I’ve come across several instances when a client calls and says that they have not withheld the proper amount of payroll tax because the tax treatment of an employee’s pay code, deduction code, benefit code, SUTA codes, or FUTA does not match the tax treatment on the code’s master setup record. There can be many reasons for this situation to occur and the consequences can be severe in both financial and employee morale terms.

If you find that an employee’s payroll code has been incorrectly taxed for one or more periods, you will not be able to change the tax treatment of that code from directly within Microsoft Dynamics GP. You will need to contact your consulting partner who can help you make the necessary changes. You will also need to enter an adjusting transaction to the employee’s payroll history and make corrections with the taxing authorities. Depending on the extent and duration if the taxing error, this can be a time-consuming and costly process. So, this blog discusses how you can detect and correct these issues before they become a problem.

You can create a SQL view that checks for instances where an employee’s pay code, deduction code, benefit code, SUTA code, or FUTA code does not match the tax treatment on the code’s master setup record. You can then surface this data in a SmartList and even create a cue in the reminders section of your home page.

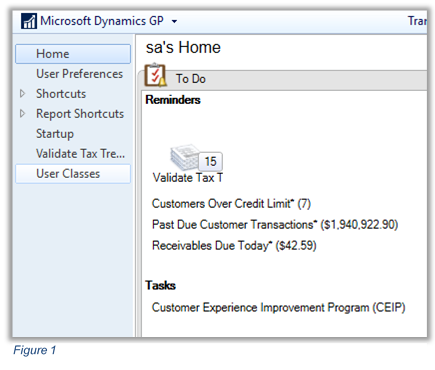

Figure 1 shows the reminder cue. It indicates that there are currently 15 instances where an employee’s pay code, deduction code, benefit code, SUTA codes, or FUTA doesn’t match the tax treatment on the code’s master setup record.

Clicking on the cue will open the SmartList.

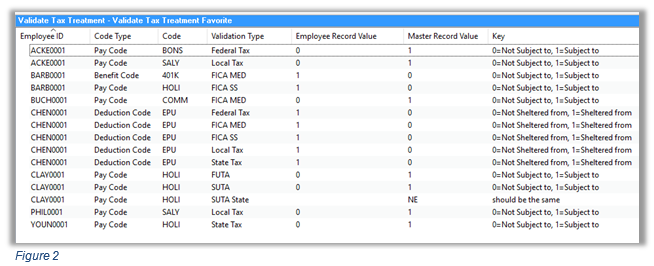

The SmartList in Figure 2 shows valuable information that can help you correct payroll tax settings before they become a serious problem. You can even create a drill down in your SmartList that will take you directly to the employee’s payroll master card. From there you can easily navigate to the problem code and make the correction.

This tool can, and should, become a routine step in your payroll cycle. Just check your cue and correct any reported problems before processing payroll.

If you are interested in getting the code for the SQL view used with this SmartList, please send me an email at the address provided below.

At RSM, it’s all about our clients. Our strong, client-centric approach differentiates us. To be considered your advisor of choice, we strive to understand you, your business, and your aspirations. By sharing the ideas and insight of our most senior professionals, we bring our local and global knowledge and resources to your environment so you feel empowered to move forward with confidence.

This is the power of being understood.® This is RSM.

Contact our experts at RSM 855-437-7201

by Dave Funk for RSM

RSMUS.com

RSMUS.com