Co-Author: Pawan Singh and Satyam Shah

NetSuite SuiteTax is a global tax management solution seamlessly integrated into the NetSuite platform, catering to the diverse tax requirements of multinational global organizations. Although NetSuite Suite tax and advanced taxation can achieve handling the Japan taxation effectively, the uniqueness of Japan Taxation requires a separate Bundle which complies to the Japan complex taxation needs of compliance and reporting’s.

NetSuite Localization Bundle for Japan involves customizing it to comply with Japanese accounting standards, tax regulations, language, and cultural norms.

Note:

The Japan Localization SuiteApp is not compatible with the Netsuite SuiteTax feature. If the SuiteTax feature is enabled in your NetSuite account, do not install the Netsuite Japan Localization SuiteApp.

Features focused on Japan:

Japanese tax system presents a significant challenge for businesses operating in Japan. With numerous rules, exemptions, and regulations, navigating the tax landscape can be daunting.

Netsuite Japan Localization SuiteApp is already installed in newly provisioned Japan Edition NetSuite accounts. If you need to install the SuiteApp then perform the following steps by going through the Installation guide Installing the Japan Localization SuiteApp, Guide to setup Japan Taxation.

A new installation of Netsuite Japan Localization SuiteApp will automatically provide the following tax records:

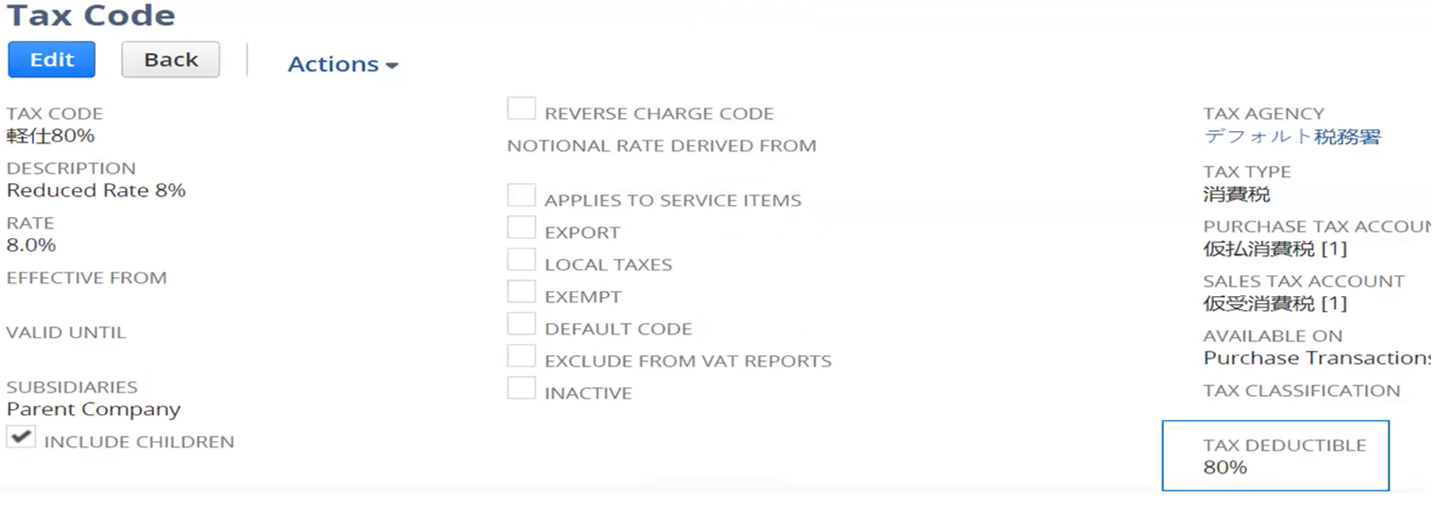

- Tax codes (to be used starting October 1, 2019)

- Tax types

- Tax control accounts

- Tax agency

| Functional Area | Feature | Description |

| General Accounting | Using Japanese Accounting Periods | The NetSuite Japan Edition provides pre-defined accounting periods that meet the requirements of common Japanese business practices. |

| Banking | Meeting Japanese Banking Requirements | The NetSuite Japan Edition supports Japanese bank account information and enables you to handle customer and vendor bank account information for use in transactions or payments. |

| Taxation | Consumption Tax Overview – Japan | In Japan, consumption tax is a nationwide tax levied on the sale and lease of domestic goods and services, and on foreign goods collected from bonded areas. Japanese businesses are responsible for collecting this tax from companies and consumers that purchase their goods and services. |

