Getting Started with the Payment Automation SuiteApp

Automation is a fast-growing facet of successful modern businesses. Cash flow management becomes harder to track as your business scales, which is where automation can help streamline your processes and free up some valuable hours for projects. NetSuite’s Payment Automation SuiteApp helps businesses to become more efficient by combining NetSuite’s automation capabilities with the banking services offered by HSBC for bill capture and payment. The SuiteApp takes the manual process of paying your bills and centralizes it in one integrated hub that gives you more control and oversight over all payment aspects and activities.

The Payment Automation SuiteApp:

- Saves you time by allowing you to perform your bill payments within the NetSuite environment, rather than jumping between platforms.

- Increases payment visibility by tracking your payments and providing statuses through all stages.

- Saves you money by allowing you to consistently make your payments early, giving you access to early payment discounts often offered by vendors.

- Improves vendor relations by ensuring your vendors are paid on time, all the time.

- Extends your payment terms with virtual cards that can extend the credit terms for up to 55 days depending on when payments are processed in the billing cycle.

If you believe your business could use the above benefits provided by Payment Automation, you will first need to provision the A/P Automation Module and ensure the following pre-requisite features have been enabled in your NetSuite environment:

- A/P

- Accounting Period

- Bill Capture

- Custom Records

- Client SuiteScript

- SDF

- Server SuiteScript

- SuiteFlow

Once the above features are enabled and the SuiteApp is installed, the following steps should be taken to get the full functionality of Payment Automation:

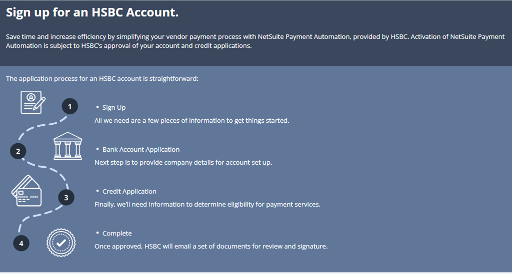

- Applying for an HSBC Online Account

- Note: Payment Automation is integrated with HSBC and users will therefore need an HSBC account to use the SuiteApp.

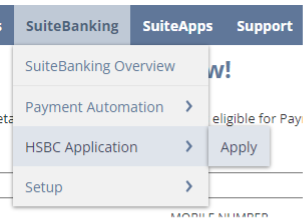

- You can apply for an HSBC Account directly through NetSuite by navigating to SuiteBanking > HSBC Application > Apply

- Generating Payment Tokens

- The payment processor will use these tokens to initiate and process payments.

- Prerequisites include enabling two-factor authentication with a one-time password.

- Setting Up Auto-Funding

- Accounts must be set up with auto-funding before payments can be initiated.

- Note: after setting up auto-funding, there will be an hour delay before the payment processing configuration takes effect. Payments attempted during this time will fail.

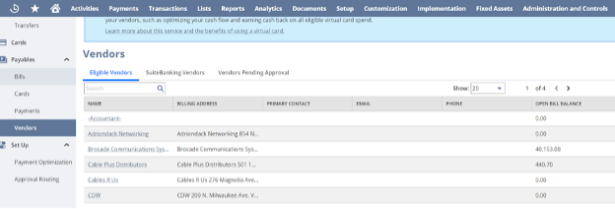

- Setting Up Vendors

- Once your vendors are set up, you can view them in the dashboard for quick access to their outstanding balances, contact information and addresses.

- Once your vendors are set up, you can view them in the dashboard for quick access to their outstanding balances, contact information and addresses.

- (Optional) Setting Up Approval Routing

- If you enable approval routing, a custom workflow or script should be set up to assign an approver to payments (SuiteFlow Overview).

- Setting up Two Factor Authorization

- You should always use 2FA with NetSuite log-ins when using Payment Automation.

- Setting Up Roles and Permissions

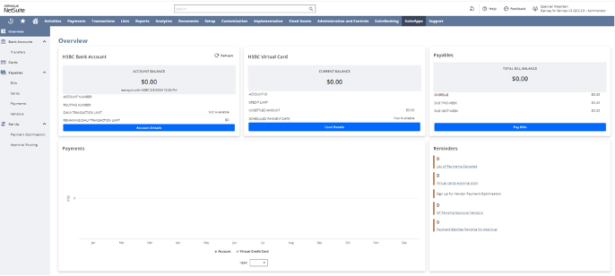

The Dashboard:

The dashboard will be your go-to hub for visibility into all the activity in your bank and credit card accounts. On the dashboard, you can quickly see your accounts, credit cards, and payables and the balances of each. You also have access to portlets such as the payments portlet, which gives an overview of your payment activity, the payables portlet, which gives an overview of the current open bills and their values, as well as a reminders portlet that keeps you notified of payments that need approval, canceled payments, and expiring credit cards.

Some other notable features of the Payment Automation SuiteApp include:

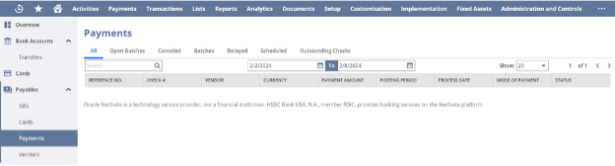

- The ability to pay with ACH, Checks, or virtual credit cards gives you flexibility in how your payments are made. The Payments tab can be accessed to see all your past, present, and current payments in details:

- HSBC bank and credit card accounts can be reconciled with NetSuite. Bank and credit card data is automatically imported, transactions and account details are automatically matched, and discrepancies will be flagged for review.

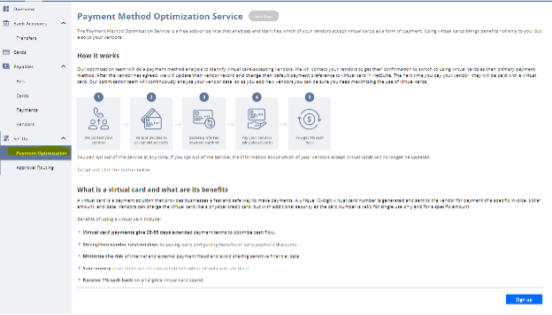

- Payment Optimization can be set up, allowing you to align with vendors that accept virtual cards and updating their payment details, so you get the full benefits of Payment Automation.

Current Limitations:

Payment Automation is not the right fit for every business. Below are some key limitations that could effect it’s viability within your organization:

- The SuiteApp is restricted, so only US-based companies can use the SuiteApp to pay suppliers in the US.

-

- USD is the only supported currency.

- The HSBC Online Account can only be managed from the NetSuite platform. Branch services such as deposits of checks and cash are not supported.

- Vendor prepayments, expense reports, and customer refunds are not supported.

The entire list of limitations can be found here.

If you have other questions about the Payment Automation SuiteApp, please first refer to this list of FAQs.

Our team is experienced in the configuration of Payment Automation tools. If you believe the Payment Automation SuiteApp is right for your business, we would love to start a conversation.

RSMUS.com

RSMUS.com