NetSuite & Healthcare

Accounting in Healthcare comes with its own complexities and extensive requirements for any company situated within the industry. When growing to accommodate for more of these complexities it’s important that companies have a simple solution for the problems encountered. One of these areas is allocation schedules and their proper use.

Allocating costs properly gives leadership the capability to make more informed decisions and to get a better understanding of how their company is performing. With NetSuite, properly allocating these costs will be more efficient and less of a burden for companies as they see their organizations grow in size and sophistication of accounting requirements.

NetSuite Allocations Introduction

Allocation schedules are used to streamline expense management by distributing expenses efficiently across various segments.

- This can include departments, locations, classes, and custom segments.

Allocation schedules can allocate expenses from multiple accounts or using the same account.

- Users can also distribute expenses to departments, classes, or locations within the same account.

Allocation schedules can be fixed or dynamic.

- Fixed Allocation Schedules use a fixed weight, and this information is populated on the allocation schedule.

- Dynamic Allocation Schedules utilize statistical accounts to dynamically update the weights for the allocation.

- Statistical Accounts allow companies to track non-financial information such as number of employees at a location, or computers assigned to a specified department. These accounts are easily created and future changes to these accounts are easy to perform.

Healthcare & NetSuite’s Allocation Schedules

With the NetSuite’s process for building out allocation schedules healthcare clients will be able to easily streamline their allocation process and create the needed allocation journal entries each month as needed. Whether it’s fixed allocation schedules that remain the same for a fixed period or dynamic schedules that will update based on statistical accounts assigned, NetSuite can solve for a previously inefficient process.

Allocation of Indirect Costs with NetSuite

Scenario: We have allocated an expense to a marketing account and want to distribute this expense to different clinics to share the services equally.

First Step

The first thing we will do is create an allocation schedule entering a name, the subsidiary it is for, and the frequency of the schedule. In this example we will make this schedule for the US East subsidiary with a frequency of “end of period” and the next date this allocation schedule is set to create journal entries for as 8/31/24.

We will keep these fixed allocations schedule, but as previously mentioned we could make it dynamic and use statistical accounts to allocate costs instead of assigning a fixed schedule.

Second Step

Our next step is to assign the source accounts that the allocation schedule will distribute the expenses from. We will select the 6010 Expenses: Marketing account with the department of “Administration”.

The source account will be what NetSuite utilizes to look for associated transactions using the “6010 Expenses: Marketing” account with the Administration department tagged. This displays how detailed you can build out these allocation schedules as needed.

Third Step

For the third step we will assign the distribution accounts which will assign how our expenses will be allocated from the previously selected “6010 Expenses: Marketing” account in this example. We will assign the destination to the same account but tagging two different clinics to allocate the shared services. The newly tagged clinics will be Clinic East -1 and Clinic East – 2.

We have selected “Values Are Percentages” so we that we can assign a weigh of “50” to each of the destination accounts. With this we can be sure to split the amount evenly for any transactions that will come from the previously selected “Source” account.

In this example if a transaction has $1,000 associated with it, then it will evenly split the $1,000 into $500 for each of the selected destination accounts.

Associated Expenses

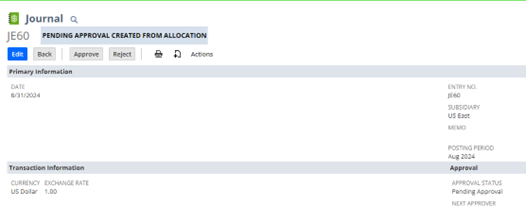

Click “Create JE” to create a Journal for any expenses within the period selected previously.

After we click “Create JE” a journal entry will be created that has fields that have been auto populated based on our previously selected values.

Here we can see how the expenses were split from the allocation schedule that was created with 50% being debited evenly to both “destination” accounts, and a credit for the entirety going to the “source” accounts.

First Steps with NetSuite

Readers may not have experience with NetSuite at this time, others may have experience but not with dynamic and fixed allocation schedules. If you are eager to get started with NetSuite the RSM team is here to help.

Let’s start with a consult and move on from there, we will work around your schedule – Contact Us

RSMUS.com

RSMUS.com