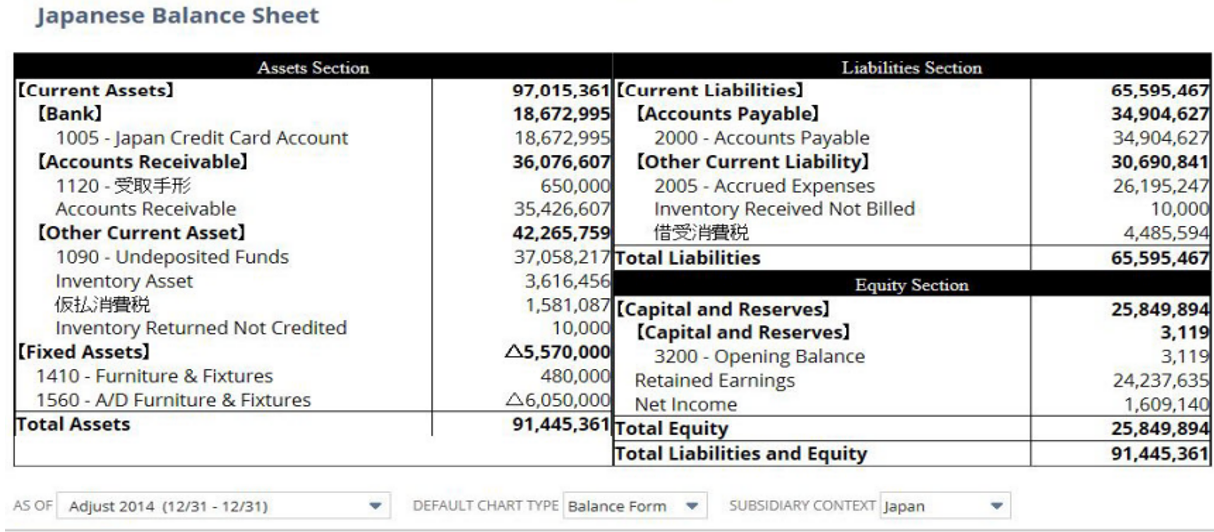

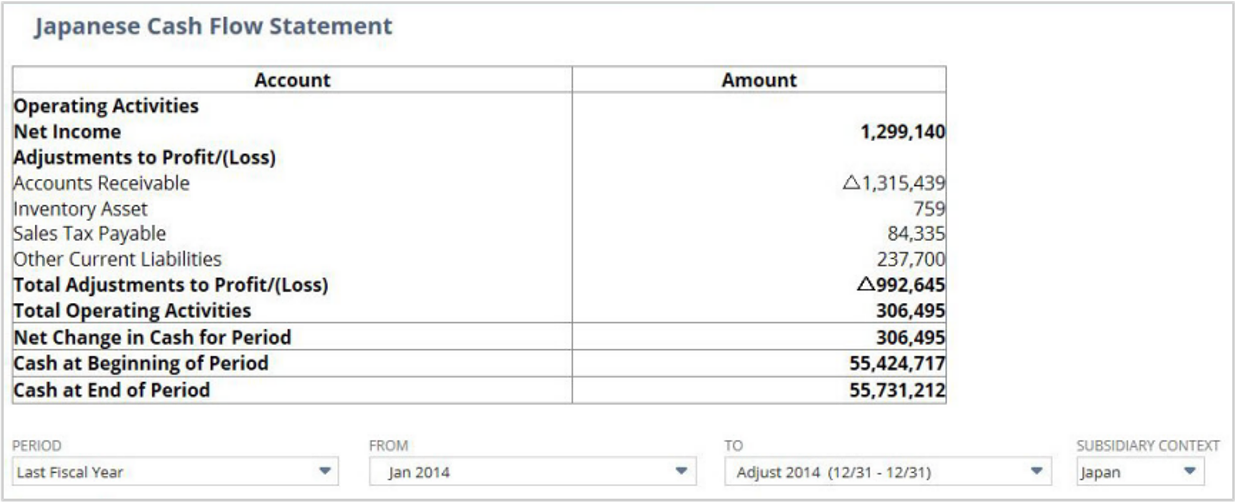

| Financial Statements | Japan Comparative Balance Sheet | Japan Localization Bundle Provides several Financial Statements reports within the Bundle such as (Japan Balance sheet, Income statement, Trial Balance, Cash Flow statement, Comparative Statements). |

| Fixed Assets Management | Japan Fixed Assets Reports | Japan Fixed Assets Reports Suiteapp generates reports for depreciable fixed assets and corresponding tax reports. |

