Rolling retained earnings in management reports is one of the more problematic areas in multicurrency. In order for retained earnings to roll seamlessly, there are a few easy steps to follow:

- Determine whether or not you are using the Legacy data provider or the Data Mart. This is important, because the two systems calculate the retained earnings roll differently. In case you aren’t sure which is which, look at your company codes in Management Reporter. If they have a –curr after the code, you are using the Legacy data provider. If it’s just the company code, you are using the Datamart.

- Calculate what the blended rate for the reporting year should be. You will need this regardless of the data provider. You will need to know how you are quoting the currency (ie. number of USD per FC or number of FC per USD). Then run a YTD income statement for the end of the year in both the reporting and the functional currency. Determine the exchange rate for the year.

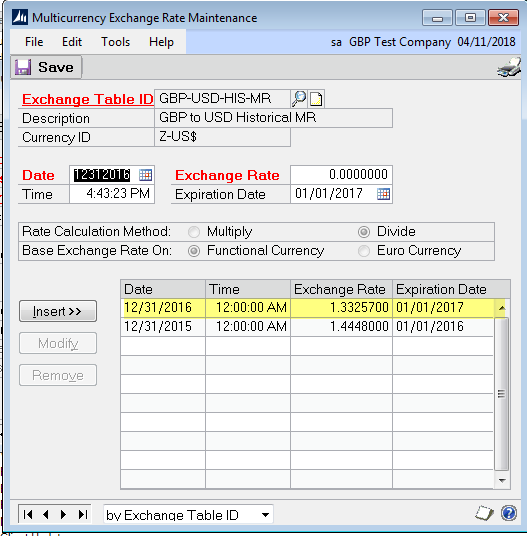

- Update the exchange table that is used for historical accounts with that exchange rate

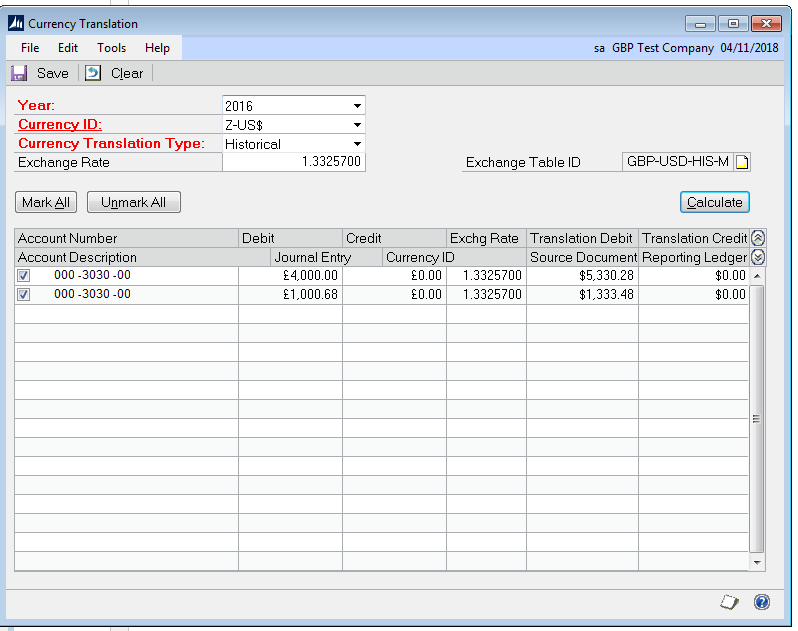

4. Legacy System: Go to Financial>Routines>Currency Translation. Enter the year end blended rate you calculated in step 2.

5. Datamart: No further steps are necessary, as the Datamart will pick up the rate you entered in the exchange table in step 2 and use it for rolling the retained earnings balance forward.

6. Troubleshooting Item: If you are using the Datamart, the exchange rate for the year end in the exchange table you have designated as historic will apply to all transactions that have been entered into historic accounts on the last day of the year. This will create a problem, since those other transactions will need rates other than the year end one. In order to avoid this problem, make sure you do not enter any transactions to historical accounts on the last day of the fiscal year. One way around this is to use the day before the last day of the year for these transactions – ie. 12/30 instead of 12/31.

If you follow these steps, your retained earnings should roll seamlessly onto your next year’s opening Balance Sheet.

To learn more about how you can take advantage of this and other Dynamics GP features, visit RSM’s Microsoft Dynamics GP resource. To make sure you stay up to date with the Microsoft Dynamics Community, subscribe to our Microsoft Dynamics Community Newsletter.For more information on Microsoft Dynamics 365, contact us.

By: Peggy Evleth

RSMUS.com

RSMUS.com