GL Matching is a feature in NetSuite that adds the ability to match transactions, a common practice in many countries, mainly Europe.

For example, “Lettrage” is a term used in French accounting that refers to linking or reconciling entries. It is about connecting entries that balance each other, like an invoice and its corresponding payment. This technique is utilized to verify the balance of an account, known as cross-referencing or reconciliation. For instance, in accounting software’s subsystems of accounts receivable or accounts payable, you can typically use a letter or symbol to indicate whether an invoice has been settled. This is crucial for tracking transactions and maintaining the correctness of the accounts.

When users install the GL Matching SuiteApp, it includes the GL Matching Report Saved Search. This search gives users a comprehensive view of the transaction lines matched or partially matched by the SuiteApp. The data in this search can change if you enable the Full Multi-Book Accounting feature. If you have the Full Multi-Book Accounting feature enabled, the GL Matching Report saved search results will be categorized according to the accounting book to which they are linked.

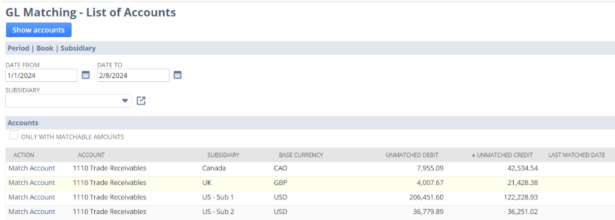

GL Matching List of Accounts Feature

In NetSuite, the GL Matching List of Accounts is a feature that lets you view the accounts that are part of the GL Matching process. Here’s how you can navigate to it:

- Navigate to Transactions > Financial > GL Matching – List of Accounts. If using the Accounting Center, go to Financial > Other Transactions > GL Matching Checklist.

- This will show you a list of accounts that are part of the GL Matching process.

If you want to add an account to GL Matching, follow these steps:

- Navigate to Setup > Accounting > Manage G/L > Chart of Accounts.

- Click on Edit next to the Account name that you want to add to GL Matching.

- Tick the Include in GL Matching checkbox on the right side of the page.

- Click on Save.

This will add the chosen account to the GL Matching process. Note, only the accounts that have the Include in GL Matching checkbox ticked will be shown in the GL Matching List of Accounts.

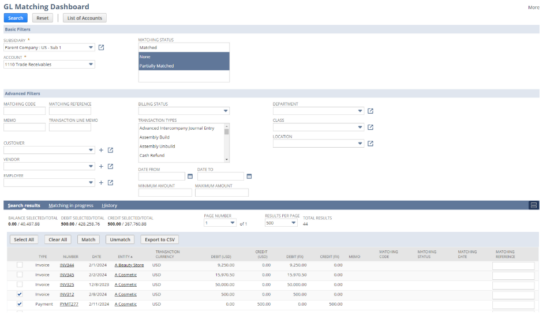

GL Matching Dashboard

The GL Matching Dashboard allows you to find transaction lines that can be matched using different search filters. You can then view, edit, match, or unmatch the transaction lines in the Search Results list. When a match is completed, the SuiteApp assigns a matching code and a matching status, which can either be Matched or Partially Matched.

Below is a list of important terms used in GL Matching features and dashboard:

- Group: A collection of transaction lines that have been matched by the SuiteApp and assigned a matching code.

- Transaction Lines: These are the lines of transactions that make up one transaction record. Each line has a debit or credit value. The SuiteApp matches transaction lines, not entire transactions.

- Matching Status: This refers to the current state of the matching process:

- None: These lines have not been matched yet, meaning they have not been assigned a matching code.

- Matched: These lines are part of a group where the sum of the credit entries equals the sum of the debit entries. Each group has a matching code.

- Partially Matched: These lines have been added to a group and assigned a matching code.

Walkthrough of GL Matching NetSuite:

- Go to the GL Matching Dashboard.

- For an Administrator, this is under Transactions > Financial > GL Matching Dashboard.

- For roles that use the Accounting Center, it’s under Financial > Other Transactions > GL Matching Dashboard1.

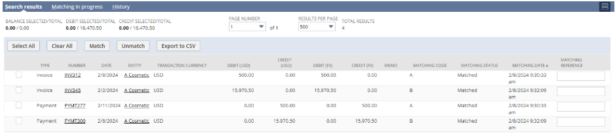

On the dashboard, you can search for transaction lines that belong to an account, such as Accounts Receivables

Once you’ve found the transaction lines you want to match, you can start the matching process. For example, you could match an invoice to a customer payment, or an invoice to three customer payments.

When you complete a match, the SuiteApp assigns a matching code and a matching status depending on the total balance of the group. The matching status can be “Matched” if the sum of the credit entries is equal to the sum of the debit entries, or “Partially Matched” if not all transaction lines have been matched.

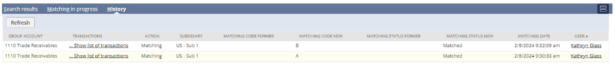

You can review the matching history to see the details of the matches you’ve made.

To summarize, NetSuite’s GL Matching is a feature that facilitates the pairing of transactions, a practice prevalent in many countries, especially Europe. It encompasses the act of associating or reconciling entries that counterbalance each other, like a bill and its respective payment. This method, referred to as “Lettrage” in French bookkeeping, is essential for confirming the correctness of account balances, cross-checking, reconciliation, and ensuring the precision of accounts. In the subsystems of accounts receivable or payable, a letter or symbol is typically used to monitor if an invoice has been paid off.

To learn more about how RSM can help you get started with NetSuite its GL Matching capabilities please contact our team at NetSuite@rsmus.com!

RSMUS.com

RSMUS.com