Co-Author: Eric Frei

The release of NetSuite 2024.1 has brought enhancements to the Revenue Recognition Field Mapping functionality.

Before diving into the new enhancements that were brought to Revenue Recognition Field Mapping, let’s look into what the functionality does.

Note: The Revenue Recognition Field Mapping functionality is only available when Advanced Revenue Management (Essentials or Allocations) is enabled.

The Revenue Recognition Field Mapping functionality in NetSuite allows users to map custom or standard fields from a source record to standard or custom transaction column fields in revenue arrangements, or directly onto revenue elements. On the source record, both body and column fields can be mapped. On the target record, only column fields can be mapped. The values of mapped fields are copied from the source when the revenue arrangement is created.

For example, if a user wants to link a start date for a sales order to a corresponding revenue start date on a transaction line in a revenue arrangement, revenue recognition field mapping can be used.

NetSuite 2024.1 brings various enhancements to this functionality that broadens the scope and makes navigation easier for the user.

Let’s go over some of the changes that have been made.

New Record Page

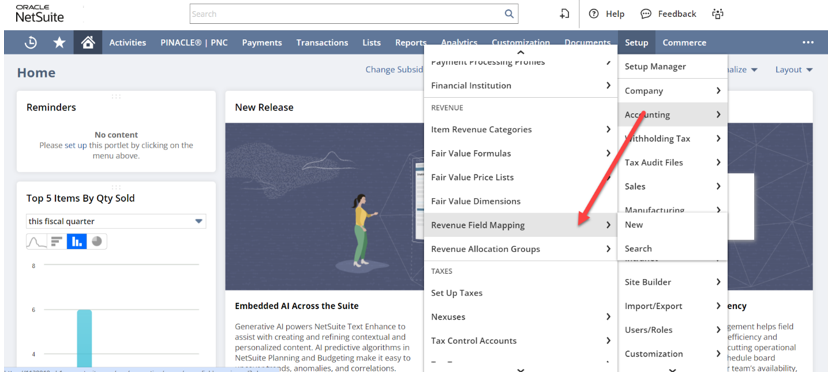

As an Administrator, navigate to Setup -> Accounting -> Revenue Field Mapping

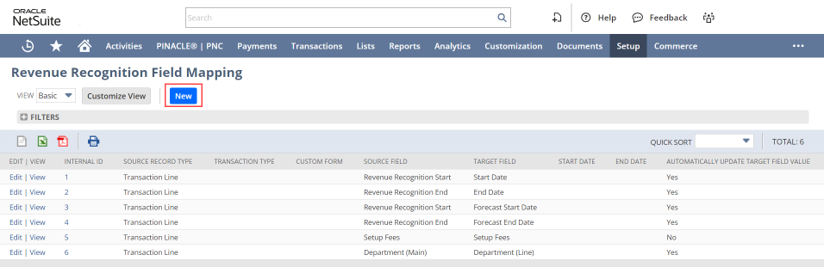

The Revenue Recognition Field Mapping page has been revamped in terms of its appearance and functionality. Users are now able to keep track of previously created Field Mappings in a list form and can customize the view to suit their business needs. Filters are also available, as well as the option to export the list as a CSV, Excel, or PDF file.

Creating new field mappings now acts similar to other records that can be viewed as a list. Users are able to view or edit existing mappings directly from this page. To create a new Revenue Recognition Field Mapping, click “New”. This brings users to the Revenue Recognition Field Mapping Record.

New Record Fields:

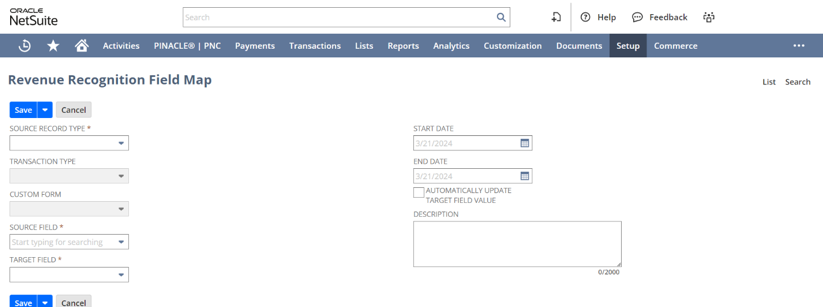

Once users enter the Revenue Recognition Field Map record, they are greeted with new options through the introduction of various new fields. Fields with a red asterisk * are required to be filled out.

Source Record Type*:

Users must select a source record type to be able to use the Revenue Recognition Field Mapping functionality. Available options include Project Revenue Rule, Subscription Line, and Transaction Line

Transaction Type:

The transaction type field is a newly added optional field that allows users to select the type of transaction they want the field mapping to apply to. Available options include Cash Refund, Cash Sale, Credit Memo, Invoice, Journal, Return Authorization, and Sales Order

Custom Form:

The custom form field is a newly added optional field that allows the user to select the custom form the field mapping will apply to based on the transaction type selected.

Source Field*:

The source field is a required field where the available values in the drop-down list depends on the selected value of the Source Record Type field. For example, selecting Transaction Line in the Source Record Type field will limit the available options in the source field to any column fields that populate on a transaction line.

Target Field*:

The target field is a required field where the available values in the drop-down list depends on the selected value of the Source Field. For example, selecting a date field in the Source Field will limit available options in the Target Field to similar date transaction column fields on the revenue arrangement.

Start Date and End Date:

The start and end date field are newly added optional fields that allow the user to select a date range that the field mapping will apply to. If the current date is outside of these parameters, the field mapping will become invalid.

Automatically Update Target Field Value:

The Automatically Update Target Field Value is a newly added checkbox that greatly improves the user experience of revenue field mapping by eliminating manual intervention of updating revenue arrangements.

With this box checked, any changes made to the source field after initial revenue arrangement creation will automatically update in the revenue arrangement and reflect the new value in the target field. Users must still run the Update Revenue Arrangements process for the target field to reflect the source field, but no manual manipulation of the target field is needed.

Note: Prior to 2024.1, users would have to manually update the target field in the revenue arrangement if any changes were made to the source field.

Description:

Users can add an optional description to any Revenue Recognition Field mapping for easier identification and contextualization of the mapping.

CSV Importing:

Users can export and import Revenue Field Mapping as a CSV file. For more information on this topic, check out this article. This new functionality will help with migration from Sandbox to Production for companies with numerous mappings.

Conclusion:

The enhancements to Revenue Recognition Field Mapping that came with the release of NetSuite 2024.1 have greatly improved the user interface, scope and breadth, and overall usability of the functionality. However, this enhancement is just one of many. To learn more about other enhancements, please refer to the Release Notes.

For more information about the new Revenue Recognition Field Mapping functionality, check out SuiteAnswers.

RSMUS.com

RSMUS.com