Introduction

NetLease was built to address the new lease accounting standards ASC 842, IFRS 16, and GASB 87. It supports each phase of the lease accounting lifecycle including lease transition, lease initiation, lease modification, and early termination. It also provides full visibility into right of use asset and lease liability calculations, automates the creation of monthly transactions, and accounts for foreign currency leases.

Overview

Lease accounting compliance in native NetSuite for ASC 842 & IFRS 16 leave your complex lease spreadsheets behind and automate your lease accounting processes. NetLease for NetSuite is the application of choice for thousands of accountants, controllers and CFOs using NetSuite.

Key Benefits

- 100% built for NetSuite and NetSuite native, requires no integrations or reconciliations with outside systems.

- Confidently transition to ASC 842 with help from our team of 45+ ex-big 4 CPAs

- Be audit-ready and compliant with the new lease accounting standard in record time.

- Save time every month by efficiently managing your lease accounting in native NetSuite.

- Fits your budget with two versions of NetLease for NetSuite:

- NetLease Go – partially automated non-GL impacting

- NetLease Max – fully automated GL impacting

- Choose self-service, group or individual implementation.

Capabilities

- Calculates schedules including lease payments, lease liability amortization and right-of-use asset amortization.

- Generates journal entries for the lease liability and right-of-use asset.

- Automates the classification of leases as operating or finance, low-value or short-term, and account for each accurately.

- Seamlessly integrates with your company’s chart of accounts, currencies, vendors, departments, classes and locations.

- Practical expedient application simplifies the transition to ASC 842 and IFRS 16

- Generate audit-ready reports with one click including disclosure footnotes, lease balance roll-forward report and waterfall report.

- All modification types are fully supported including standard modification, decrease in scope and ROU impairment, and automatically produce the updated journal entry and schedules.

- Integrated with NetSuite’s AP process removing the disconnect between lease payments and lease journal entries.

- Store and access key lease details such as commencement date, renewal options, vendor and other key contract details

- Robust audit trail provides detailed change tracking for strong internal controls.

- CPA-approved calculations have been audited by the big four since 2018 and are trusted by thousands of accountants worldwide.

Compliant with IFRS 16 and FASB ASC 842 requirements for lessee accounting › Supports lease reporting & decision making throughout the entire lease lifecycle › Push-button reporting for both FASB and IFRS disclosures › Full lease automation › Integrated AP management › Robust end-to-end audit trail › Manage lease modifications › Store and access key details and documents for each lease record › Built for NetSuite certified.

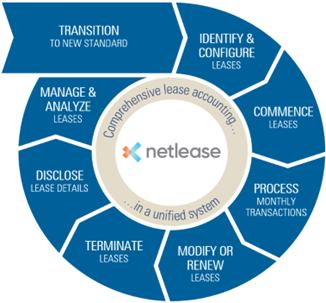

Lease Accounting Life cycle

The lease accounting lifecycle was developed to give a full 360-degree view of a lease—from beginning to end. Each step appears to be simple, but when examined a bit closer, there are some different variables to be considered with the new standard. We are providing a brief overview of each step below.

- Identify & Configure Leases

The first step in the lifecycle is to identify contracts meeting the definition of a lease under the new accounting standards, which most simply put, is a contract that gives you a right to control use of an asset in exchange for consideration.

The approach is to

(1) review and identify contracts with leases, and

(2) within those contracts, determine the separate components of the contract and whether each component meets the definition above.

The identified lease components will need to be included in your present value calculations to determine your lease liability and right of use asset. Non-lease components can be tracked separately but will not impact your balance sheet. An example of non-lease components includes CAM charges and property taxes on real estate leases.

NOTE: Both ASC 842 and IFRS 16 offer a practical expedient to allow companies to take a simplified approach and combine lease and non-lease components by class of underlying asset. For US GAAP companies ( ASC 842 only), you will still need to determine whether your lease meets the criteria for a financing or operating lease type. While bright lines determinations are cautioned against, the criteria are similar to the previous standard. International and Government entities will now account for all leases as a single financing type.

