Electronic invoicing (e-invoicing) refers to the exchange of invoice documents between businesses, their partners, and tax authorities in a structured electronic format using machine-readable data transmission standards like XML, JSON, and PEPPOL BIS.

E-invoicing is gaining global traction due to its ability to transmit and process transactional data electronically, enable real-time auditing of transactions, and accelerate the collection of value-added tax (VAT). Many governments are mandating e-invoicing to reduce tax fraud, increase transparency and ultimately improve tax collection and the expectation is that e-invoicing will become the global standard in the next three to five years.

Starting in January 2025, German businesses will be required to have accounting systems capable of receiving supplier invoices in an electronic format. The ability to issue B2B invoices electronically needs to be in place by December 31 2026 for companies with a turnover in excess of €800k. For companies with a turnover less than €800k this deadline is extended to December 31 2027.

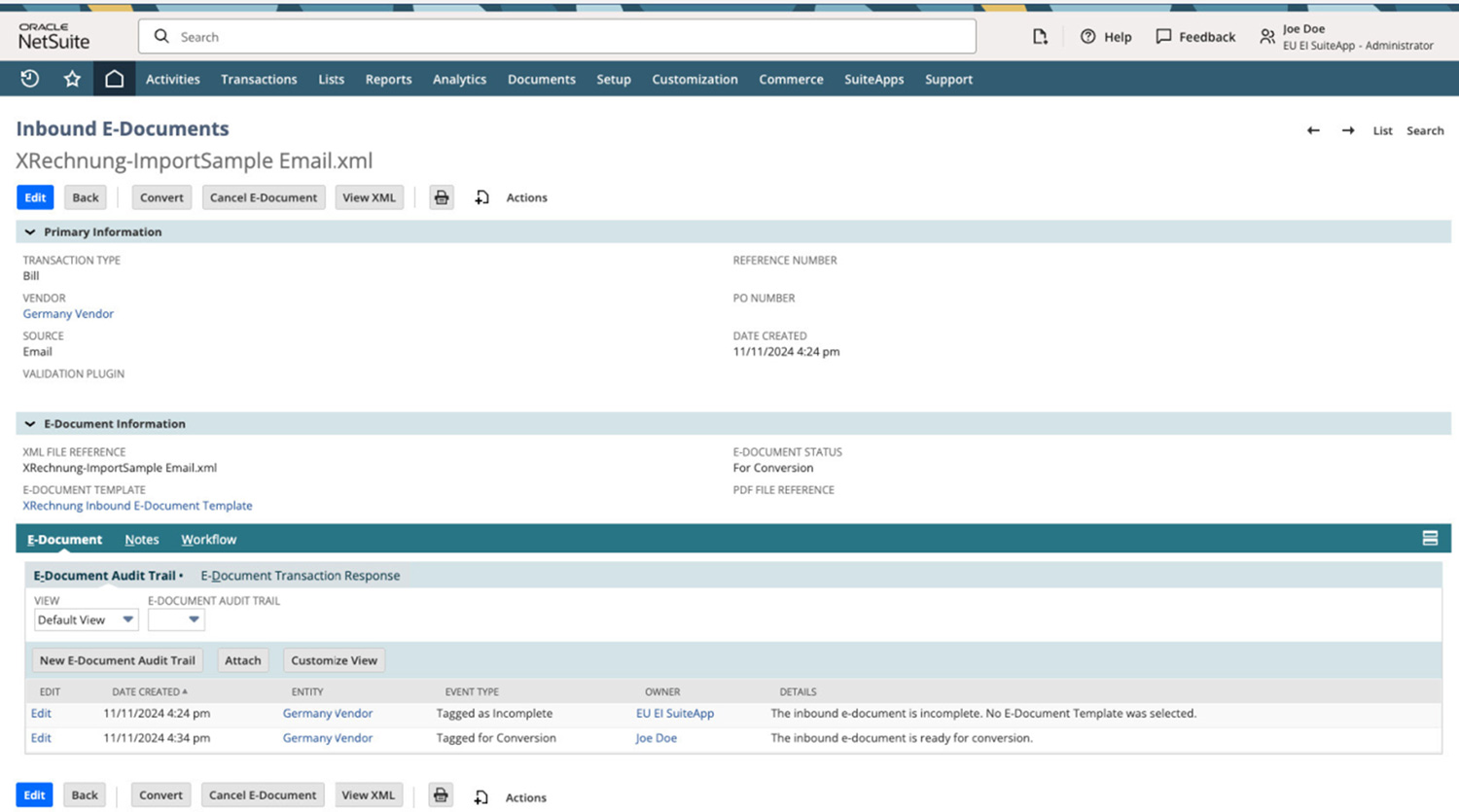

To meet these new regulations, NetSuite has enhanced its existing e-invoicing SuiteApp to facilitate the receipt of invoices in the German X-Rechnung format.

Once the SuiteApp and necessary configurations are in place, the system will automatically process supplier invoices received in X-Rechnung format, posting vendor bill and vendor credit transactions directly into NetSuite.

Companies looking to implement this feature should be aware of the following limitations and best practices:

- Items only, not expenses, are supported on vendor bill transactions. Businesses in EMEA regions should already use items on payables transactions to fully leverage automation via the tax engine.

- Inventory transactions with Multi-Location Inventory enabled will require the Location field to be populated for each item in the transaction line.

- Tax mapping is not supported for inbound XML e-documents. This means the native tax engine logic will apply regardless of the tax information displayed on the document. Provided that master data and settings are correctly configured, this should generally result in the proper tax logic being applied. However, companies should always verify VAT codes and amounts during the accounts payable process.

- Both the legacy tax engine and SuiteTax engine are supported.

As German businesses prepare for these new e-invoicing requirements, it’s crucial to ensure that systems are properly configured and aligned with regulatory standards. RSM can help guide your organization through the process, from configuring NetSuite’s e-invoicing SuiteApp to ensuring your broader global e-invoicing strategy is both efficient and compliant.

Contact RSM today to get started on optimizing your e-invoicing processes and ensuring a smooth transition to these new requirements.

RSMUS.com

RSMUS.com