their lease-related activities.

Recent NetSuite FAM Enhancements:

NetSuite continues to evolve and update its Fixed Asset Management offering; recent enhancements are as follows.

1. FAM Diagnostics Portlet: With the recent enhancement, you can now quickly check the health of their FAM bundle. You can add the portlet to your dashboard by following navigation Dashboard > Personalize > SuiteApps > FAM Diagnostics. The portlet shows the following important information which needs to be corrected.

- Scan for assets without asset value: This function will review the Fixed asset records for missing mandatory data in fields that impact the calculation of depreciation values. Since this can happen when assets are uploaded without enabling server scripts, this is most useful users are uploading Multiple Assets and wants to check the Uploaded Assets.

- Scan for lease payments without contracts. The Portlets helps to identify and show missing Contract information. Missing Contracts happen when the enable server scripts is not selected during a CSV upload and contract is important as it contains the lease details and links to the lease record and journal entries.

- Scan for depreciation history records (DHR) without associated records. Helps to clean/delete the records which does not have history or any associated transaction records.

2.Quarterly and semiannual rental frequency options for lease: Now you can create leases with rental frequency of quarterly or semiannual compared to just annual or monthly. These additional options will generate lease payments and calculate net present value and interest based on these frequencies.

3.Splitting Assets: Split assets into multiple records in one transaction. Previously you were just able to split the asset into 2 at a time. To split one asset into more than 2 records, you would have to perform the asset split function multiple times. Now with the help of Asset Split Details subtab you can create up to 120 separate records from one record and be able to specify the quantity and value of each new asset record.

For more information about our NetSuite Industrials team please visit our website.

RSMUS.com

RSMUS.com