For nonprofits to make the biggest impact, comply with all funding requirements, and maintain a positive reputation, they must carefully manage every dollar. That’s why accounting software is so important in the nonprofit world—it can either help an organization make the most of funding or cause confusion, errors, and inefficiencies within accounting.

Sage Intacct has become one of the most popular financial management platforms among nonprofits because it turns high-level accounting into something that’s accessible and efficient for any organization. The software does that by providing a robust toolkit combined with expansive customization options so that organizations can intuitively create solutions to their most urgent or annoying accounting issues.

A prime example of how Sage Intacct upgrades accounting processes to save time and improve financial outcomes is with committed and encumbered costs. What used to be a struggle for nonprofits can now be a strength.

Tracking Costs for Smarter Spending

Nonprofits need to know how much they’re spending on projects or contracts compared to how much they’ve committed to spend. These insights are crucial for understanding financial performance and informing what course corrections may be necessary, yet tracking encumbered costs compared to committed costs hasn’t been easy for nonprofits.

Accountants usually had to track the data manually, gathering it from multiple sources into a spreadsheet that existed outside the accounting system, which was time-consuming and error-prone. The unavoidable result was that financial decision makers had an outdated, incomplete, or inaccurate perspective on spending, leading to commitments where the funding ran out early or left funds unused.

With Sage Intacct, accountants can track these costs within the software, eliminating the need for external spreadsheets, but that’s just the start. After a simple setup (outlined below), nonprofits can simplify, streamline, and largely automate how they track these costs.

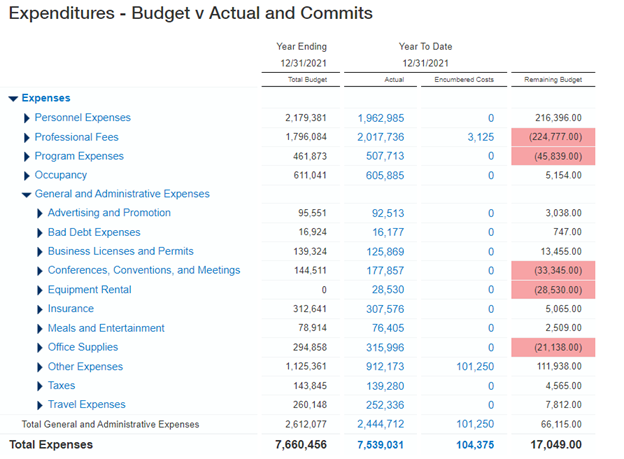

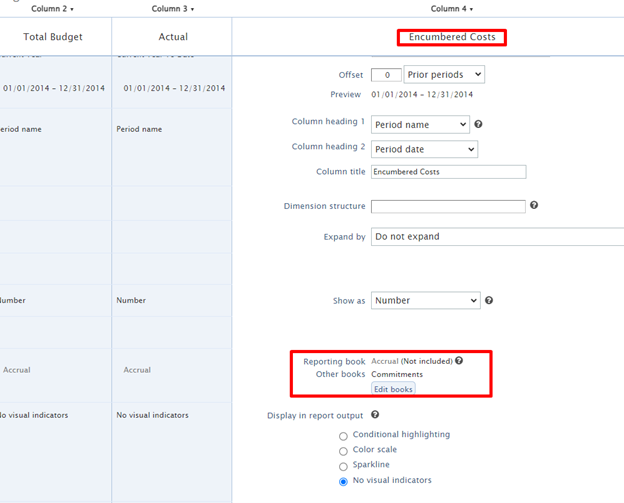

Here’s a Sage Intacct report with committed and encumbered costs tracked side-by-side. Like a snapshot on spending, it keeps nonprofit leaders laser-focused on cash flow and aware of any costs tracking above or below what was budgeted so they can intervene before issues arise. Sage Intacct comes standard with this reporting capability and makes the process to get started remarkably simple.

Setting Things Up in Sage Intacct

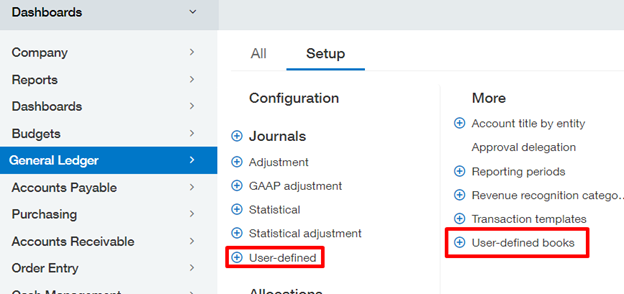

There are just two steps to create reports comparing actual and encumbered costs against a budget.

