NetSuite has many great features, some of which slip under the radar and are underused. One such feature is Revenue Recognition Schedules.

Revenue recognition is something that can of course be done manually via general ledger entries. However, if you have a lot of GL entries and/or deal with a lot of invoices that require revenue recognition, it can sometimes be difficult to keep it straight as to which recognition entries apply to which invoices. Furthermore, outside of manually finding and pulling the information, it can be cumbersome to present a “complete” picture of your revenue recognition throughout the year when the auditors come knocking.

NetSuite’s revenue recognition schedules allow you to easily link together entries that apply to deferred revenue invoices as well as providing clear, concise reporting. A simple example of how revenue recognition works in NetSuite is provided below.

Note: this feature is not something that comes with every NetSuite account; it is an add-on feature. If you do not have this feature and would like to explore getting it, please contact RSM at erp@rsmus.com or at 855.437.7202.

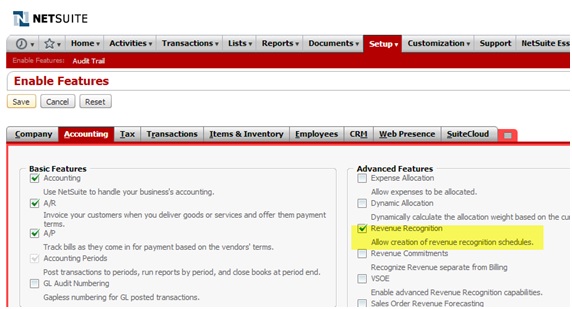

Before you can do anything with Revenue Recognition (RR from here on out), you will need to enable the feature. It is under the Accounting subtab of Enable Features.

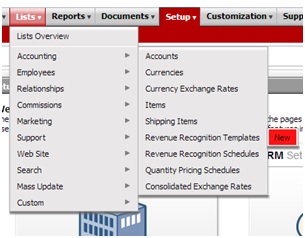

Once enabled, go to the path below to set up a new RR template.

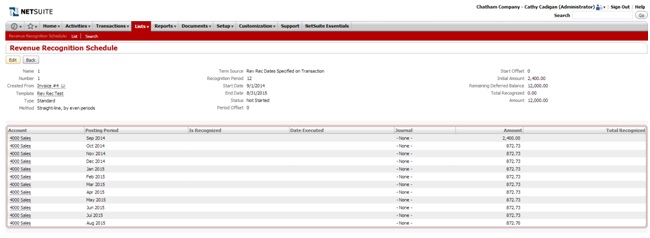

You will come to the screen below. As you can see, the setup for these schedules is fairly basic. You will need to add a name. All of the other information other than Recognition Period and Initial Amount fill in automatically. For this example, a Recognition Period of 12 (1 year) and Initial Amount of 20% are being used.

A few definitions:

Recognition Period: The number of periods for which revenue is recognized.

Period Offset: The number of periods that you want to delay starting the RR schedule. Please note that this will not increase the number of periods that the revenue is recognized over. For example, if you put in 2 as a period offset, your recognition period will be shortened to 10 periods and the amount per period (assuming straight-line recognition) will be adjusted accordingly.

Start Offset: This feature also is the number of periods you want to delay starting the RR schedule. However, the schedule will still run the full term. For example, if you entered 2 as the value in this field of a schedule starting 9/1/2014, the schedule would begin 11/1/2014 and run through 10/31/2015 instead of beginning 9/1/2014 and ending 8/31/2015.

Initial Amount: This is the amount to be recognized in the first period. This can be useful if accounting rules allow you to recognize 20% of the revenue up front and then recognize the rest on a straight-line basis. The remaining 80% will be recognized evenly over the remaining months of the schedule.

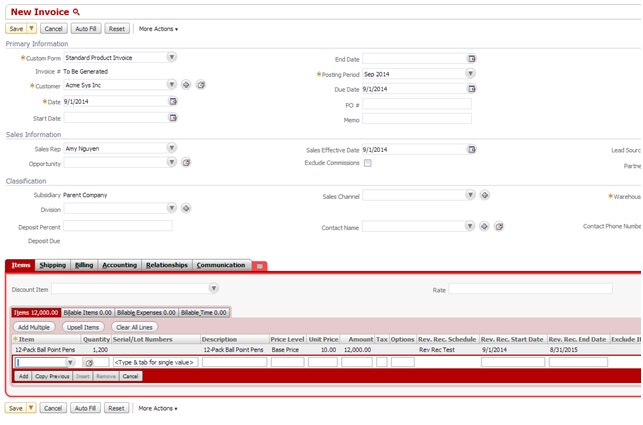

Once you have the RR schedule set up, you can use it on transactions, like a sales invoice or a GL entry. At the line item level, you will need to define a Rev. Rec. Schedule and at least a Rev. Rec. Start Date. If you specify a Rev. Rec End Date that encompasses a period longer or shorter than the period set on the RR Template, the beginning and end dates set on the transactional level will be the ones used. For example, if the end date in the example below was 10/31/2015 instead, the revenue would be recognized over 14 periods instead of the 12 set on the schedule.

