Whether you’re a nonprofit executive stewarding donor trust, or a financial systems user managing day-to-day accounting in Sage Intacct, restricted funds can be a challenge — but they don’t have to be.

Donors provide these funds with conditions — for a specific period, program, or purpose — and your job is to honor those restrictions while ensuring compliance, accuracy, and transparency in your financial reporting. Fortunately, Sage Intacct offers a built-in, no-cost tool that makes this easier: the Restriction Release feature.

This blog is your combined guide — strategic for leadership and instructional for users — to understanding, setting up, and using this feature effectively.

What Are Restricted Funds?

Restricted funds are contributions received with specific stipulations, typically defined by the donor or governing board. They must be tracked separately from unrestricted funds, with proper documentation of how and when restrictions are satisfied.

|

Types of Restricted Funds |

||

| Type | Description | Example |

| Time-Restricted | Can only be used during a specific timeframe | $100,000 grant to be used over two fiscal years |

| Purpose-Restricted | Intended for a specific program, activity, or function | $25,000 designated for youth programming |

| Permanently Restricted | Principal may not be spent; earnings can be | Endowment donation where only interest is used |

Why Use the Restriction Release Feature?

The Generate Restriction Release tool in Sage Intacct automates journal entries that shift funds from restricted to unrestricted — based on actual expenses incurred.

What it does:

Creates a journal entry:

- Debiting release from restriction and the Restricted dimension

- Crediting release from restriction and the unrestricted dimension

This happens in alignment with expense activity — helping you stay compliant without the headache of manual accounting.

Core Setup: Dimensions Matter

Before enabling the feature, it’s important to align your dimensions correctly for accurate tagging and tracking.

|

Recommended Dimension Configurations: |

|

| Restriction | Class (preferred), UDD, or Location |

| Funding Source | Project (common), Department, or other dimension not used as Restriction |

Using two dimensions (restriction + funding source) enables Sage Intacct to correctly match donations with related expenses.

Tracking Activity: How It All Flows

Below is a simplified flow of restricted fund usage and release:

- Donation received → Recorded as restricted revenue

- Program expense occurs → Recorded as unrestricted expense

- Release process runs → Transfers value from restricted to unrestricted net assets

It is important to tag consistently:

- Revenue: Tag both restriction and funding source

- Expense: Tag unrestricted with the same funding source

This ensures the system recognizes the relationship and knows when to trigger a release.

Step-by-Step: Enabling and Using the Restriction Release Functionality

Once you’ve configured dimensions and tagged transactions, here’s how to activate and use the functionality in Sage Intacct.

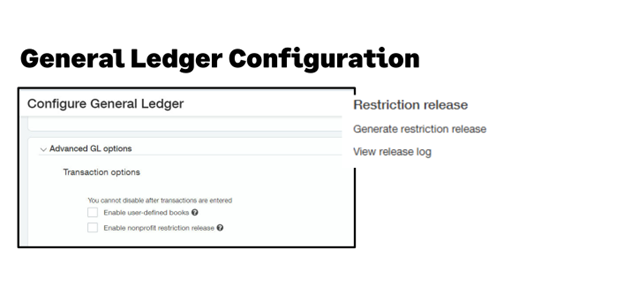

1. Navigate to Configuration

Go to General Ledger > Configuration and enable “Generate Restriction Release.”

2. Set Up the Restriction Release Options

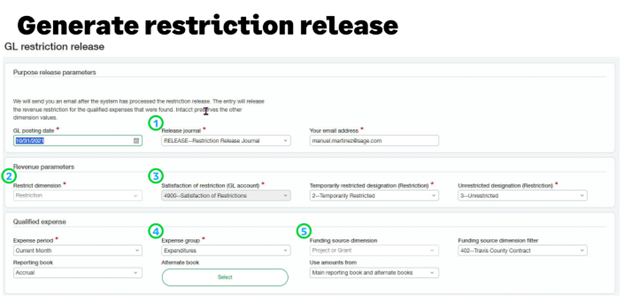

After enabling the feature, define the five required fields:

| Field | Description |

| Release Journal | Choose your preferred journal (accrual or custom) |

| Restriction Dimension | Define which dimension governs restrictions (e.g., Class) |

| GL Account | Where the release entries will post |

| Expense Group | Identify the types of expenses that trigger release |

| Funding Source | Assign the appropriate dimension (e.g., Project) |

3. Run the Release Process

Use the Generate Restriction Release page to initiate the process. You can filter by period, dimension, or amount.

This action will create journal entries automatically and record the transfer in your designated journal.

Reporting: What Decision Makers Need to Know

Once the release entries are generated, your financial statements will reflect the updates seamlessly. These are the key reports to monitor:

Statement of Activities

- Shows restricted vs. unrestricted revenue and expenses

- Useful for donor and board reporting

Statement of Financial Position

- Reflects net asset classifications as “with restriction” or “without restriction”

- Tracks organizational health over time

Other Considerations & Pro Tips

- First-time Release: Review existing expenses before initiating your first run

- Recurring Releases: Can be scheduled for consistency

- Drill-Downs: Use the Release Log to investigate entries or confirm accuracy

- Validations: Use dashboards or trial balances to confirm balances are reducing as expected

Alternatives (When You’re Not Ready Yet)

Still not ready to flip the switch? Here are a few interim options:

- Recurring Journal Entries: Manual and error-prone — not ideal for scale

- Dynamic Allocations: More flexible but requires setup

- Purpose-Based Releases: Use this when only one dimension is used to define release logic

Final Thoughts: Why This Matters

Restricted funds aren’t just accounting entries — they represent promises to donors, commitments to programs, and often, the reputation of your nonprofit.

By setting up Sage Intacct’s Restriction Release tool properly, you not only simplify the day-to-day work of your accounting team but also strengthen your organization’s financial integrity and reporting confidence.

At RSM, we help nonprofit organizations unlock the full potential of their systems to streamline compliance, donor stewardship, and financial clarity.

Need Help Getting Started?

We’ve worked with dozens of nonprofits to enable the Restriction Release feature and optimize dimensions for long-term success. Reach out if you’d like a one-on-one walkthrough or help configuring your system to meet your needs.

Let compliance be one less thing on your plate — and let your mission take center stage.

Presented by Rashida Calvin, RSM US LLP at Sage Future 2025.

RSMUS.com

RSMUS.com