Month-end close is a stressful time for many of our clients, and simplifying that process is one of the many reasons people choose NetSuite. In a dynamic system, NetSuite continues to develop new and improved ways to complete Month-end. One of those processes is the Match Bank Data module, where users complete their bank reconciliations. An app that takes the process one step further is the Automated Cash Application. This app is primarily used to reconcile Customer Payments and ensure they have been adequately accounted for.

Users from any industry can utilize the Match Bank Data and Automated Cash Application features. In this blog post, I will give an overview of how to use the Application, what happens during the process, and any native customizations NetSuite has included to increase functionality.

Overview

The Automated Cash Application feature enables users to generate a batch of customer payments automatically in NetSuite and apply them to open invoices. The generated customer payments are then automatically matched and reviewed in the system. The feature allows NetSuite users to import or connect their bank data to create an efficiently completed reconciliation process by matching invoice numbers through the payment import file to existing invoices within NetSuite. The Application can benefit clients who import their invoices every week or utilize an integration.

Setup and Functionality

Below is a walkthrough of the Automated Cash Application in NetSuite. There may be differences in each client’s environment, depending on any customizations or from the financial institution they are utilizing. However, this should give a straightforward perspective of what the feature can accomplish.

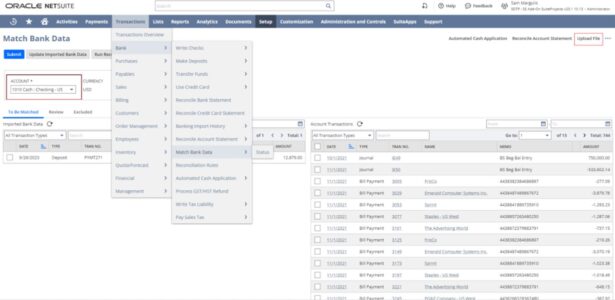

Before manually matching transactions, you should use the automated cash application feature to generate all customer payments from imported bank lines and match them. Start by selecting the account you want to upload the payments towards, and then select ‘Upload file’ in the top right of the screen. In this Upload File screen, two options are available when importing the file: import with the default parser and use NS’s template or the financial institution (their import template) option, which will act like a saved import file for additional flexibility. This is also where we can enable a plug-in to a bank (the plug-in must be built prior and can be enabled here).

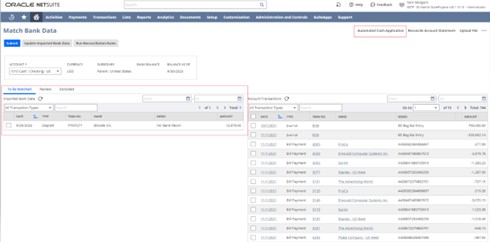

Following a successful import, notice all the lines in the Match Bank Data screen. We want to create payments for these lines and move them to the Automated Cash Application button in the top right. You can select individual payments or the option on the grey row to select all when multiple transactions are being matched. Then select ‘Submit.’

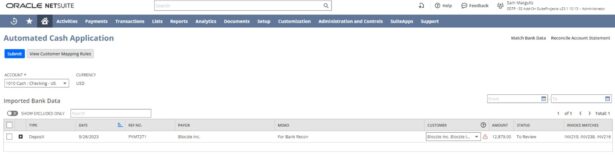

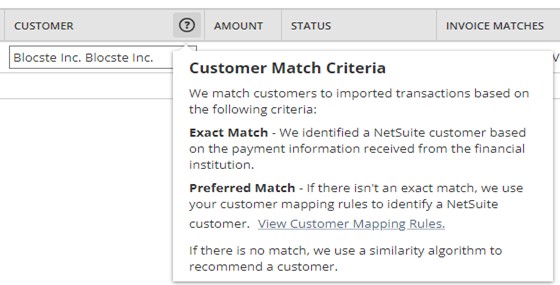

On the Automated Cash Application screen, notice the customer field. This field includes a dropdown list of all customers, and the default selection stems from the Accounting Preference of an Exact or Preferred match. If no match occurs, you will create a rule that will essentially create a default for similar payor names. These rules will continue for future imports, and you can see all the rules by selecting ‘View Customer Mapping Rules’ next to the submit button. The rules can be deleted and changed with updates to customer relationships.

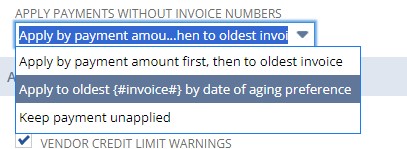

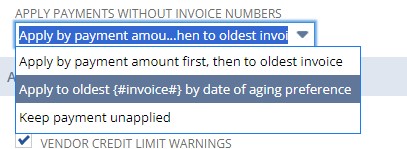

When applying for the payments, some Accounting Preferences can impact the order of payments completed. Under Setup > Accounting Preferences > Accounts Receivable > Apply Payments Without Invoice Numbers, three options can impact handling payments without invoices. “Apply by payment amount first, then to oldest invoice” is the default selection. In many cases, the payments will have already been applied to the invoices and connected to all those in the list.

After selecting the payments you would like to apply, select the ‘Submit’ button and generate the payments. Allow the payment to complete, and notice that you can access the record directly from the generation page. Assure the values are correct from the import template.

Lastly, we need to reconcile the account. This can be done back in the Match Bank Data screen. In the top right, select the ‘Reconcile Account Statement’ button. Notice that the newly created transactions are automatically matched in the ‘Review’ subtab, while other transactions can be reconciled.

Tips and Reminders

It is important to remember that there may be some differences clients face regarding customizations in their process or from the bank they utilize. I would recommend testing the process first with a small number of Customer Payments, ensuring the client notices the same accuracy as if doing so manually, and continuing to grow the number of payments processed.

Conclusion

Month-end close can be a challenging time for clients, and it is our responsibility to help them by suggesting the best NetSuite solutions for simplification and accuracy. The Automated Cash Application checks both boxes and allows clients to feel more confident moving forward.

Helpful SuiteAnswers

Customer Match Criteria – a link to help understand the customizations surrounding the customer selected for the payments

Match Bank Data – an overview of the Match Bank Data feature in NetSuite for general purposes

RSMUS.com

RSMUS.com