FOR DYNAMICS 365 FOR FINANCE AND OPERATIONS

Overview:

The managing of trade allowances in Dynamics 365 for Finance and Operations is an important feature for those companies that primarily deal with business-to-business sales. This feature offers discounts tied to specific promotions or programs that are budgeted within the company. This feature is not to be confused with trade agreements, which also offer discounts. These discounts are either in the form of prices or line/multi-line/total discounts. Resulting price reductions for both features effectively come to the same conclusion, yet they are configured very differently. The final result provides you the ability to set a budget and track how the promotion is working.

Process:

Let’s look at a few examples of what would be considered a trade allowance:

-

Example 1:

When you agree to provide a customer a price discount if they advertise your product. Later, you put it on an end cap in a retail store. Next step, you set up the trade allowance to show that you normally sell 1,500 of a particular item in a week. Last, you estimate that because of the advertising and product placement of the customer, you would expect that volume to increase by 40%.

-

Example 2:

Allocate a budget of $20,000 in discounts for a particular product family. This budget will be given to a specific group of customers.

-

Example 3:

Agree to share costs with a customer for building a specific display for your products. Then pay the customer by check when the display is completed.

Creating a Fund

The first step in creating a trade allowance is to create the “fund” for the promotion in Dynamics 365 for Finance and Operations. As a result, this budget you have set aside to account for the total of the price discounts will be given in hope of increased volume.

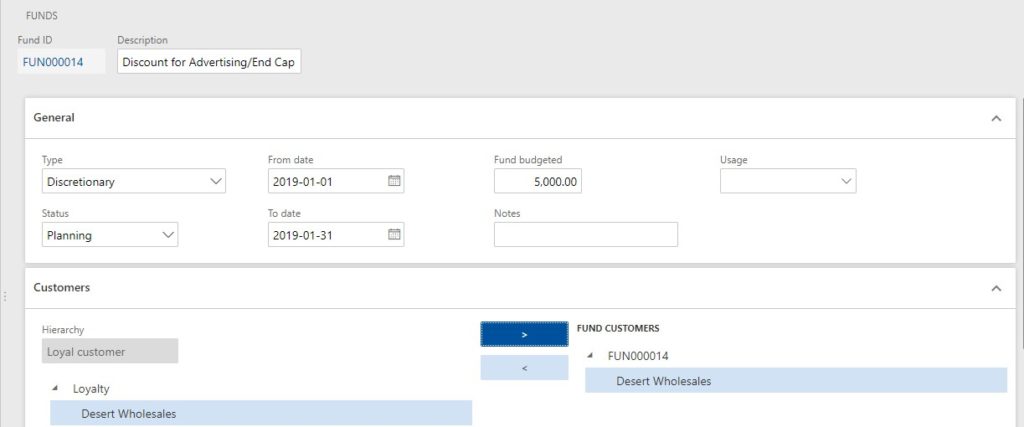

Sales and marketing > Trade allowances > Funds > Fund

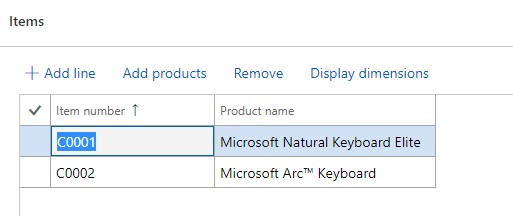

As you can see in the screenshot that we have selected Desert Wholesales as the customer. In the fund setup, there are added items to be discounted, which is shown in the screenshot below:

Setting Up Rules

Once we have the funds set up for the promotion, we define all the rules for the promotion in the Trade allowance.

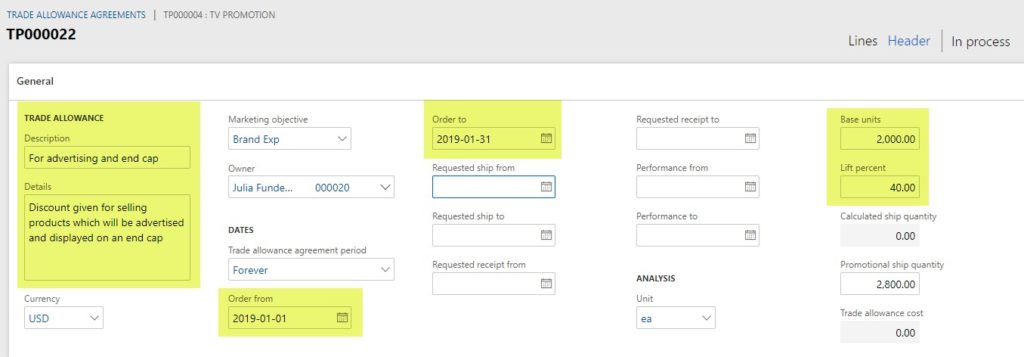

Sales and marketing > Trade allowance > Trade allowance agreements

The key areas in the Header view of the General FastTab are the name and description of the trade allowance, the dates of the promotion, and the base units or normal sales volume along with the Lift percent expected.