2. Commence Leases

The lease commencement date is the date on which the lessor makes the underlying asset available for use. Effective from this date until the end of the lease, the company will record a right of use asset and lease liability on the balance sheet. The liability is established at the present value of future lease payments. The right of use asset is equal to the lease liability, adjusted for initial direct costs, prepayments, and incentives.

KEY DIFFERENCES: leases were recognized under the prior standard at the lease inception date, which could frequently take place before the commencement date as defined above.

3. Process Monthly Transactions

In addition to the standard creation and payment of vendor bills to lessors, you will now need to record monthly amortization entries for your newly created right of use assets and lease liabilities. The lease liability is reduced using the effective interest method, and the right of use asset will be amortized on a straight-line basis for financing leases. Operating leases will continue to be recorded as a single expense, and the Right of Use asset is brought down over the lease term using the plug method (equals the difference between liability accretion, single expense, and payment).

4. Modify or Renew Leases

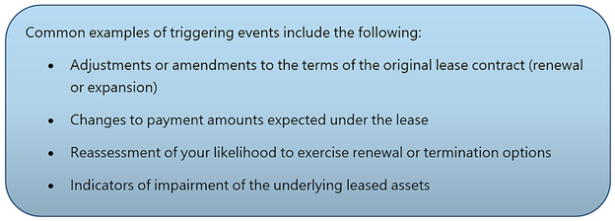

Throughout the duration of a lease, there may be changes to the lease agreement or other triggering events that result in a modification to the recorded lease balances and expenses.

Lease modifications require you to measure the lease liability with the new terms (rate, payment, duration). The offsetting amount is typically recorded against the ROU asset.

5. Terminate Leases

Circumstances may require an early termination to the lease. In these instances, a termination is required to remove the entire ROU Asset (and accumulated amortization), as well as any remaining lease liability, settling the final payments paid or received with an offset to a gain/loss account.

6. Disclose Lease Details

The new required disclosures are significantly more comprehensive than those under the old standards and include both quantitative and qualitative requirements. You will continue to disclose undiscounted lease maturity, but additional disclosures range from the simple (e.g., general description of your lease portfolio, renewal options, residual value guarantees) to the complex (e.g., weighted average term, weighted average rates, lease costs, and cash flows).

7. Manage & Analyze Leases

As companies capture and consolidate more information to comply with the new accounting standards, there are opportunities to use this data to better manage their lease portfolio. Having information in a centralized repository can enable improvements to lease efficiently and controls so that you never miss a key date.

8. Transition to New Standard

Upon the adoption of the new standard, lessees are required to apply a one-time modified retrospective transition approach. Although the wording sounds ominous, fortunately, the standards boards have provided a number of practical expedients you can elect to make the transition smooth and less confusing. For example, you can elect NOT to adjust comparative periods in your comparative financial statements, allowing you to present old and new side by side. Additionally, you can elect to use hindsight to determine lease terms, not revisit classification or direct costs determinations, and whether contracts contain a lease.

Taking advantage of the all the practical expedients allows a transition to actually be quite simple. The simplest approach would be to measure your lease liability as of the effective date and recording your offset to create an ROU asset and adjust the ROU asset for existing prepaid/accrued rent, remaining balances of your lease incentives, and unamortized initial direct costs.

Why Choose NetLease?

With so many systems out there, what makes NetLease shine? NetLease simplifies complex lease accounting processes while delivering the technical functionality your organization needs.

NetLease integrates seamlessly with any Enterprise Resource Planning (ERP) system, allowing accountants to easily manage in-house leases, whether your organization has a handful or a huge portfolio of leases.

The automated features ensure compliance and save you time and money by reducing manual effort and errors. These include:

- Lease amortization schedules and disclosures

- Posting to the general ledger

- Disclosure reporting

- Roll-forward and waterfall reports

- Automated modifications and terminations

- Support for operating and financial leases

- A complete audit trail.

With NetLease, you’ll stay GAAP compliant without the hassle.

NetLease is also a must-have for NetSuite users because NetLease is embedded and customizable within NetSuite.

RSMUS.com

RSMUS.com