Note: Revenue Recognition schedules can also be set at the item level under the Accounting subtab.

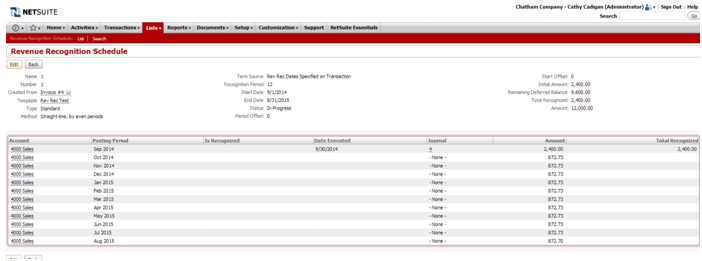

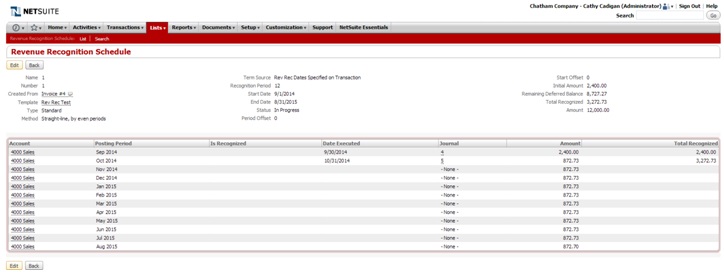

Once an entry is saved that specifies RR information, a schedule is automatically created in the system. Note the larger amount in the first period since an Initial Amount was specified.

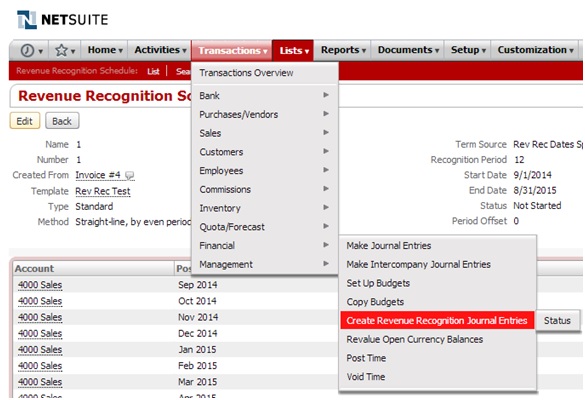

RR entries do not generate automatically, but it is a very quick process to do so. They can be created from the path below.

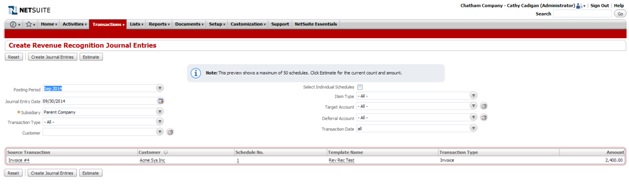

Clicking on Create Journal Entries will generate the applicable GL entries.

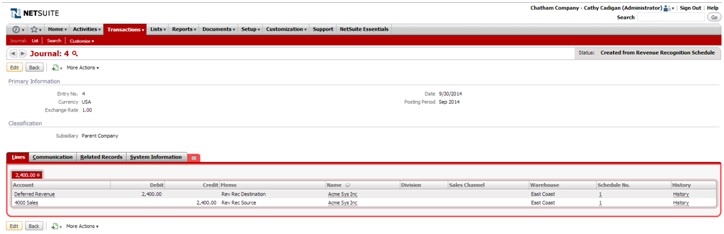

Once the process is noted as “Complete,” going back to the RR schedule shows that it has been updated with the information for the created GL entry, including a link. The entry is also noted as “Created from Revenue Recognition Schedule.”

The process will be continued for as many months as needed.

With the Rev Rec module also comes supplemental reporting which can make reporting even easier.

RSM has certified professional NetSuite consultants who can assist your organization with revenue recognition. For more information about the licensing of this module or to speak with one of our NetSuite consultants, please contact RSM at erp@rsmus.com or at 855.437.7202.

By: Ryan Meyer – National NetSuite Solution Provider

RSMUS.com

RSMUS.com