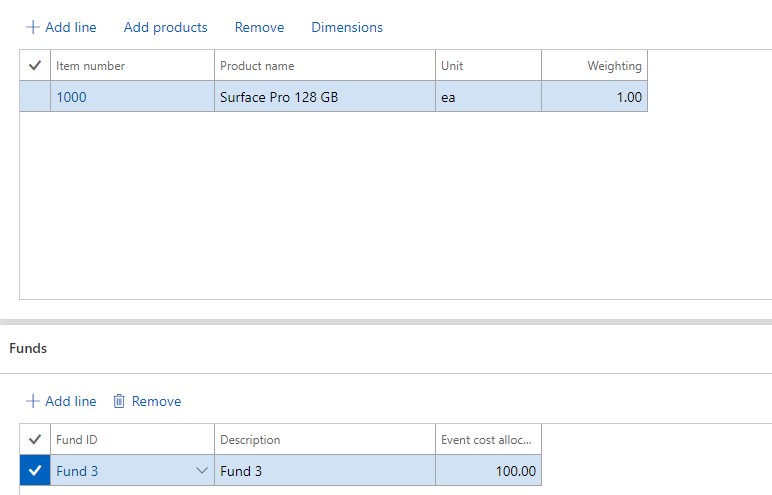

In the Header view, we also add the items and list the fund that will be used as the budget for the promotion.

Adding Merchandising Events

An important key area of the trade allowance is the definition for the merchandising events. This information is located on the Trade allowance agreement page, in the Line view. To see this, expand the Agreement lines FastTab.

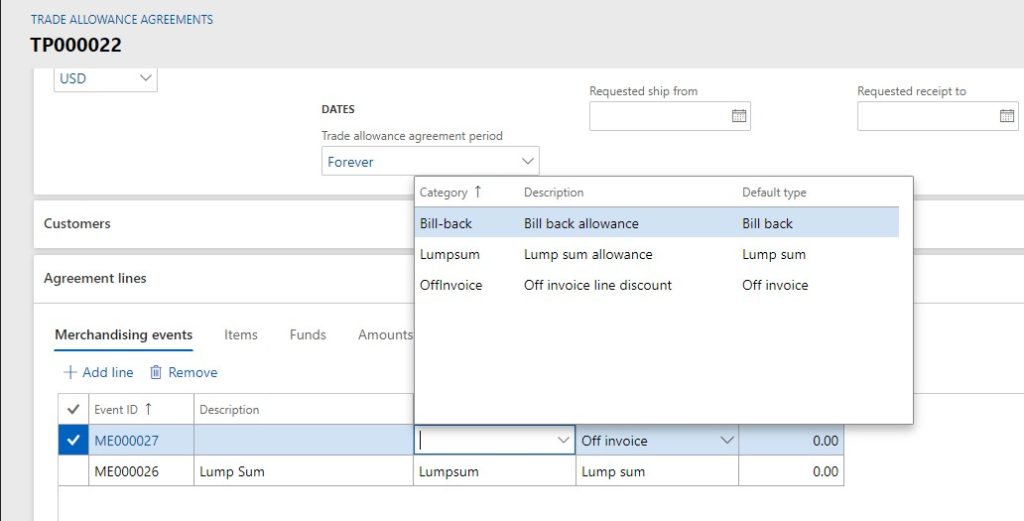

There are three event types, shown in this screenshot.

- Bill-back. This is where you set up how the discount will be populated, either by an amount off, a percentage off, or a specific price of an item. Once the bill-back is set up and a sales order is invoiced for the customer and for the item, you can choose to have a the discounted amount paid with a check. More commonly, this amount is deducted from the invoice on the sales order

- Lump sum. With this event type, you typically create an invoice to be paid to the customer or directly create a “negative” free text invoice so you can pay the customer

- Off invoice line discount. This event type looks exactly like a Trade agreement discount; as soon as you enter a line on a sales order that matches the criteria, the line is populated by the discount percentage, just like a Trade agreement. The difference, however, is that as these occur, you can keep track of the total discounts against the budget along with any sales lift

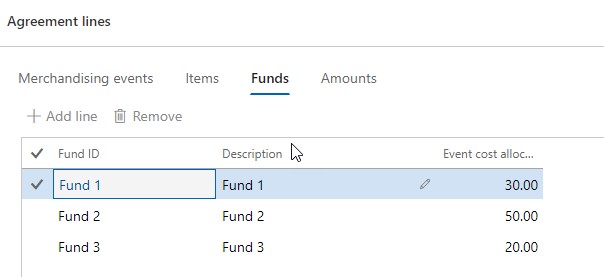

The merchandising event also includes the items and the funds to be used. It’s important to remember that you can provide discounts based on multiple funds, as you see on the screenshot below. This allows you to impact different budgets that you might have for different product groups. The Event cost allocation column here shows that any discount given will be split up by the different percentages listed.

