ASC 606 requires companies to overhaul their system processes for revenue recognition and perform complex analysis to recast revenue according to the new standards. Another looming challenge that is likely to affect far more NetSuite customers is implementation of ASC 842, the new accounting standard for lease agreements. IFRS has also issued new guidance on this topic under IFRS 16.

Who is impacted by the change?

At the highest level, both lessees (entity paying for right to use or control something) and lessors (entity receiving payment in exchange for right to use) are impacted by the change. ASC 842 maintains existing categories of operating and finance leases but stipulates that all leases other than those defined as short term (12 months or less) must be maintained on the balance sheet. IFRS 16 eliminates the category of operating leases entirely. The criteria for identifying leased components within a contract are also updated.

Click here for a thorough explanation of the changes and analysis of impact to businesses.

How can NetSuite help?

In 2019.1, the Fixed Asset Management bundle reveals new functionality designed to facilitate compliance with the new accounting standards. Previously, asset records had a subtab storing details specific to leased assets but the fields were informational only and did not drive functionality. The new release introduces processes specific to lease accounting including an automation to record interest expense. The FAM enhancements are targeted to lessees and aim to ease the burden of managing leases as a balance sheet liability.

Here’s how the new functionality is used to record a financing-type lease.

Controller signs a 5 year lease beginning on January 1 for a copier used at HQ. Lease payments are due annually on December 31st and the total liability is $5,000. The controller has calculated the implicit interest rate is 5%.

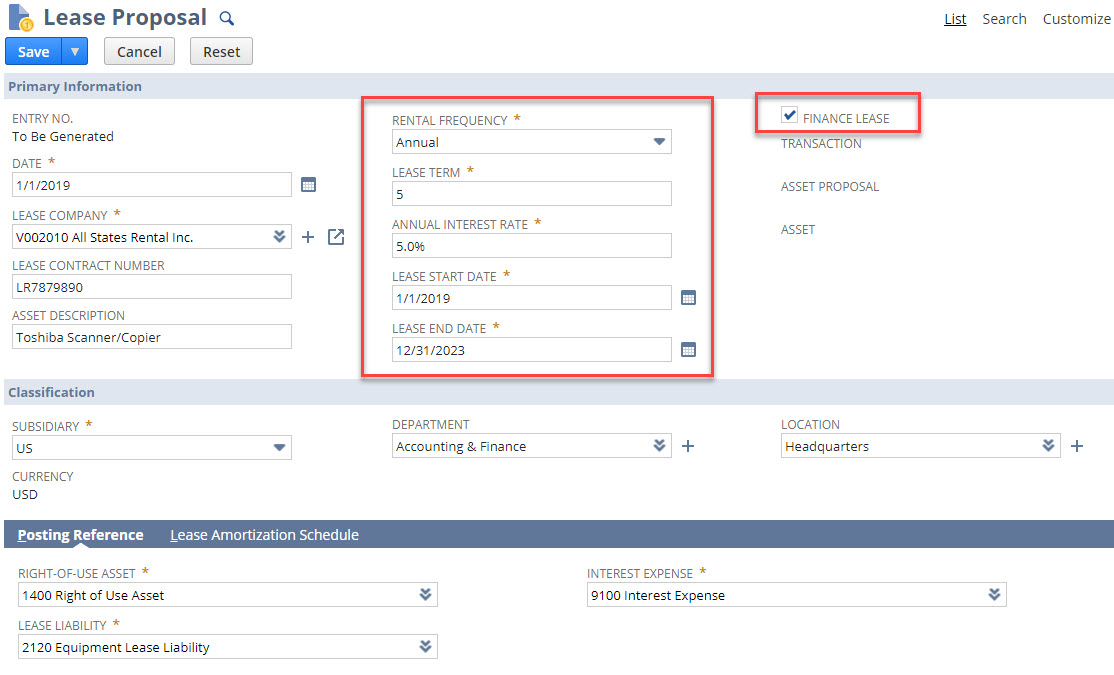

Accountant manually creates new Lease Proposal record using the details from the lease agreement. The screenshot below flags key fields on the new record. Upon save, the Lease Proposal is in a state of ‘Pending Lease Payments’.

