Clients frequently want to understand the options for tracking construction in progress (CIP) assets in Microsoft Dynamics GP. CIP assets are long term assets for which the cost of construction must be accumulated until the asset is placed in service. [Tweet this post] In Microsoft Dynamics GP, you have two basic options depending on the length of time required to place the asset in service and the purchasing options you have set in Fixed Assets. If the timeframe is relatively short and you either post to fixed assets from accounts payable or post from purchase order processing by account, the recommended procedure is as follows:

1. Add a construction in progress account to the list of Fixed Asset Purchasing Posting Accounts.

2. Use the CIP account when distributing an AP voucher or a purchase order receipt.

3. Accumulate the fixed asset purchase records created in step #2 until the asset is placed in service.

- The costs associated with the asset will accumulate in the CIP account on the balance sheet.

4. Once the asset is placed in service:

- Create the asset general information record and assign the asset an Asset ID and Suffix.

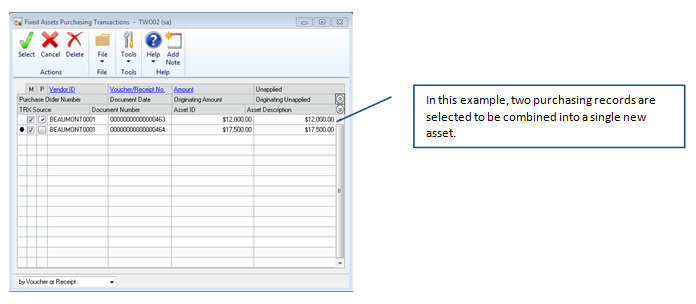

- Click on the Purchases button and select all of the invoices/receipts associated with the asset in the Fixed Assets Purchasing Transactions window.

- Assign the asset to an asset class and account group. The account group should have a balance sheet fixed asset account as the asset cost account.

- Create the asset book records.

- Once the book record for the Corporate Book is created, the system will create a journal entry crediting the CIP account and debiting the cost account from the account group.

If the construction process timeframe is long or you post to fixed assets from purchase order processing by receipt line, the recommended procedure is:

1. Create a separate asset class or classes for CIP.

- The CIP asset classes should have account groups with CIP accounts for asset cost.

- The CIP book/class records should have the depreciation method set to No Depreciation.

2. Create CIP assets from purchases records created from either accounts payable or purchase order processing

- Select the purchases record(s) associated with the CIP asset.

- Assign the asset to the appropriate CIP asset class and account group.

- Create the asset book records.

- Once the book record for the Corporate Book is created, the system will create a journal entry crediting the fixed asset purchasing posting account used on the AP voucher/PO receipt and debiting the CIP account from the account group.

3. Once the asset is placed in service:

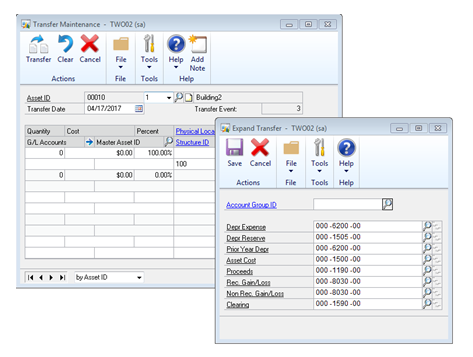

- Enter an asset transfer transaction.

- Select an Account Group in the Expand Transfer window appropriate to the type of asset being placed in service.

- Completing the transfer transaction creates a journal entry crediting the original CPI account associated with the asset and debiting the asset cost account in the new account group.

- Complete the changes to the asset record.

- Open the asset general information record.

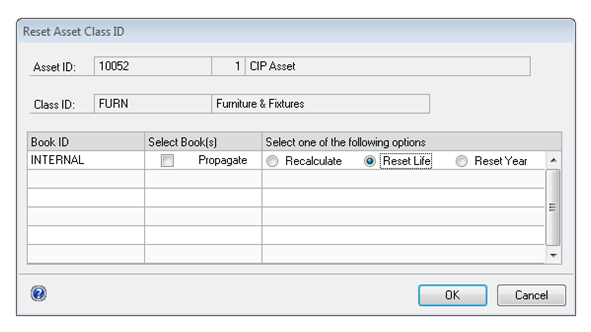

- Change the asset class from a CIP class to a depreciable asset class.

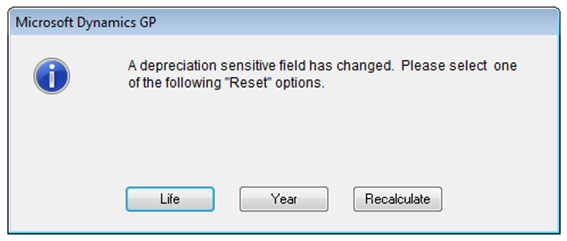

- When you save the changes to the asset general information record, choose Reset Life and propagate the changes to all books when prompted.

- Open the asset general information record.

- Open the asset book records.

- Change the placed in service date to the actual date the asset was placed in service.

- Change the depreciated to date to the placed in service date.

- Verify the asset useful life and the remainder of the book record information.

- Save the book records and choose to reset the asset life when prompted.

4. Completing these steps prepares the newly placed in service asset to be included the next time you run depreciation.

If you use the second, more complex option for accounting for CIP, you may encounter situations where additional costs are incurred after the CIP asset is created and before it’s placed in service. We’ll address the procedures for this in a future post. However, if you have any questions, leave a comment below or tweet us @RSMUStech.

By: Hans Wulczyn – Pennsylvania Microsoft Dynamics GP partner

RSMUS.com

RSMUS.com