The Project Module and accounting in Microsoft Dynamics 365 for Operations can be very valuable for any kind of business, and just about any company can use a project. Any time that you want to capture data with any business effort, the Project management and accounting module can be used.

The concept of the “project” in systems is usually associated with a service operation of some kind. A company is hired to perform a service—a repair, an installation, a tax return, consulting—and the project is used to capture all costs and revenues associated with performing that service. You send invoices from the project and you can analyze your performance on the project to help prepare for the next one.

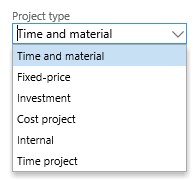

First, let’s take a look at the different kinds of projects in Dynamics 365 for Operations:

Most of us are familiar with the Time and Material and Fixed-price project types. These are the standard service type projects where you capture costs and do the billing to the customer on either a fixed price or time and material basis. In this blog article, we’re going to talk about the Investment project type.

The Investment project type is typically used by a company that is making an effort to make something for its own use that will become a fixed asset of the company. Think of a pharmaceutical company that conducts research to produce a new drug. All costs associated with that research will go into the value of the fixed asset that is eventually produced. Alternatively, you can think of a company that manufactures equipment for the purpose of renting that equipment.

To show how this works, I’ve created an Investment project and posted costs to the project. To see how the costs accumulate and post, from the All projects page, go to the Manage tab, then the Process group, and click Estimates.

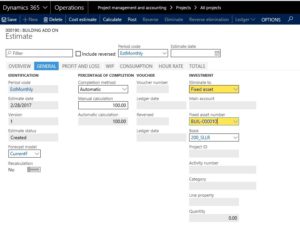

The page below shows the Fixed asset assigned, which only became enabled when the Eliminate to selection was listed as Fixed asset. Then, the Fixed asset number became enabled and the Fixed asset I created in this example was available to be selected.

Project management and accounting > Projects > All projects > Estimates > General

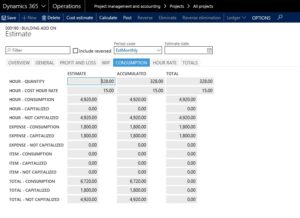

Now, when you go to the Consumption tab, you can see all the costs that have accumulated for the project based on the costs I entered in journals.

Notice that the expenses have shown that they will be capitalized to the project, and then if you look at the WIP tab, you see that they are in the WIP totals.

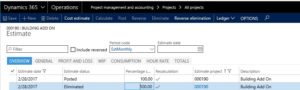

Now that we’ve looked at our transactions and viewed the totals, we would be ready to close the project and transfer all the costs to the fixed asset. The first step in that would be to Post, which you can see below after posting.

Once it is posted, it is time to eliminate the costs from the project and transfer them to the fixed asset. So my next step would be to click the Eliminate tab, and then you would see the screen below on the Overview tab:

Once the Estimate status is listed as Eliminated, you can see that you can click Reverse elimination in the Action pane if you want to back it out. On the Totals tab, you will see that the total cost is shown

So there you have it. We created an Investment project and journalized costs which were eliminated to a fixed asset. This is a very valuable use of the Project module in Dynamics 365 for Operations.

In further blogs, we will go over other types of Projects that are often very useful for a business.

For more information about using Microsoft Dynamics 365 for Operations, check out our Dynamics Community News publication or contact our experts at RSM 855-437-7201

by Howard LeCover for RSM

RSMUS.com

RSMUS.com