Finding payroll technology success by combining software functionality and strategic advice

In an ever-evolving world of innovation—including the emergence of artificial intelligence (AI)—payroll technology has reached a new level of embracing efficiency. Between enabling companies to hire the right talent across functions, managing workforces globally for unmatched productivity and keeping compliance in check—payroll technology delivers powerful analytics for a deeper understanding of people and businesses.

Payroll software helps automate payroll processes and significantly reduces time spent on manual efforts. These AI-enabled systems streamline payroll processes from start to finish, irrespective of the size and scale of the business. However, modern technology is only one element of a successful payroll optimization approach.

Data integrity is pivotal

Payroll technology software provides personalized windows that display pay stubs, tax information and benefits options, allowing employees to access and update their personal information and tax details via self-service functions. It is important to note that any inconsistencies or inaccuracies in these figures can negatively influence paycheck results, thereby reducing employee confidence in the business and, as a result, lowering employee satisfaction.

The key to improving the employee experience is making the technical advancements that allow for enhanced functionality and ensuring the processes the technology relies on are sound. Both contribute to delivering an accurate, secure and easily accessible payroll experience for your employees.

“You could be on any payroll software system, but unfortunately, you will not meet your desired outcomes if your processes are broken,” says Lorry Twisdale, RSM US principal. “You must ensure departments like HR and benefits have strong processes in place to ensure that their data, which filters down to payroll, is accurate.”

Ultimately, as advanced as payroll technology has become, it can only perform as well as the processes behind it. Working with a qualified payroll advisor can optimize your entire payroll approach in several ways, including:

- Managing administration of the payroll system

- Evaluating and analyzing data to address challenges related to scalability, new locations, size and functions

- Automating and utilizing systems better

- Increasing payroll accuracies, thereby minimizing payroll disputes or audits

- Assessing tax, overtime and pay and expense policies

- Analyzing employee payroll trends and benefits

- Mitigating risk

- Keeping global compliance and regulations in check

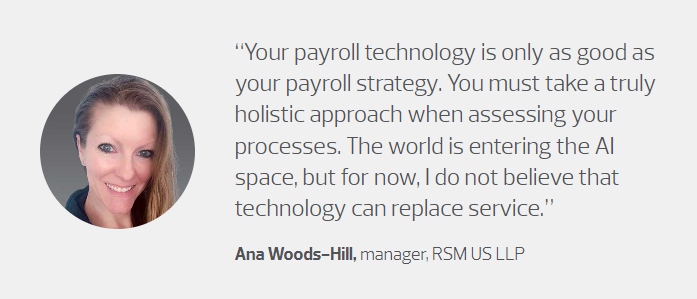

“Your payroll technology is only as good as your payroll strategy,” says Ana Woods-Hill, RSM manager of payroll outsourcing services. “You must take a truly holistic approach when assessing your processes. The world is entering the AI space, but for now, I do not believe that technology can replace service.”

Woods-Hill advises that help may be necessary to optimize your payroll approach. “Sometimes, it takes time to fully explore any product’s capabilities, which may not happen within the first three or more months of its use,” she says. “Therefore, that is an excellent opportunity for companies to work with a team focused on payroll strategy to help them discern the nuances of their unique business processes.”

People-related challenges

The dynamics of people, staffing and outsourcing have remarkably changed in recent years. Despite technological advancements, the demand for skilled payroll professionals remains significant. There is a constant need, and even a growing trend of leveraging resources with extensive knowledge, experience and valuable networks.

Workforce dynamics are evolving, and human insight is essential now more than ever. Technology is not diminishing the need for professionals; instead, it is reshaping job roles to allow employees to focus on different, more value-added areas.

“Businesses are realizing that hiring someone with deep experience in a network is usually more advantageous than bringing someone strictly in-house,” says Woods-Hill. “Additionally, since the COVID-19 pandemic, organizations are facing increased turnover issues and the economic lag of compliance changes.”

Maintaining data integrity amidst self-service strategies

Data integrity is always crucial. It is a mistake to assume that data will somehow be accurately processed if entered into the payroll system incorrectly; therefore, conducting audits is paramount to ensuring data accuracy. Interestingly, payroll-related data entered in real-time via self-service functions often goes unchecked and can have long-term implications, potentially affecting payroll timelines, constructive receipt time stamps and even compliance efforts.

“The garbage in, garbage out rule is of supreme importance now more than ever due to employees’ self-service functions,” concludes Woods-Hill. “Companies have relinquished control due to this practice, and human intervention is, therefore, still needed. Some companies may argue they don’t need as many HR professionals due to self-service functions. But they also may create $1 million worth of audits and compliance risk by letting their users control the inputs. Therefore, payroll success today is all about great people, a great system and a great payroll strategy advisor.”

Explore RSM’s payroll solutions

By: Ana Woods-Hill and Lorry Twisdale

RSMUS.com

RSMUS.com