Why implement HMRC Integration functionality within NetSuite?

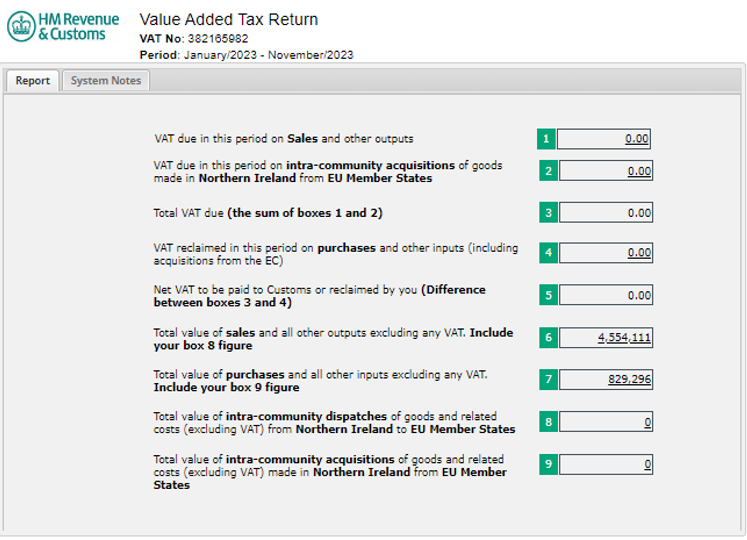

As of April 1, 2019, the United Kingdom requires VAT-registered businesses with a taxable turnover above 85,000 GBP over the past 12 months to remain in compliance with the Making Tax Digital system. The Making Tax Digital system requires companies to keep and maintain digital records, prepare VAT Returns, and digitally submit the UK VAT100 report through the VAT MTD API (Register for VAT).

In compliance with the Making Tax Digital requirements, the NetSuite HMRC integration adds tax reporting functionality to support businesses in complying with the Making Tax Digital requirements through a connection to HMRC for UK VAT100 report preparation, digital submission, digital storage, and historical return retrieval functionality.

Overall Functionality

- Streamlined tax integration between NetSuite and HMRC allowing for generation and digital submission of the United Kingdom VAT100 report to HMRC through the VAT (MTD) API.

- Review VAT return submission history and retrieve previously submitted UK VAT100 Returns.

- Ability to export the UK VAT100 report to Excel or submit via CSV file.

- NetSuite supports digital record keeping in compliance with HMRC of the following data:

- Designatory data

- Supplies made

- Supplies received

- Recording of reverse charge transactions

- Summary data

- Creates additional standard Tax Reporting roles

- Compatible with the Multi-book accounting functionality

Key Considerations and Requirements

- NetSuite bundles, SuiteApps, and SuiteScripts – Multiple objects are required to be installed and deployed to meet functionality requirements to digitally submit the UK VAT100 report to HMRC.

- NetSuite Roles – Four standard roles are created for the additional tax reporting functionality. Updates are required to allow existing custom roles to utilize new functionality to view, prepare, and submit the UK VAT100 report.

- NetSuite End User Training – Additional user testing and training is required for employees with login access responsible for submitting UK VAT100 report to understand how to view, prepare, review, and submit the UK VAT100 report to HMRC.

- VAT and HMRC Reporting Information – VAT Registration Number, VAT Reporting Period, VAT Accounting Scheme, HMRC User ID, HMRC Password are required to setup the initial configuration of the VAT 100 report.

Summary

NetSuite integration with HMRC allows VAT-registered businesses to remain in compliance with United Kingdom tax reporting requirements through digitally preparing and submitting the UK VAT100 report. After the initial one-time setup, the functionality streamlines the preparation and digital submission of the UK VAT100 report for companies with a UK subsidiary to maintain compliance with the Making Tax Digital system.

To learn more about how RSM can help get you started in ERP and integrate NetSuite with HMRC, please contact our team!

Nicole Mikhailov

nicole.mikhailov@rsmus.com

RSMUS.com

RSMUS.com