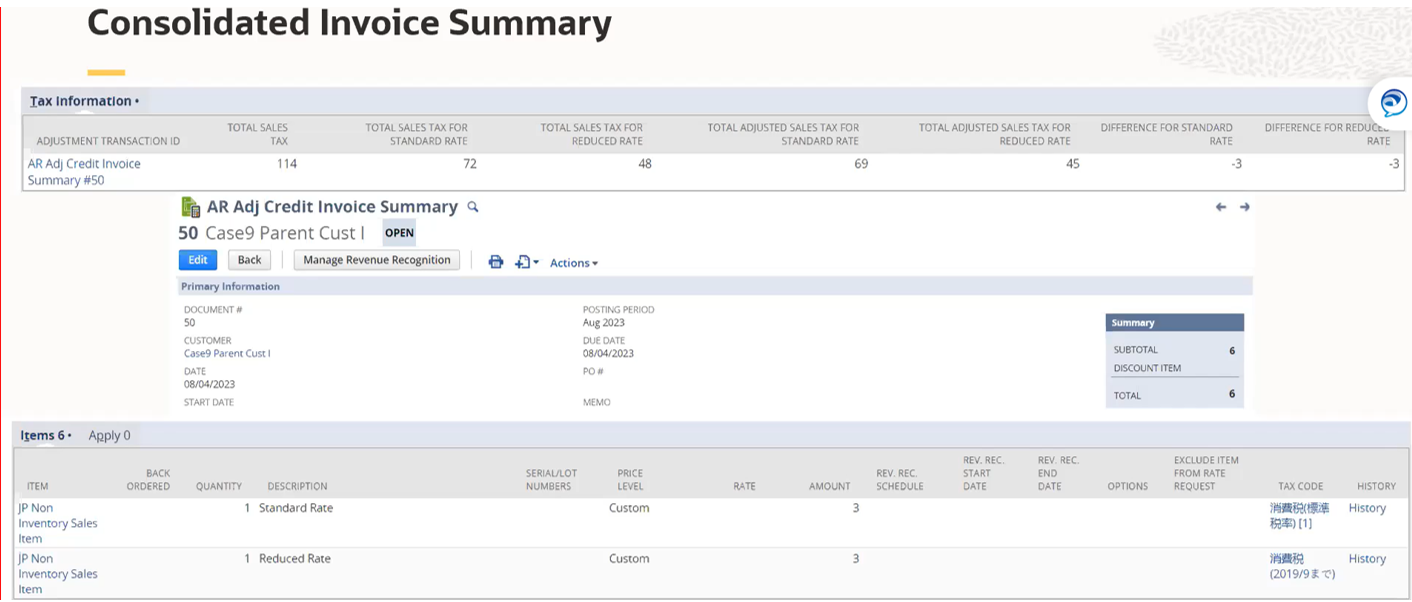

| Billing and Invoices | Japanese Invoice Summary | The invoice summary (formerly called item detail statement (IDS)), is a consolidated invoice covering a billing period. The invoice summary can include invoices and credit memos as well as canceled and closed sales orders. |

| Payment Processing | Using Tegatas | Receive payments (receivable tegata) from customers using tegatas, which are a traditional form of payment in Japan. Tegatas are like promissory notes. |

| Payment Gateway | Integrate with a local payment gateway service provider, Veritrans, to accept credit card payments from customers. | |

| Overdue Balances and Collections | Japanese Billing Cycle and Payment Terms | In Japan, most companies use a billing cycle based on the closing date and the payment due date. Similar to credit card payments, companies agree on a closing date with customers before starting business transactions. |

| Vendor Payments | Using Tegatas | Make payments to vendors (payable tegata) using tegatas, which are a traditional form of payment in Japan. Tegatas are similar to promissory notes. |

| Japan Payment Formats | Pay vendor bills and employee expenses Japan by generating payment files formatted using the Zengin payment file specifications of the Zengin Payment Clearing Network of banks. |

SuiteApps/Bundles available for Japan specific needs:

| SuiteApp | Description |

| Installing the Japan Localization SuiteApp | Provides Japan-specific features, Reports in compliance with Government tax Structure. |

| Japan Fixed Assets Reports | Japan Fixed Assets Reports SuiteApp generates reports for depreciable fixed assets and corresponding tax reports. |

| Japan Financial Statements | Provides Japanese Balance Sheet, Japanese Income Statement and Japanese Cash Flow Statement. The SuiteApp also includes two templates for each financial statement, one template in English and another in Japanese. |

| International Tax Reports | Provides VAT/GST reports and online reporting generated in the local format for ease and accuracy of submission, sales and purchase reports by tax code, and pre-configured tax codes when a new nexus is created. |

| Electronic Bank Payments | Provides Japanese payment formats to enable businesses to pay vendor bills and employee expenses and receive payments from customers in Japan. |

Japan Localization SuiteApp Limitations and Best Practices

The following are the current limitations of Netsuite Japan Localization SuiteApp, as well as the best practices for using the features.

