Cumulative Translation Adjustment (CTA) account balance represents the translation gain or loss due to the translation of financial statements of foreign entities to the reporting currency at consolidation.

Depending on how the GL accounts are setup, NetSuite translates local entity balances to the reporting currency using the average, current and historical rates. The weighted average currency exchange rate is used to translate income statement accounts balances, the current exchange rate is used to translate most asset and liability accounts and the historical rate is used to translate the Equity accounts. Because the translation process involves three different types of rates, it creates an imbalance in the Consolidated Balance Sheet, so a CTA balance is required to balance the Consolidated Balance Sheet.

Before the translation process starts, the system remeasures the local accounts balances using the current and historical rates which generate transaction gains and losses in the local entity’s financial statements.

CTA is calculated differently under different accounting standard. Often NetSuite users look for an immediate impact in the CTA account balance after major changes in the local account balances in a particular period. As the CTA account balance shows the cumulative impact, it may not fluctuate immediately after any large changes in local accounts balances.

This post will discuss the process of generating custom report to analyze the account balances that are contributing towards the CTA. It will further explore how individual transactions impact CTA in a period.

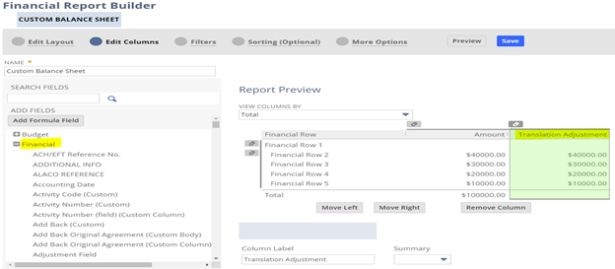

To determine what account balances are contributing towards CTA, create a custom Balance Sheet report using the customize section under the Balance Sheet report.

From the Edit Columns section, make the following selection –

Financial >Translation adjustment > Save

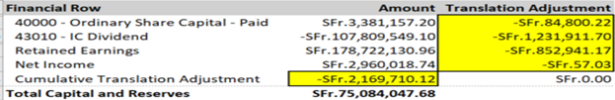

A custom Balance Sheet report will be generated which will show the respective subsidiary account balances that are contributing towards the CTA balance. In the example below, the following four accounts from the local entities were generating the CTA balance at consolidation.

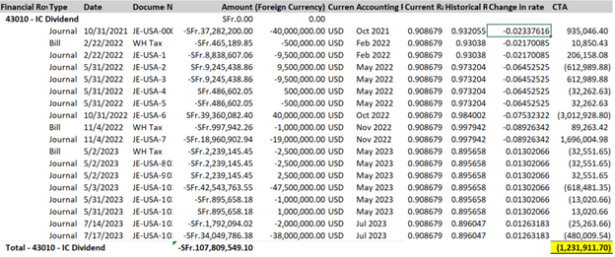

To determine how individual transactions in a particular account are impacting the CTA balance in a period, create a Custom Balance Sheet Detail report.

From the Edit Columns section, make the following selections –

Financial > Amount (Foreign Currency) > Save

Financial > Accounting Period: Name > Save

Financial > Currency > Save

From the consolidated exchange rate table generated from the system obtain current and historical exchange rates. Calculate change in rate for each accounting periods and then multiply the change in rate with the original transaction amounts (foreign currency amount). CTA balance for each transaction can be calculated in this way. Notice that the total CTA balance generated from the account below is a net result of CTA balances for individual transactions.

During the financial consolidation process, NetSuite translates the financial statements of foreign entities to the reporting currency to produce single currency consolidated financial statements. CTA balance is a cumulative balance which represents the accumulated translation gain or loss balance over the periods. NetSuite should be configured using the applicable accounting standard to the reporting entity, so the system generates appropriate CTA balance. Configuring NetSuite using the applicable accounting standard (e.g., US GAAP, IFRS) will generate CTA balance accordingly.

RSMUS.com

RSMUS.com