Guaranteed in Life: Death & Taxes

Oracle NetSuite’s decision to build a next generation tax engine represents a wise investment in functionality certain to benefit many, if not all, customers. This article introduces SuiteTax, the new NetSuite tax engine, providing an overview of the key new features while also identifying known limitations in the current release. While the announcement has practical implications for current NetSuite customers, it also reaffirms Oracle’s commitment to NetSuite following the 2016 acquisition, highlighting the resources devoted to ensuring continued success of the product in years to come.

What is SuiteTax?

SuiteTax replaces existing tax functionality (hereafter referred to as ‘legacy tax’) and the features are not built to coexist in a single environment. NetSuite developed an automated migration process that will run on all transactions containing legacy tax data when SuiteTax is enabled in an account. (Note – there is no GL or financial impact to the migration process). Since SuiteTax and legacy tax are not intended to work together, many of the bundles developed to augment legacy tax functionality like International Tax Reports, Tax Audit Files, Supplementary Tax Calculation and Withholding Tax must also be removed before SuiteTax may be enabled. When complete (features are being released in phases), SuiteTax should include most of the functionality addressed by these supplementary bundles.

Key Benefits – All Customers:

SuiteTax offers enhancements for US and International customers, including in countries with challenging tax structures like India and China. Acknowledging that third party solutions may be better positioned to handle complex tax requirements, SuiteTax can work side by side with other tax engines within the same NetSuite account. Businesses are no longer forced to choose between NetSuite tax or a third party; they can now determine per nexus which tax engine will be used. This ensures that customers can pull in a specialized solution where needed but also that they are not paying for unnecessary features or overcomplicating tax in nexuses where requirements are straightforward.

A frequent customer complaint centers on the manual work required to update tax codes and rates in legacy tax. For businesses operating in the United States, trying to keep up with changes across 50 states and innumerable counties and cities is nearly a full time operation in and of itself. SuiteTax offers automated rate and effective date updates for all tax codes in supported nexuses, greatly reducing the burden of user maintenance and decreasing the risk of errors due to incorrect or expired rates. As with all standard NetSuite records, tax codes have an audit trail allowing users to monitor any changes applied by the system.

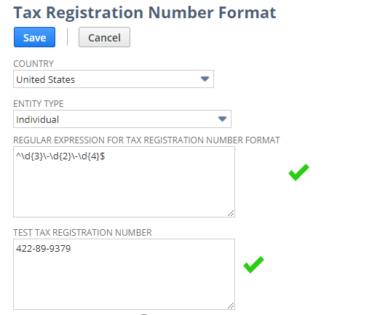

Real-time validation of tax registration numbers according to preconfigured rules set for each country. When adding a tax registration number to a customer, vendor, or subsidiary, the user will receive notification if the number does not match the format outlined in the rule for that country.

SuiteTax offers greater flexibility than legacy tax where many preferences were previously only available at a subsidiary or entity level. For example, in SuiteTax you can define exempt status per item for a customer where in legacy tax, exempt status was maintained at the customer level and would apply to all items sold. Similarly, under SuiteTax, entities like vendors and customers can have multiple tax registrations; legacy tax supported only one per entity.

