The deadline for filing 1099 tax documents for independent contracts has almost arrived. You need to submit all documents to the IRS by January 31, 2025.

Getting them in on time is critical to avoid fines, penalties, and more stress on your own tax season. Just as importantly, timely filing ensures your independent contractors receive their tax documents before their own deadlines come due.

You have every incentive to file 1099s on time—but that doesn’t mean it will be easy.

Depending on how many contractors you work with, there could be many documents to complete, file, and distribute, requiring plenty of time and energy spent on administrative work. This work comes at the very beginning of the year, when you’re focused on building momentum for the year ahead rather than wrapping up last year. Yet if the numbers are wrong in any way or late to reach the IRS, it creates unnecessary obstacles for all.

Sage Intacct has the solution.

Streamlining Your Tax Season

Instead of relying on a manual process that consumes time and creates errors, Sage Intacct users can automate most of the 1099 filing process to ensure it goes quickly and correctly.

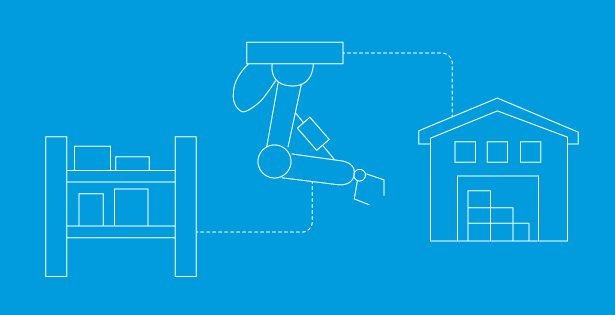

Sage Intacct has an integration with TaxBandits, one of the leading solutions on the market for filing 1099s, among other tax-related services and solutions. The integration allows data to flow seamlessly from your financial management system into your tax software, combining the tools on both ends into an effortless workflow.

Here’s how it works:

- Instant Exports: With one click, all the 1099 tax data in Sage Intacct transfers to TaxBandits, which has the ability to instantly format and organize the data to comply with current filing requirements.

- Intuitive Tools: As one of the simplest tax management tools available, TaxBandits makes it remarkably easy to explore, adjust, or augment tax data in one place without making mistakes that negatively affect filing status.

- Automated Validation: Tax-expert automation developed by TaxBandits scans all incoming 1099 data for common validation errors and flags them automatically, making errors easy to find and fast to fix.

- Effortless Distribution: Leave it up to the team at TaxBandits to print all your 1099s, stuff and address the envelopes, and get them into the mail as soon as possible to make tax season simpler for you and your freelancers.

- Accessible Data: See all your 1099s in one place, with easy tools to navigate the data and the ability to access tax records for seven years. TaxBandits also adjusts to changes in state and federal tax law so your filings and data always remain compliant.

The integration between Sage Intacct and Tax Bandit takes a process that used to take hours or days and transforms it into one that takes several minutes to complete and poses minimal risk of error or omission. Your tax season has one less undertaking. You also have more freedom to work with independent contractors knowing the tax obligations run almost on autopilot.

Get Started This Tax Season

Taking advantage of the Sage Intacct integration with TaxBandits is just as simple as filing your 1099s with this dynamic software duo.

If you already have a Sage Cloud Services account, you only need to create a TaxBandits account for free, then integrate them by changing a few settings. It’s quick, easy, and inexpensive—and by far the simplest way to get your 1099s to the IRS, your freelancers, and your financial records.

RSM would be happy to help you get this workflow setup and optimized. Or, we can help you implement Sage Intacct, evaluate your tax management, and make strategic upgrades that harness the power of advanced financial management software.

Whatever you need to make this tax season successful, rely on RSM. Contact our team.

RSMUS.com

RSMUS.com