Of course creating a backup before you close the general ledger is very important, but the most common issue that occurs with the year end close is that an account type was not setup properly. When creating a new general ledger account you are required to select an account type of either Balance Sheet or Profit and Loss. When you close the year end, if the account type is Balance Sheet then the system will carry forward a beginning balance. If the account type is Profit and Loss, then the balance forward is zero. If the account type is not set properly and you close the year, you will have an account with an incorrect balance which causes your trial balance and financial statements for the new year to be inaccurate.

How to prevent this

The easiest way to prevent this from happening is to create two SmartLists, one that checks for balance sheet accounts that are setup as Profit and Loss and the other that checks for profit and loss accounts setup as Balance Sheet. Prior to closing the year, run both of these smart lists. If there is any accounts setup incorrectly they will display in the SmartList. Correct the account type first and then proceed to close the year.

To setup the SmartLists:

- Select SmartList – Financial – Accounts and select the * which is the default SmartList for Accounts

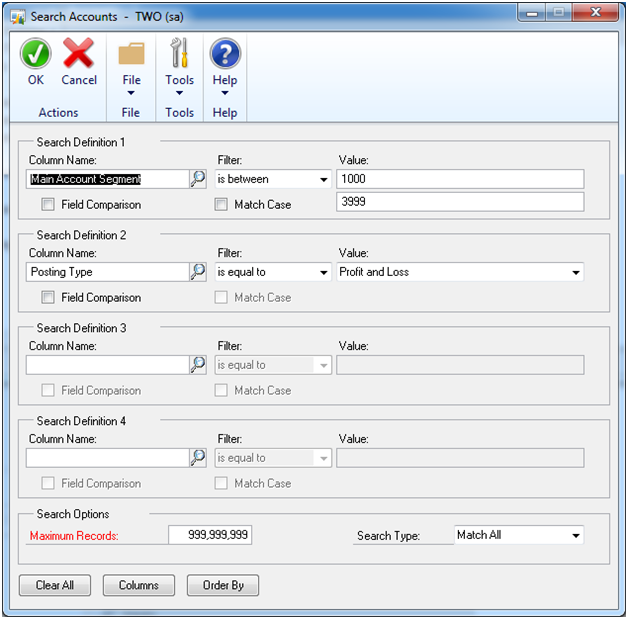

- Select Search and define two searches, the first to select a range of accounts based on your account number or a segment in your account number that selects all the balance sheet accounts. In the sample below all balance sheet accounts start with 1000 and end with 3999, so our search is a range between 1000 and 3999.

- The second search is where Account Type is equal to Profit and Loss

- Make sure you change the maximum records to 999,999,999

Once you select OK and no accounts displayed, this validates that your balance sheet accounts are setup properly.

Save this SmartList under favorites by selecting Favorites, enter a name for the SmartList, such as ‘Validate Balance Sheet Accounts’ and select Add – Add Favorite

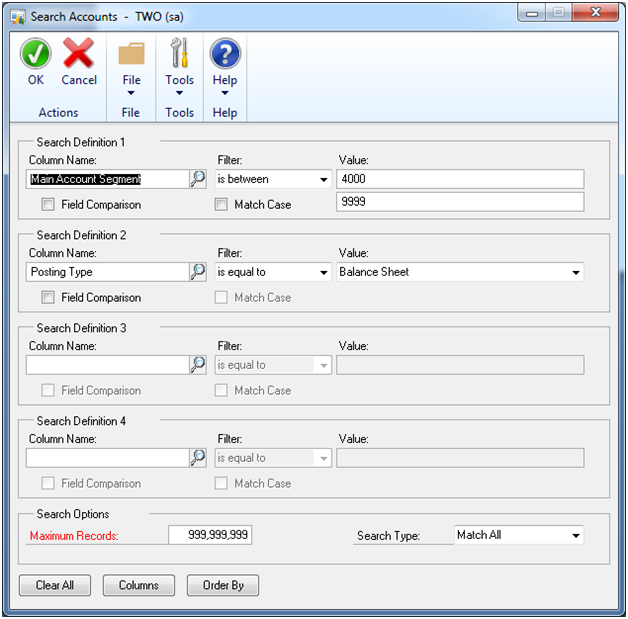

Create the second SmartList to validate Profit and Loss Accounts by following the same steps except in the Search screen your account range should reflect the Profit and Loss accounts and the account type is equal to Balance Sheet.

Make sure to save the second under a new name such as ‘Validate Profit and Loss Accounts’

Samples of both SmartLists searches are outlined below.

Now you are set for next year. Just make sure to run your SmartLists first before closing the year and make any corrections.

What to do if you close the year with an incorrect account type

The best way to correct this problem after a year end close is to follow the instructions on KB864913, Changing the posting type on an account after you close the year in General Ledger for Microsoft Dynamics GP. The steps to resolve this issue require knowledge of SQL along with access to the SQL Server. The steps to prevent this take much less time and effort then the steps to fix.

If you require additional assistance with your year-end closing process, our Microsoft Dynamics Support Specialist can help. We offer access to certified professionals, help desk and phone support, dedicated account management and knowledge of third party products. You can also learn more by subscribing to our Microsoft Dynamics Community News, a quarterly publication for Microsoft Dynamics users. Our professionals can be reached at erp@rsmus.com or by phone at 855.437.7202.

By: Susan Laux-Maede – Illinois Microsoft Dynamics GP partner

RSMUS.com

RSMUS.com