What is Form 1099 and Why Does it Matter?

Form 1099 is used to report any non-employment income to the Internal Revenue Services (IRS). Similar to a W-2 which is used to report payments to employees, Form 1099 is used to report payments made to non-employees. Businesses are required to issue a 1099 form to a taxpayer who has received $600 or more in non-employment income during the tax year.

There are 2 types:

- Form 1099-NEC

- Form 1099-MISC

Previously, the IRS required nonprofits to report non-employment income using Form 1099-MISC. Now the IRS requires using Form 1099-NEC to report payments made to vendors, contractors, freelancers and/or anyone else who are not employees but are hired to complete a job. Form 1099-MISC is now used to only report truly miscellaneous income including rents, prizes and awards, medical and healthcare payments, crop insurance proceeds and etc.

1099 Reporting Process & NetSuite

NetSuite leverages a data driven approach to aggregate and extract eligible transaction detail for 1099 filing. NetSuite has several built-in Bundles that leverage saved searches to export the formatted data for a one-step upload to a related filing provider (e.g. Sovos, Yearli by Greatland and Track1099). Each contractor that requires a 1099 form must be identified as a 1099 contractor on their vendor record to generate accurate 1099 information.

(*A vendor is 1099 eligible only if it operates in the US or a US territory)

For vendor payments to accrue on the 1099 form, the following setup must be completed:

- Mark each contractor as 1099 eligible

- Associate an expense account with 1099 categories and select an expense account associated with a 1099 category when you add each expense to vendor bills

- Pay the vendor bills which converts the transaction to cash-basis

How to Set Up a Vendor as 1099 Eligible:

- Go to Lists > Relationships > Vendors

- Click Edit next to the vendor you want to make eligible

- NetSuite reports the total amount paid to these vendors which include payments made by paying existing bills or by writing checks

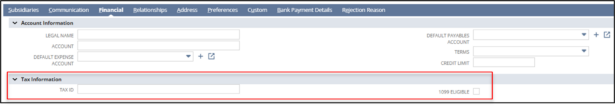

- On the vendor records, click Financial subtab

- Under Tax Information, click the 1099 Eligible box. Note: You should also populate the Tax ID as well as an Address for the vendor for filing.

- Click Save

How to Associate an Expense Account with 1099 Categories

- Navigate to Lists > Accounting > accounts

- To create a new expense account, click If not, click Edit next to the expense account you want to associate with a 1099 category.

- If creating a new account, select Expense/Other Expense in the Type field to enable the 1099 Category field

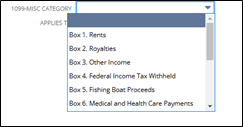

- In the 1099 Category field, select the type of vendor payments made with this account

- These categories correspond to the boxes on the 1099 form and cannot be added to/deleted

- Click Save

How to Use The 1099 Saved Searches to Report Vendor Payments:

- Go to Customization > SuiteBundler > Search & Install Bundles

- In the Keywords field, type “1099 Vendor Payment Report”

- Click the name of bundle for your 3rd party provider then click Install

- After the saved search is installed,

- Navigate to Reports > Saved Searches > 1099 Vendor Payment Report – Vendor Name > Edit

- Edit the search as needed. Typical updates include:

- Adding Company information

- Filtering out vendors who do not meet the minimum payments threshold set by the IRS.

- Export the search to a CSV/Excel file

1099 Filing

Once the CSV file is exported from NetSuite, users will make an account with the filing provider selected, then upload the CSV file to the third party’s platform to process the filing and related payment.

RSMUS.com

RSMUS.com