For any company that has and receives inventory items in NetSuite, this account can be a little daunting to reconcile. The main reason being is that there is no direct link between item receipts and vendor bills created from a purchase order.

When you receive inventory on an item receipt, the accounting impact is debiting your inventory account (current asset) and crediting the NetSuite system generated Inventory Received Not Billed account (current liability). The natural balance is an accrued balance of all inventory that has been received and has yet to be billed. Once you receive the bill from your vendor and you bill off the purchase order in NetSuite, the accounting impact a debit to Inventory Received Not Billed and a credit to Accounts Payable. This should effectively net the IRNB account but only if the quantity and rate for the item receipt and vendor bill are the same.

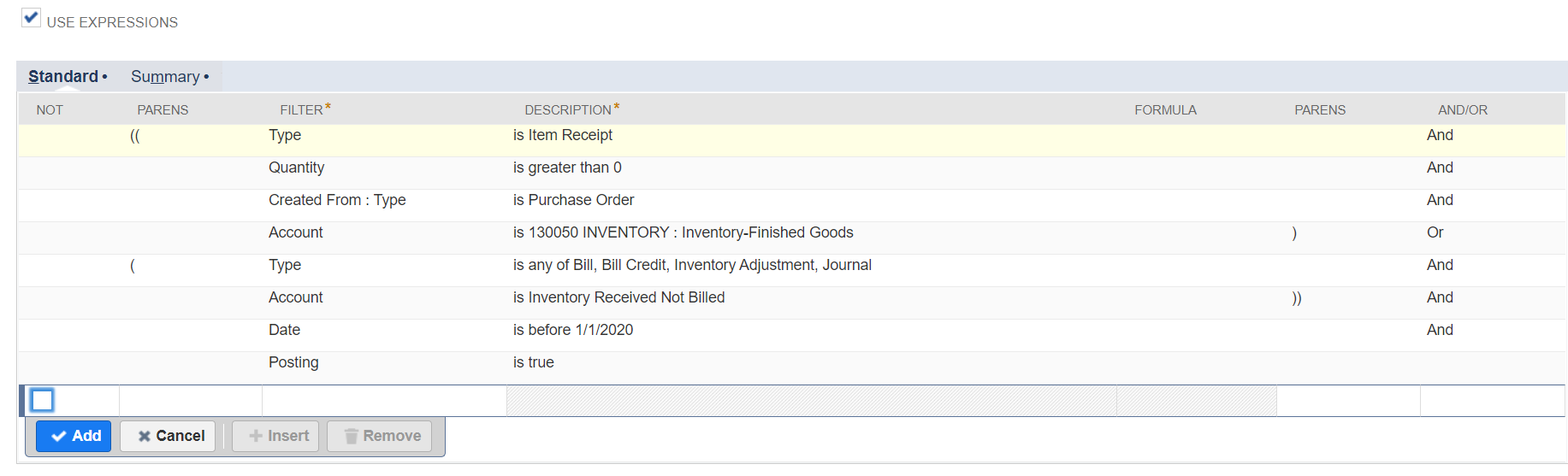

However, that may not always be the case. In order to see why your IRNB has a balance, a transaction saved search can be helpful in finding out why. I prefer using expressions in order to show all item receipts that hit your inventory account and all other transactions that could possibly hit the IRNB account (that are posting) including bills, bill credits, inventory adjustments and journals:

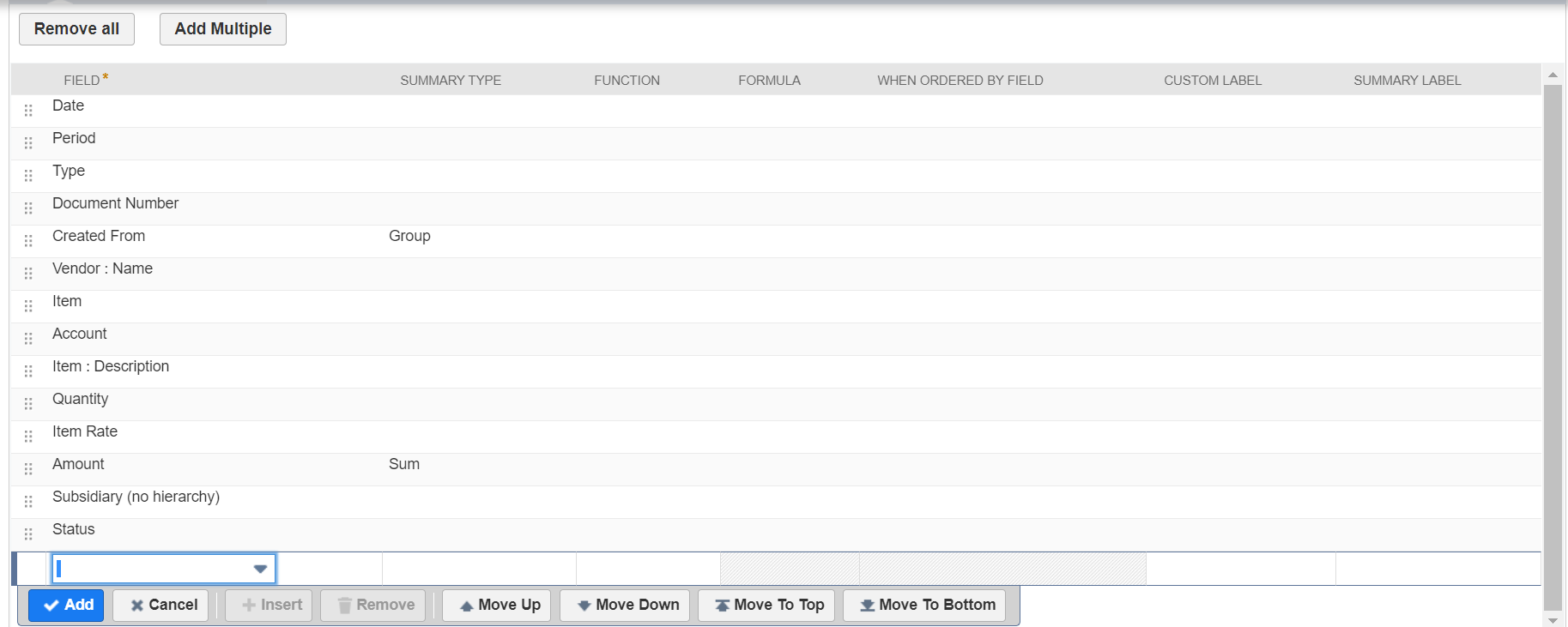

Then, I group the results by the document created from (purchase order) to see where I’m off by each transaction:

This will give you a good starting point to see where each purchase order was either over received or over billed.

For more information on this topic or others related to NetSuite, contact RSM at netsuite@rsmus.com or by phone at 855.437.7202.

RSMUS.com

RSMUS.com