The latest NetSuite 2024.1 Release introduces upgrades aimed at empowering organizations to optimize their data management, bolster software security, and enhance SuiteApp utilization across multiple products. By grasping the advantages and functionalities offered by NetSuite 2024.1, businesses can fully capitalize on the potential of this fresh release.

NetSuite Pay SuiteApp is a comprehensive payment processing solution intricately crafted for businesses leveraging NetSuite. It streamlines the acceptance of credit card payments, whether online, over the phone, at physical points of sale, or through digital payment avenues, all the while ensuring adherence to PCI standards for data security. By harnessing NetSuite’s capabilities, you gain access to a complete repository of transaction records, providing a 360-degree view of your customer transaction history. Additionally, meticulous audit tracking safeguards the integrity of your financial processes, maintaining the confidentiality and security of payment card data throughout the entire transaction lifecycle.

Audience

The NetSuite Pay SuiteApp is accessible to all NetSuite customers within the United States, including existing customers who haven’t yet established a merchant services account with a payment gateway partner. End users will consider their customers and transactions conducted in US dollars. The merchant application form must be completed by an authorized individual affiliated with the business, who can provide ownership details and certain personally identifiable information related to the company.

User Benefits

- Ability to accept ACH and all major credit card brands

- Allows full visibility of your financials in NetSuite

- An easy, automated onboarding with a secure application form in NetSuite

- Detailed daily and monthly reporting

- Automated reconciliation

- Risk management included – transaction monitoring, fraud prevention and dispute resolution

- Begin accepting payments in 2 days or less

Prerequisites and Setup

- Need to have NetSuite ERP.

- Any customer who onboarded for NetSuite in 2019 or prior will need to check if they have payment instruments enabled.

- Setup included installation of NS Pay SuiteApp, filling out the Merchant Application form, submitting it, then configuring the payment processing profile.

Customer Lifecycle

(Sales) Product Awareness – Customers might have questions about payments, they will want to know things like; processing rates for Ach and credit cards.

(Customer) Merchant application – Once the SuiteApp had been installed, the customer will be responsible for filling out the merchant application form.

(Gateway) Underwriting – The merchant application form then gets sent out to underwriting. The gateway company will have their team review the details from the company info submitted in the application. Here is where they can access on a merchant-by-merchant basis as to what those daily processing limits will be.

(Customer) Onboarding & Account Setup – Once approved, payment processing profile can be setup. This will follow things like sending out invoices, accepting payments and transacting where you will receive daily and monthly settlement reports.

How to Apply:

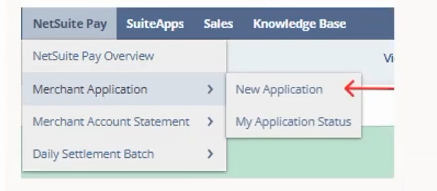

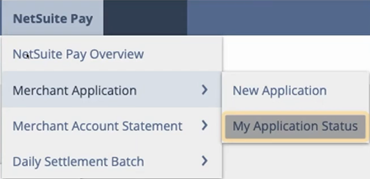

After installing the SuiteApp, navigate to NetSuite Pay > Merchant Application > New Application

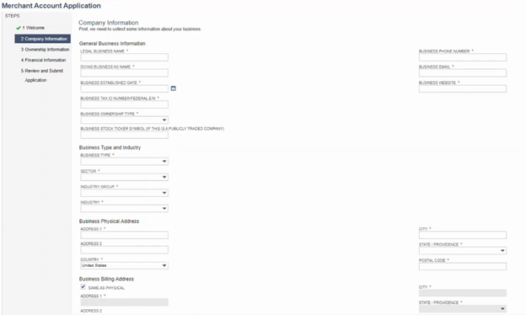

On the Merchant Account Application Form; Company Information, fill out important information like Legal Business name, DBA name etc.

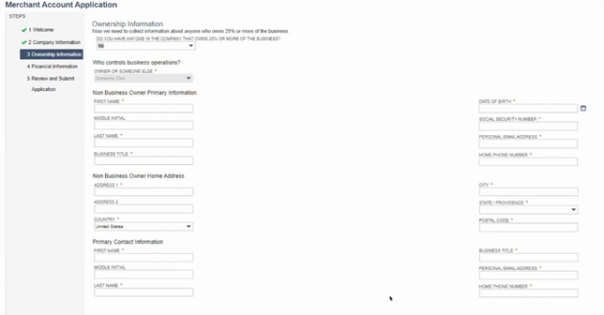

The Ownership Information section of the form is where it’s important to have someone who has the correct information to fill this section of the form out like the primary contact information. This is information that is used for underwriting and is a regulatory requirement for the financial services industry.

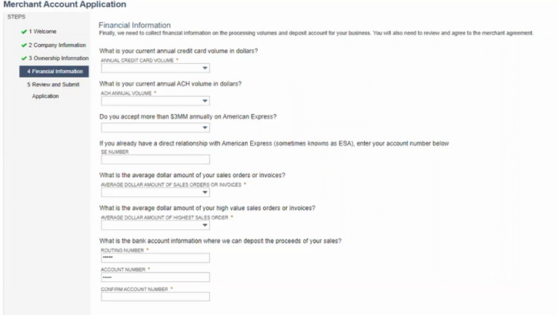

The last step of the application form is Financial Information. This is what they’re looking for to know where the customer wants to receive their daily funding. (Account number, routing number etc.)

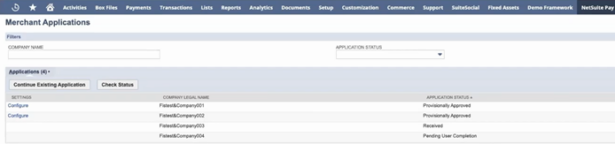

Once the application has been filled out and submitted, customers can navigate to the Merchant Applications page and view the application status. Is the status reads as ‘Provisionally Approved*’ or ‘Approved*’ you can go ahead and start configuring at that point.

Navigate to NetSuite Pay > Merchant Application > My Application Status

The application status in NetSuite will show as one of the following:

- Pending User Completion* – Application has been started but not submitted.

- Application Complete – Application has been submitted and is pending processing.

- Received* –Application has been received and is being reviewed.

- Processing* — Application is being processed.

- Provisionally Approved* — Application has been tentatively approved but is still being processed.

- Approved* — Application has been approved.

- Closed – Application has been denied and no further action is needed.

- On Hold – application is on hold pending more information from applicant.

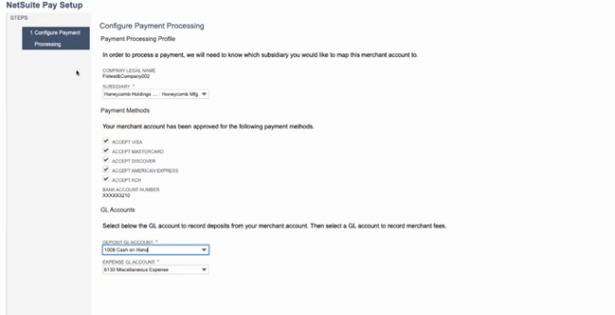

Once you hit the Configure button, you can begin setting up the payment processing profile. You can select the subsidiary associated with the merchant account, you can select and turn on payment methods you wish to use as well as select the Deposit GL account and Expense GL account.

RSMUS.com

RSMUS.com