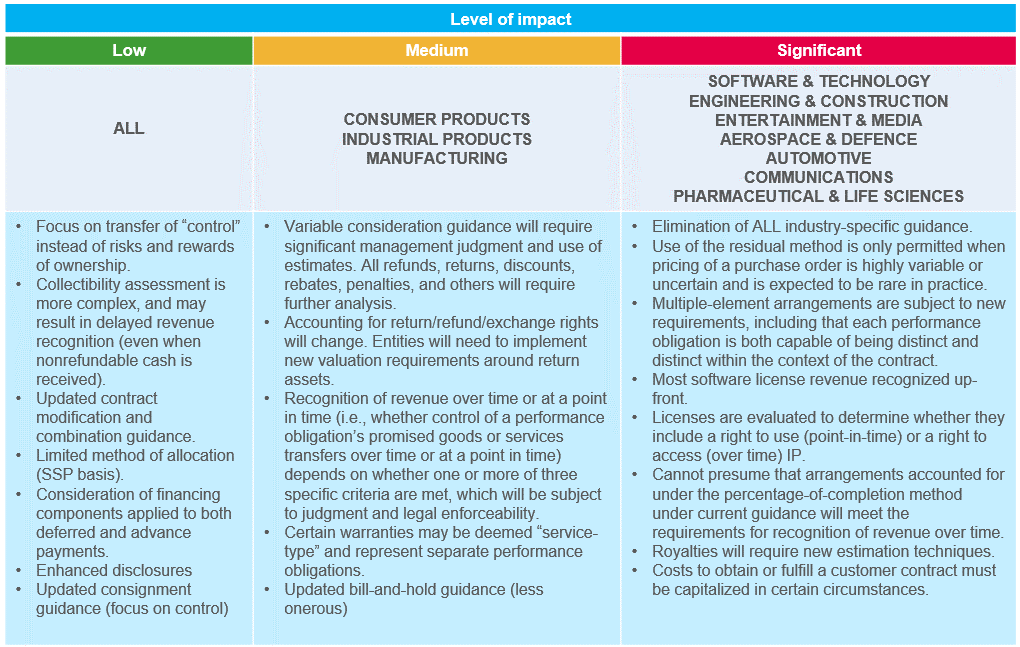

Coming out of SuiteWorld last week, we were a bit surprised at the number of companies who still have not yet started planning for their ASC 606 adoption. Time is starting to run out, especially for those who are moderately to significantly impacted. Some points to think about by industry:

We spoke with application managers who are growing concerned with the amount of effort to prepare their systems. The following is a summary of things to consider as you begin estimating and planning your organization’s impact:

- Establish a cross organizational steering committee

- Changes to support ASC606 can impact many departments across your organization. Ensure you build a cross functional steering committee, including representatives from Revenue, Sales, Order Processing, Fulfillment, FP&A, Professional Services, Product Development, Business Applications, and Business Intelligence/Reporting.

- Assess your impact under ASC 606 soon

- The sooner your organization understands the extent of the impact and choices for transition method, the sooner you will be able to determine the amount of change required within NetSuite to support.

- The potential impacts we have seen that drive system challenges are 1) need to breakout additional performance obligations. 2) changes in revenue allocations and 3) changes in timing of revenue recognition.

- For example, single term software license SKU may now need to be separated into multiple in order to accelerate or extend revenue recognition by obligation. As a result, all open sales opportunities, quotes, and orders will have to migrate to the new SKU structure so that prospectively they capture the appropriate detail for revenue recognition.

- Evaluate your current systems

- Take inventory of all applications used through the Lead to Cash process including any downstream reporting systems.

- Evaluate your revenue system’s ability to allocate revenue within a multiple element arrangement as well as options to support cost amortization.

- Understand contract modifications may require a reallocation of revenue and determine current system capabilities.

- Data integrity to support adoption

- The adoption will require some population of contracts to be recalculated to meet the new standards’ requirements, whether your company decides to transition using the Modified or Full Retrospective Approach (for more information, please see: Revenue recognition: A whole new world).

- Data availability and quality can be a challenge in the recast effort. Has your company recently been acquired, made an acquisition, or potentially implemented a new ERP or Contracts system? How good is your historical data for contracts going back several years?

- Changes to your existing item master to support additional ASC 606 performance obligations requires an evaluation of all open Opportunities, Quotes, etc. so that transactions generated from those documents meet the new requirements.

Summary

- Start now!

- Do not underestimate effort to…

- First understand the accounting and disclosures impact.

- Amount of effort to properly configure, test, and implement system changes.

- Remember that although this will be a critical project impacting your organization this year, your Finance and other teams will continue to have “day jobs” as well which must continue to be completed. The adoption date will not move and so the earlier you get started, the fewer late nights you may have ahead.

- Immediately establish a cross functional committee that meets regularly including: IT, Sales, Professional Services, Product Development, and Finance.

- Large Finance teams must ensure to include GL, Tax, and FP&A teams.

- Engage your Audit partner throughout your process to ensure that they are comfortable with your assumptions and adoption methodology.

- Maintain detailed design decision documentation and sign-offs throughout the project.

Technical Accounting Consulting Resources

- Revenue Recognition Resources

- Services

- Industry Insights

- Why private companies should care about the new guidance now

NetSuite Consulting Services

Articles from our Clients

For more information on this topic or others related to NetSuite, contact RSM at erp@rsmus.com or by phone at 855.437.7202.

By: Jill Nadeau, Supervisor

RSMUS.com

RSMUS.com