Indicating Discounts

The final setup of the Trade allowance is found on the Amounts tab of the Trade allowance agreement page. This is where you indicate the discount, the lump sum and how it is paid, and any price/discount breaks for volume. For each type of merchandising event (bill-back, off-invoice, and lump sum) the Amount screen will be different.

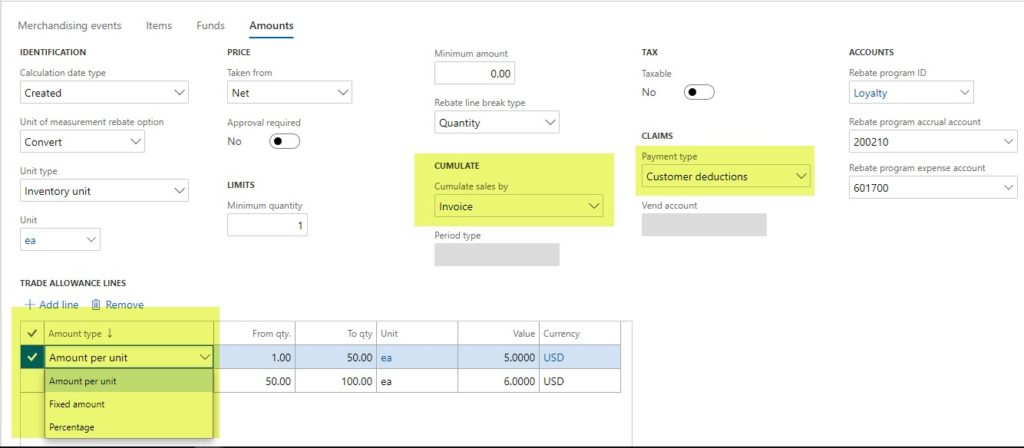

The screenshot below shows the Amount screen for a bill-back event. The key fields there are:

- Cumulate. By cumulating you will find the deduction to be accumulated by a single invoice, week, month, year, or custom date range. This also allows deductions to be totaled together if needed.

- Payment type. In this case, we have selected Customer deductions, but you can also select an option to Pay using accounts payable. Customer deductions mean when the customer pays the invoice. Next, they deduct the amount of the trade allowance earned. In this last step, there is a form on the Payment journal to enter the deduction.

- Notice the different ways you can compute the discount on the Trade Agreement Lines, and discounts per quantity of items sold. This can be seen in the lines area where we select the quantity breaks along with the discount allowed per item.

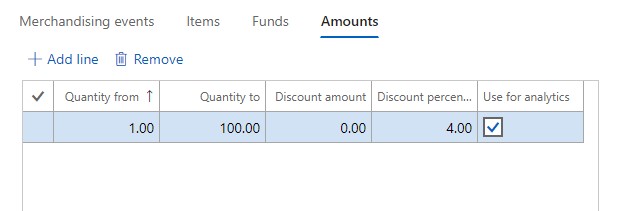

In the screenshot below show the Amounts tab for an Off-Invoice event, including the quantities of the items included, and the discount amount or percent.

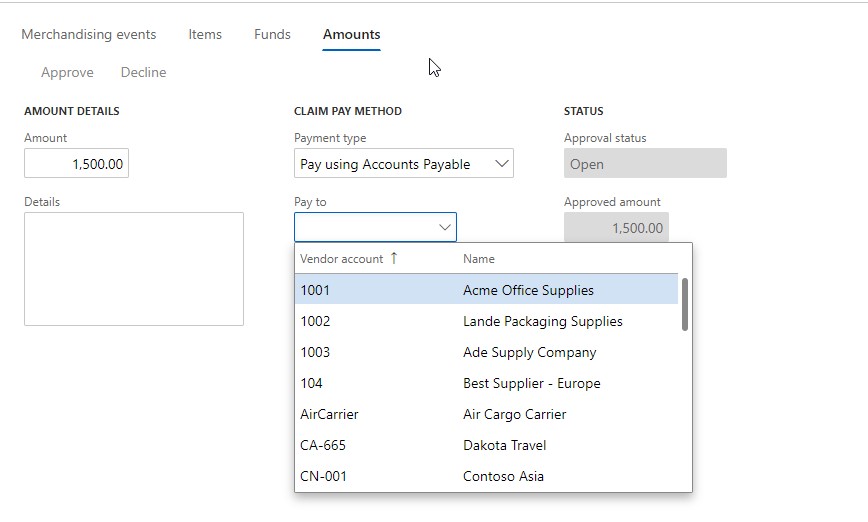

This Lump Sum event has an Amounts tab that shows the amount to be paid, and how to pay it. Review the screen shot below.

In the next article, we will cover the following:

- Process of capturing the rebate amounts

- Application of rebate amounts to sales invoices

- Review check preparation for payment to the customer

- Off invoice events, and how they look when they are processed

Want to learn more? Visit academy.rsmus.com for eLearning courses and information about our hosted training classes! You can also our Microsoft Dynamics experts at RSM (855) 437-7201.

RSMUS.com

RSMUS.com