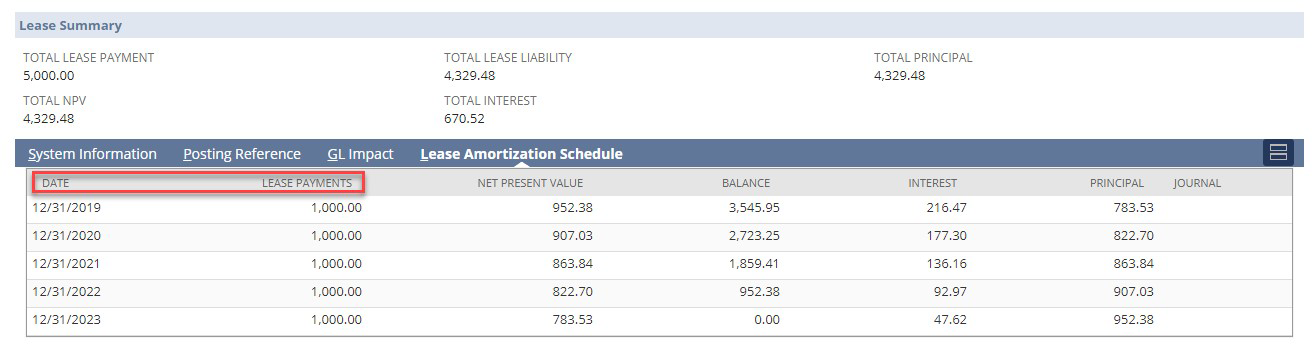

Accountant adds lease payment details to the proposal record on the Lease Amortization tab. Date and Lease Payments can be manually keyed in or imported via CSV file. Once saved, the system will compute the Net Present Value, Balance, Interest and Principal as shown below. The date and payment information you input should represent each payment due to the Lessor.

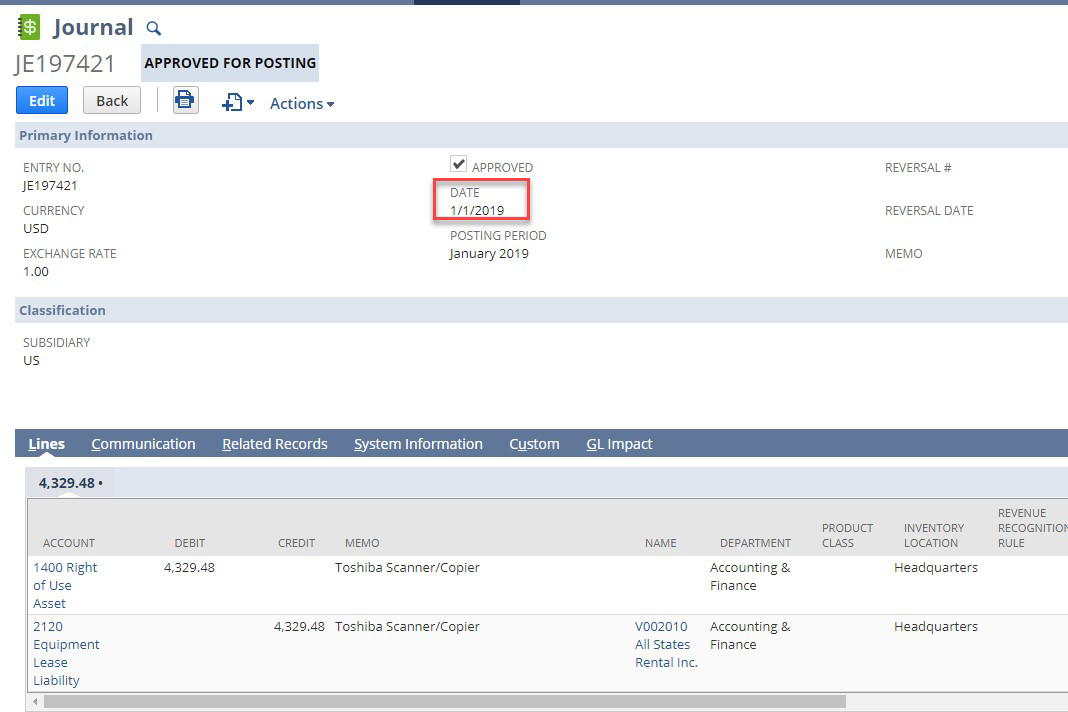

The Lease Proposal is now in a state of ‘Pending Lease Journal Creation.’ The accountant will see a ‘Create Lease Journal’ button on the Lease Proposal. Clicking the button creates a journal to establish the lease on the balance sheet with the Net Present Value shown on the Lease Proposal record. Note – the journal will NOT equal the ‘Total Lease Payment’ as the interest is not recorded as part of the lease liability. The journal will match the ‘Total Lease Liability’ field value.