1. Compatibility with SuiteTax Feature: Netsuite Japan Localization SuiteApp does not support the SuiteTax feature yet. Limitations will be observed in the scenarios described:

- If you enabled Netsuite SuiteTax first, you will not be able to install Netsuite Japan Localization SuiteApp.

- If you installed Netsuite Japan Localization SuiteApp first, and then enabled SuiteTax, the Invoice Summary Generation page will display an error and you will not be able to generate invoice summaries. Also, you will not be able to generate the Purchase Tax by Tax Category Report and the Deductible Tax & Taxable Sales Ratio Calculation Form.

2. Limitation with AutoCash and Installment Payments: The AutoCash and Installment Payments features are not supported by Netsuite Japan Localization SuiteApp. Any Transactions created using the AutoCash and Installment Payments features will not be included in the invoice summary search results and generated report.

3. Invoice Summary Generation: You cannot use the regenerate feature for invoice summaries created by previous versions of Netsuite Japan Localization SuiteApp earlier than Bundle ID 15580.

4. Accepting Payments for Invoice Summaries: On the Customer Payment page, when you select a customer in the Customer field, the system displays a warning that you are about to leave the page and that the transaction has not been saved. This is normal behavior. Click Leave this Page to continue working on the transaction.

If the number of transactions lines on the Customer Payment page exceeds 10,000, you may receive a session timeout error. To prevent timeout errors for customers with a high volume of transactions in the period, it is ed that you apply the payment in batches or use the filters to narrow the search result.

5.Custom Fields: Custom fields included in Netsuite Japan Localization SuiteApp are shown on forms if the subsidiary or company is Japanese. These custom fields cannot be hidden on custom forms because the visibility of the fields is dependent on the country of the subsidiary or company.

Tax Reports:

The Japanese Balance Sheet Report: Shows a summary of assets, liabilities, and equity as of a particular month, quarter, or year. The report is shown in the Japanese layout if you select Balance Form in the Default Chart Type field. If you select Report Form in the Default Chart Type field, the report is displayed using the NetSuite standard report layout.

The Japanese Cash Flow Statement Report shows activities that affect a company’s cash balance during a selected time period.

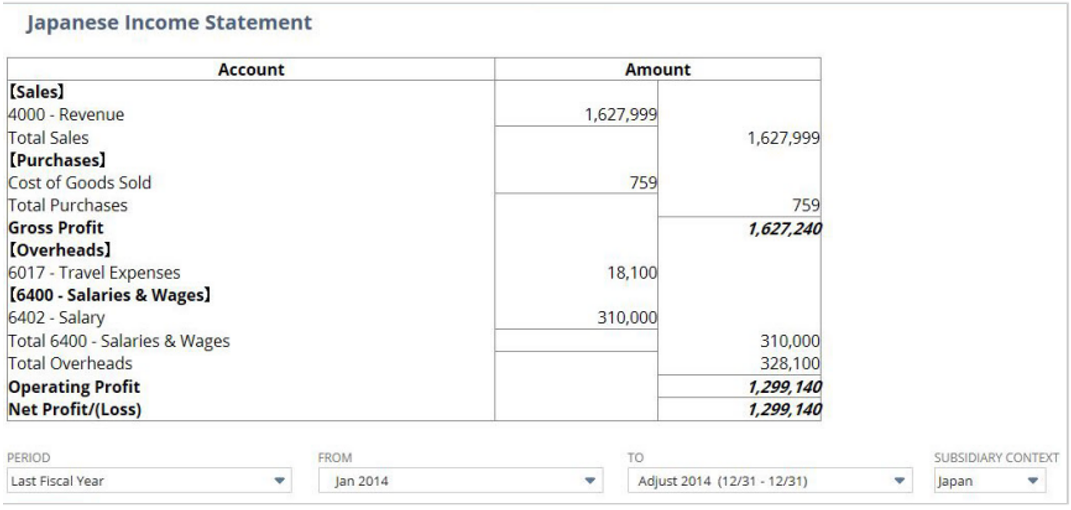

The Japanese Income Statement Report shows a company’s income, expenses, and net income for a specific period.

Summary: By implementing NetSuite for Japan, organizations will streamline tax administration, reporting, and compliances through automated procedures and precise computations. RSM provide NetSuite Suitetax and localization Setup & Configuration Management Solutions assure compliance and enhance operational efficiency by adhering to best practices for setup, configuration, and execution. Using NetSuite will improve tax administration, increase efficiency, and accelerate business development and expansion in today’s volatile market.

To learn more about NetSuite Suite Tax or how you can get started leveraging it, contact the RSM team!

RSMUS.com

RSMUS.com