A common complaint at month end is the process of reconciling intercompany accounts. We hear that it’s painful, particularly when multicurrency is involved. So here are a couple of tips for relatively painless multicurrency intercompany reconciliations:

- Determine the currency that the inter-company accounts will be denominated in. For most companies, this will be the parent company’s reporting currency, usually the US Dollar.

- Enable the GP intercompany functionality so that entries will be created for all companies referenced in intercompany transactions.

- Double check that there are no unposted intercompany entries in all the companies.

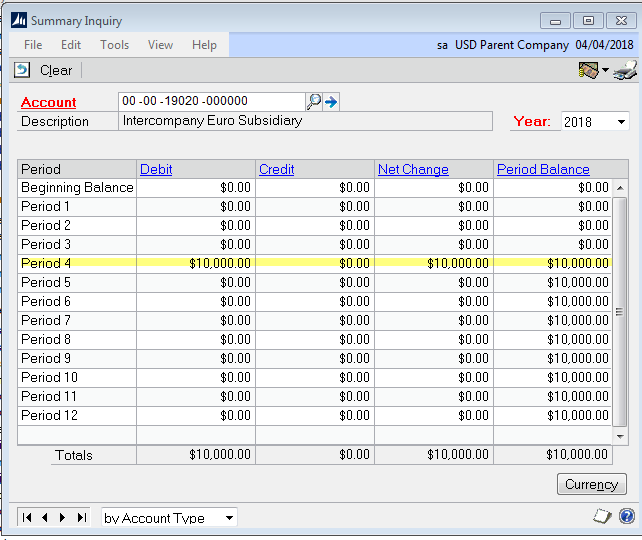

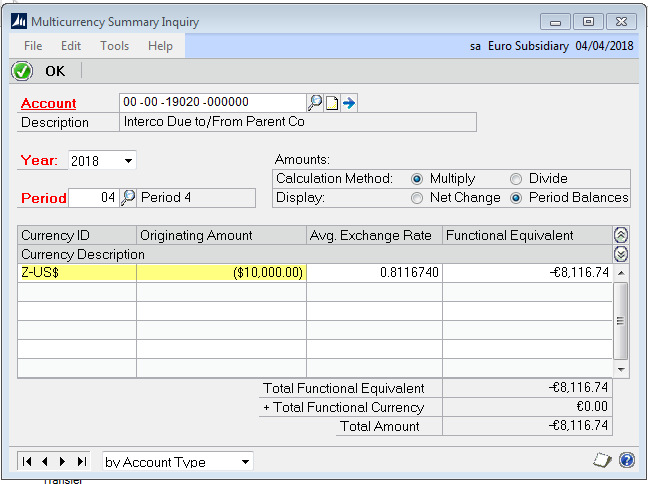

- Make sure *all* transactions are completed in the designated intercompany currency, regardless of what the functional currency is of the company who is originating the transaction. For example, a GBP company in the UK need to charge the US Parent back for intercompany charges in USD, not GBP. You can confirm that only USD transactions are in the account by looking at the Currency Summary screen for that account.

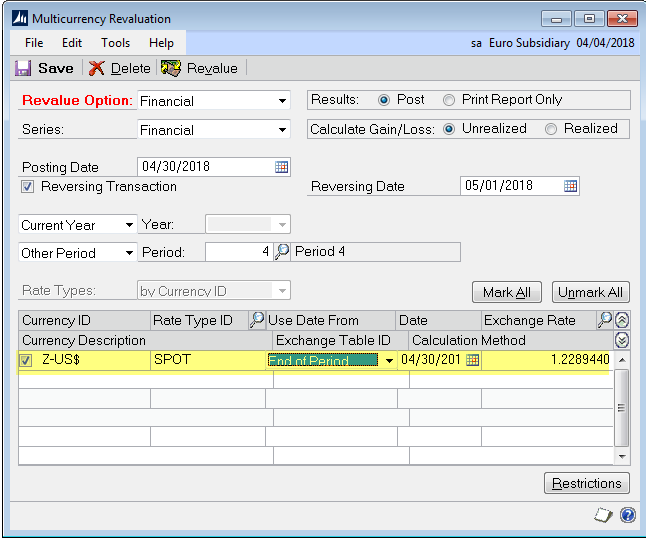

5. If the intercompany accounts are translated using the current method, revalue the USD amount into the functional currency at month end. Make sure the month end rate used is the same rate that is used for translating the functional currency back to USD (the reporting currency)

6. If these steps are followed, the result on the financial statements will be that the intercompany balances will auto-eliminate in the reporting currency.

To learn more about how you can take advantage of this and other Dynamics GP features, visit RSM’s Microsoft Dynamics GP resource. To make sure you stay up to date with the Microsoft Dynamics Community, subscribe to our Microsoft Dynamics Community Newsletter.For more information on Microsoft Dynamics 365, contact us.

By: Peggy Evleth

RSMUS.com

RSMUS.com