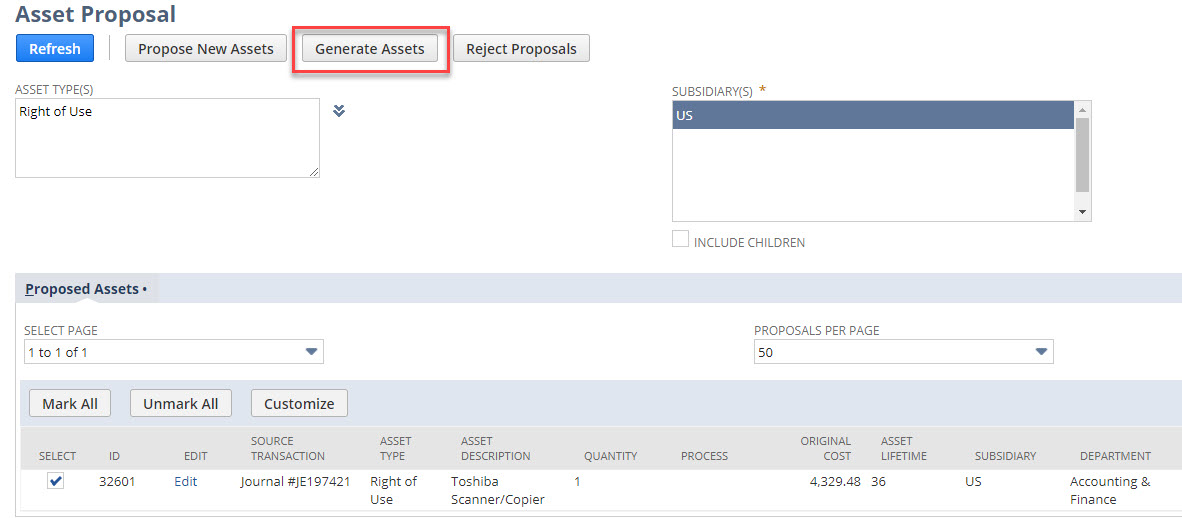

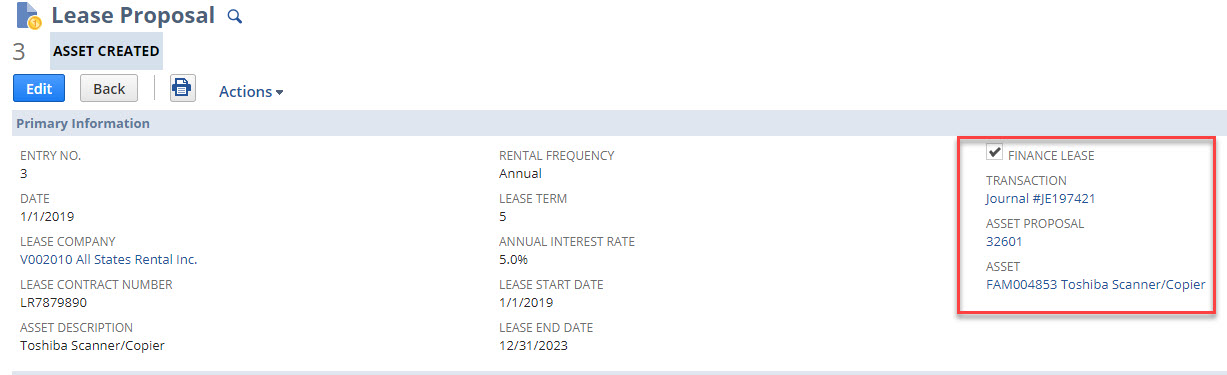

Now, the accountant needs to propose an asset record for the leased asset. Via the standard Asset Proposal process, the journal entry created in the prior step is used to propose and generate a new asset.

The lease proposal record will contain links to all of the ‘generated’ records for easy cross reference.

