The clock is ticking – let these key software tools help you reduce your contract risk

LIBOR, or the London Inter-Bank Offered Rate, is a benchmark interest rate that has been used in financial instruments worldwide since the 1980s. This includes standard interbank products like interest rate swaps, futures, and options, and commercial products like variable rate mortgages and certificate of deposits or even student loans. LIBOR has also been considered as a gauge for market expectations on interest rates published by central banks and is used as a reference rate for many standard processes such as clearing and valuations all over the world.

Regulatory reform has begun in recent years to reform benchmark interest rates with an ultimate goal of replacing LIBOR as the interbank borrowing interest rate. As of January 1, 2022, banks will no longer be required to publish LIBOR and while there is much uncertainty as to a replacement rate (or multiple replacement rates). The Alternative Reference Rates Committee (ARRC) of the Federal Reserve has endorsed the Secured Overnight Financing Rate (SOFR) as a rate to replace LIBOR by 2023.

With LIBOR no longer being published and uncertainty around the replacement rate (or rates), this puts tremendous pressure on asset managers, private equity funds, banks and other financial institutions that have historically used LIBOR to identify where LIBOR exists in their portfolios and determine appropriate next steps for a replacement interest rate within each of the instruments they issue or hold. This complexity begs the question: How can these stakeholders review all of their deals and instruments in time to prepare for the transition?

Unfortunately, LIBOR data is unstructured and not only may look different for each portfolio but also for each deal, instrument, or loan. Each deal is unique, each contract may reference LIBOR differently, and contracts come in a large variety of formats and structures. How do you turn that text into a single, uniform structure that can be analyzed? It’s as complicated as turning letters into numbers and is a great opportunity to leverage the power of artificial intelligence.

Your business process for identifying and reducing LIBOR risk should include two key types of technology: artificial intelligence and business intelligence to ensure timely preparation for the transition away from LIBOR.

Artificial intelligence (AI) to automate contract review

Natural language processing (NLP) is a branch of AI focusing on giving computers the ability to understand text. This software has the ability to not only digitize contracts but to also take in text and assign it context, essentially “understanding” what it means so that the relevant language can be identified automatically. This allows for the repetitive task of identifying the relevant language to be automated so that analysts and team members can focus on the higher order item: assessing the risk within that language.

As the software continues to “read” more contracts, it can be trained to more effectively identify the language of interest. What is really exciting about this technology is that it essentially gets “smarter” as it reviews more contracts and continues to improve while working extremely fast. Though a human reviewer may realize some efficiency gain, that team member will eventually reach an optimal speed and begin to level out; with computers, the sky is the limit.

An example of LIBOR language NLP software can locate for analyst review.

An NLP tool allows teams to not only automate digitizing contracts, but also interprets the text and locates the language you need so that the contract review process focuses on the real value: analysis. By capitalizing on tools that use AI combined with OCR, you can create real efficiencies for your finance team, legal team, accounting team, and more — especially departments involved in contract review during the LIBOR transition.

Business intelligence (BI) to help you see LIBOR risk

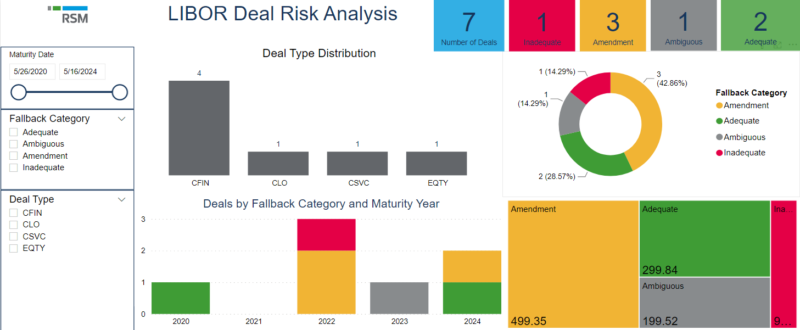

Once the unstructured data problem has been solved and the team has a standard set of data points in a consistent format, there’s a great case for business intelligence tools to analyze the entire dataset and make sense of the portfolio from a higher level. That’s the benefit of business intelligence tools – they help transform the dataset into a more digestible and understandable visual to provide a clearer picture of the analysis. This picture is critical to developing an informed plan for transition.

An example of a business intelligence dashboard for analysis of contract risk.

When dealing with a time crunch such as LIBOR, prioritize and focus on the most important deals to your business first. Business intelligence tools allow LIBOR transition teams to do just that – you can use the tool to identify priority contracts based on the risk criteria important to your business specifically. When that criteria changes, the tool allows teams to quickly change their analysis and adjust the relevant risk criteria. Many tools can also export a list of contracts to provide to the right people for prioritization during the remediation process. That’s the power of business intelligence – you can determine the risk criteria that is right for your business and then use that to inform a transition plan that is backed by data.

When these two tools are combined, analysts can really unlock their full potential for the LIBOR transition. Artificial intelligence expedites contract digitization and identifies the relevant language, allowing team members to focus on the actual analysis of that language and how that language poses risk to the organization. Business intelligence tools then allow the team to review the portfolio as a whole, apply a number of risk factors concurrently, and prioritize contracts for an informed remediation plan.

Conclusion

We’ve heard from many clients who have already manually inventoried their contracts. While that may have been a workable solution in 2020 and earlier this year, as the deadline approaches, a manual approach may not be feasible for many organizations. Clearly, technology is a must throughout the LIBOR transition, especially during a tight deadline when time is the most precious resource and every moment counts.

The nuances of the LIBOR transition are as complex as the technologies are varied. Consult an RSM professional for assistance with both.

RSMUS.com

RSMUS.com