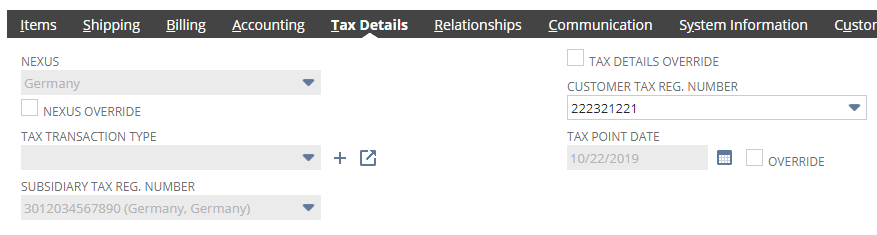

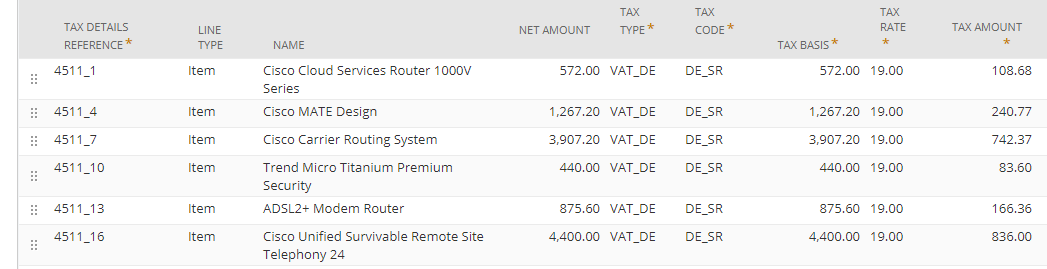

With SuiteTax, tax details are removed from transaction lines and a new ‘Tax Details’ tab is added to all transaction forms to store all tax-related fields. This redesign centralizes tax information on a single, consistent location throughout the system and reduces the need for users to scroll back and forth to see tax information for each line. Each line will have a new ‘Tax Details Reference’ field which will identify the relationship between the transaction line and corresponding row on the tax details tab.

US Sales Tax Enhancements

Enhancements to US Sales Tax calculation are available in the earliest phases of SuiteTax rollout. With release 2019.2, SuiteTax supports Zip+4 calculation logic and tax determination for origin vs destination states and interstate vs intrastate sales (California modified rule also supported). While not currently available, support for use tax is on the product roadmap. When a new nexus is added, NetSuite will automatically generate all necessary related records:

- Tax Accounts

- Tax Agencies (Vendor Records)

- Tax Codes & Types (state, county, district, city)

- Tax Groups (group of tax codes applicable to Zip+4 location)

Tax holidays are supported through new item non-taxability rules, allowing optional input of start/end dates for item non-taxability, reducing manual upkeep required.

A new record type called ‘US Exemption Certificate’ enables storage of customer exemption certificates (permitting multiple per customer) and facilitates upkeep with searchable expiration dates. The exemption certificates can be blanket, applying to all items or you can configure a saved search to limit exemption to a predefined subset of items.

International Tax Features

The following enhancements address use cases common in countries outside of US & Canada:

- Tax inclusive pricing – the price presented to the customer must include any tax applied to the sale. This is a requirement in countries like the United Kingdom.

- Modified tax point date – a date other than the NetSuite transaction date may be used for tax calculation and reporting. With configuration, you can default the tax point date to fulfillment date but you may also override on an individual transaction as needed.

- Reports can be configured to consider either the tax point date or accounting period, depending on requirements.

- Produce tax returns (VAT, GST, etc.) in each country’s local format (not all countries supported initially). Some countries will support electronic submission from NetSuite to the tax authority. A generic tax report is available for all countries as an alternative or additional option.

SuiteTax Limitations

SuiteTax rollout will take place over several years, with new features added in each release. Currently, there are many features incompatible with the new tax engine. Most of these will be addressed in later releases but a few are features that are being deprecated and NetSuite has no plans to modify to include support for SuiteTax.

- Prompt payment discounts (terms discounts)

- Intercompany Journals

- SuiteCommerce, SuiteCommerce Advanced and SuiteCommerce In Store

- SiteBuilder (will not be supported)

- Withholding Tax

- MOSS (EU)

- Multiple Shipping Routes

- Japan Localization SuiteApp

- SuitePromotions

There are other unsupported features not listed in this post so please review SuiteAnswers article ID 64724 for a complete list of limitations in the current release.

Conclusion

SuiteTax is an exciting new feature with the potential to transform taxation in NetSuite. Businesses will always need to devote resources to tax compliance but the enhancements planned for SuiteTax will reduce this burden by automating manual processes like tax code maintenance and enhancing reporting capability, including electronic submission of tax returns.

As of Fall 2019, RSM does not believe that SuiteTax is ready for widespread adoption. However, all NetSuite customers should educate themselves on the functionality and begin to consider a migration strategy. For guidance on implementation, please reach out to the RSM NetSuite practice by contacting us at NetSuite@rsmus.com or call 855.437.7202 for an adoption strategy tailored to your company’s requirements.

RSMUS.com

RSMUS.com