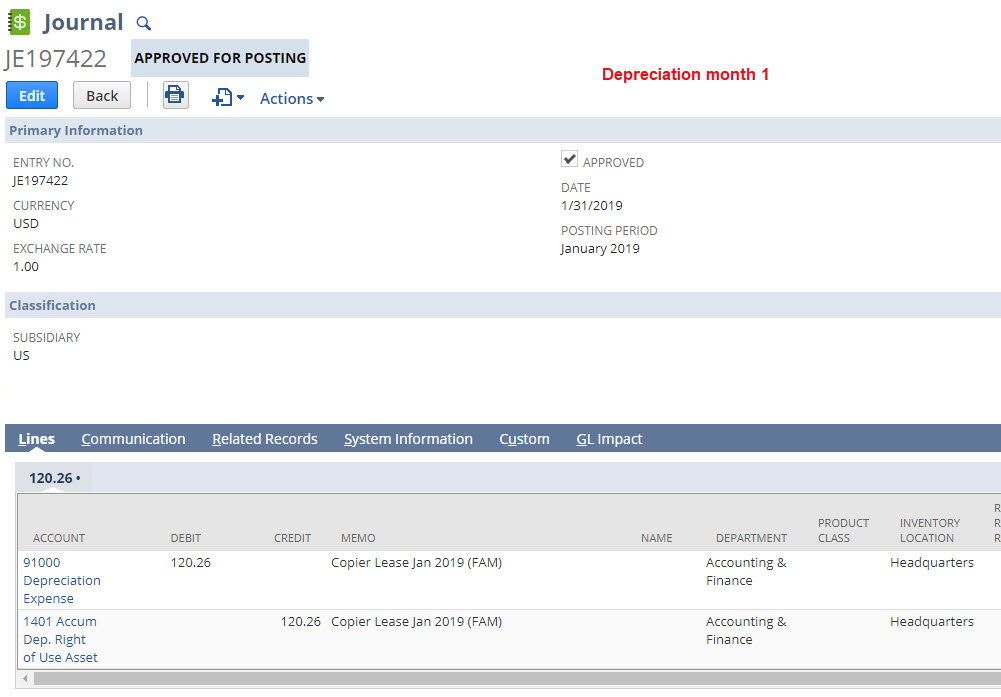

When the accountant runs depreciation for January, the entry below is generated from the asset.

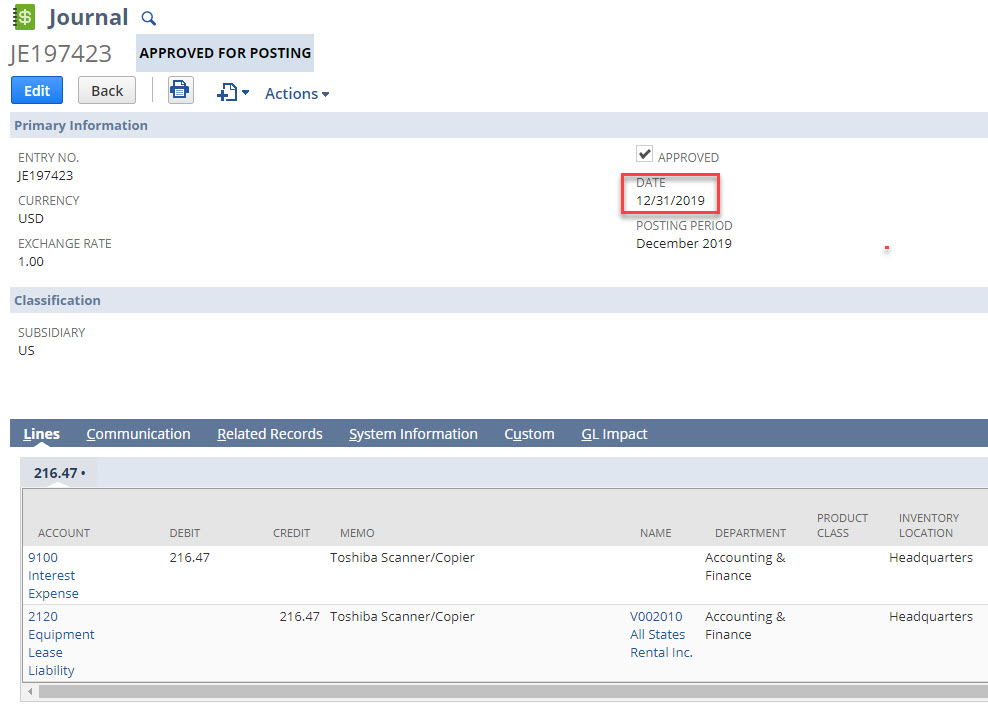

The last step is to run the ‘Record Lease Interest’ process to create a journal entry to book interest for each period. The GL impact of the journal will differ based on whether the lease is a Financing or Operating-type lease (for ASC 842). The Lease Amortization Schedule subtab on the lease proposal will contain a link to each interest journal once generated. In our example, the first interest journal would not be generated until December 2019, when the first lease payment is due. Here is what the journal would look like:

Each month, the accountant will repeat the steps to depreciate the leased asset. If payments were due monthly, interest expense would also be recorded on a monthly basis.

Now what?

After reading this article, users should feel comfortable recording new lease agreements via FAM. However, many companies will have existing leased assets that must move to the new format. A follow up article will walk through how to migrate leased assets, ensuring your company is fully prepared to implement the new standard for current and future lease agreements.

Until then, please visit RSM’s Lease Accounting Resource Center for more information about the new lease standard and adoption considerations.

RSMUS.com

RSMUS.com