The first is creating a user-defined book. Sage Intacct lets users create books separate from the general ledger for things that might be interesting or important to track even if they aren’t required by GAAP. All committed costs get recorded into one of these user-defined books.

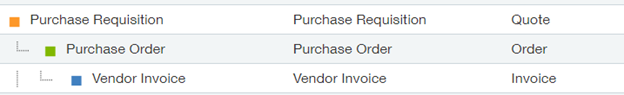

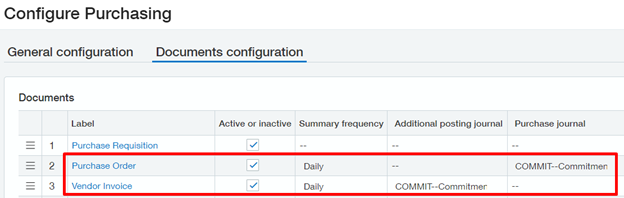

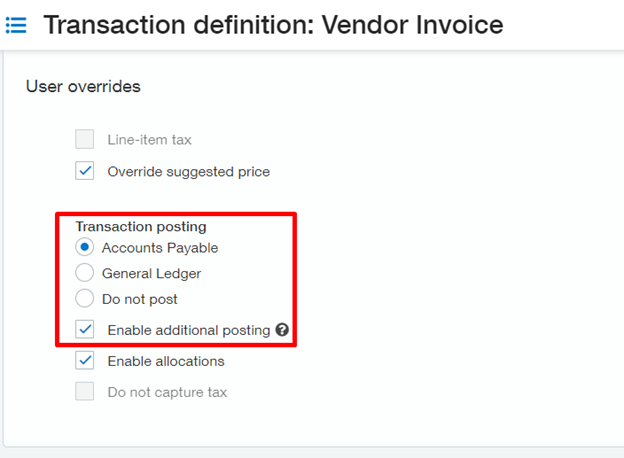

Second is configuring a purchasing workflow (such as a Purchase Order to Vendor Invoice process) that posts to both the user-defined book and the AP sub-ledger. Purchase Orders should record the committed costs directly to the user-defined commitment book while the incoming invoices post to the actual ledger and reverse the commitment in the commitment books. Sage Intacct allows users to post invoices against multiple books so that information enters the general ledger along with any other books where it’s relevant.

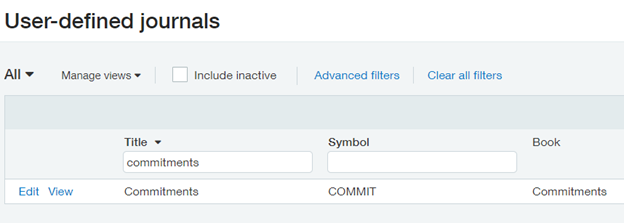

With these two elements set up, tracking committed and actual costs becomes a matter of making a few clicks and keystrokes. New committed costs get added to the commitment book as PO’s are created, and matching invoices will move these costs from ‘committed’ to ‘actual’ so that spending comparisons stay accurate and up-to-date. Generating a report comparing the two costs takes no time or special training, either, thanks to intuitive, DIY reporting capabilities. End users will just need to be sure to include the Commitment book in the column assignments within the Report Writer.

Setting up and running this process is quick, easy, and accessible to all—but the advantages are much bigger than time savings. By bringing this vital information about financial performance into the accounting system itself, accountants and executives have more data on one platform to inform every decision they make. In that way, cost tracking improves, as do all aspects of financial analysis, planning, and management.

Know More With Sage Intacct

Nonprofits eager to make accounting more efficient, effective, scalable, and sophisticated have the solution in Sage Intacct, and they have an implementation partner in RSM. With expertise across the fields of technology, accounting, and nonprofits, RSM helps clients use Sage Intacct to the fullest.

See more of what Sage Intacct can do for nonprofits. Contact RSM for a demo or consultation.

RSMUS.com

RSMUS.com