Introduction of NetAsset

In NetSuite, Net Asset refers to the value of a company’s assets after accounting for accumulated depreciation and amortization. It represents the actual worth of long-term assets, such as property, equipment, and vehicles, over time. This feature is essential for maintaining up-to-date balance sheets and supporting compliance with accounting regulations. Net Assets provide a clear view of a company’s financial health and the value of its tangible investments.

Overview

NetAsset by Netgain is a SuiteApp for NetSuite that provides advanced fixed asset management, enabling businesses to streamline accounting, maintenance, insurance, and reporting throughout the asset lifecycle.

Key Benefits

-

100% Drill-Down Capability:

NetAsset in NetSuite allows users to drill down into detailed asset records, offering complete transparency and access to granular information. Users can view every transaction, change, and status related to assets, helping ensure full accountability and control over asset management.

-

Direct Links to the Asset Record Throughout NetSuite:

NetAsset offers seamless connectivity across various NetSuite modules. Users can easily access the asset record directly from purchase requests, orders, vendor bills, invoices, and journals. This direct linkage ensures that all asset-related information is available in one place, improving workflow efficiency and reducing the need for manual data entry.

-

Scheduling & Tracking of Maintenance, Claims, and Usage:

The platform allows for the scheduling and tracking of maintenance activities, claims, and usage of assets. This feature helps companies stay proactive in maintaining assets and ensures timely servicing, ultimately extending the life of the assets and avoiding costly repairs or downtime.

-

Capture Financial & Non-Financial Data:

NetAsset is designed to capture both financial (e.g., asset cost, depreciation) and non-financial data (e.g., asset location, condition, maintenance history). This comprehensive data capturing provides a complete overview of an asset’s performance, allowing for better decision-making and reporting.

-

Everything in a Unified System:

With NetAsset, all asset-related information is stored in a single, unified system. This eliminates the need for disparate systems and data silos, ensuring smooth collaboration across departments and a holistic view of asset management.

-

Zero Integrations or Outside Systems:

NetAsset operates within the NetSuite ecosystem, meaning there’s no need for additional integrations or external systems. This simplifies the process, reduces the complexity of managing multiple platforms, and ensures that all asset management tasks are streamlined within NetSuite itself.

Key NetAsset Capabilities

1. Proper Segregation of Duties Across AP, Fixed Asset, Accounting & Facilities Teams:

NetAsset ensures clear segregation of duties by assigning roles and permissions to different teams, such as Accounts Payable (AP), Fixed Asset, Accounting, and Facilities. This helps maintain internal controls, reduces the risk of errors or fraud, and enhances accountability.

2. Advanced Reporting Including Fixed Asset Roll-Forwards & Waterfall Reports:

NetAsset offers advanced reporting tools, including Fixed Asset Roll-Forwards and Waterfall Reports, which provide detailed insights into asset movement and changes over time. These reports help with comprehensive financial analysis and long-term asset planning.

3. Direct Connection to Vendor Bills & Projects:

NetAsset integrates directly with vendor bills and project management within NetSuite. This connection ensures that asset-related expenses and project costs are automatically linked to the relevant asset records, improving financial accuracy and visibility.

4. Reporting & Decision Support Throughout the Entire Asset Lifecycle:

The platform provides robust reporting and decision-making support throughout the entire asset lifecycle, from procurement to disposal. This continuous flow of data aids in strategic decision-making and ensures better asset performance management.

5. Comprehensive Physical Asset Tracking:

NetAsset includes comprehensive physical asset tracking capabilities, allowing organizations to monitor asset locations, condition, and usage. This improves asset visibility, reduces loss or misplacement, and optimizes resource allocation.

6. Intercompany Asset Transfers & Eliminations:

NetAsset supports intercompany asset transfers and eliminations, simplifying the process of moving assets between different business entities or subsidiaries. This feature ensures accurate accounting and reporting of intercompany transactions in compliance with financial standards.

7. Asset Build-Ups, Splits, Revaluations & Disposals:

NetAsset handles complex asset management tasks such as asset build-ups, splits, revaluations, and disposals. This flexibility allows businesses to manage changes in asset structure, accurately reflect asset value, and track the lifecycle of assets efficiently.

8. Advanced Alternate Depreciation Schedules & Multi-Book Enabled:

NetAsset supports advanced depreciation schedules, including alternate depreciation methods, and is multi-book enabled. This means businesses can manage different depreciation rules for various financial reporting needs, ensuring compliance with international accounting standards.

9. Bulk Processing:

The platform allows for bulk processing of asset-related transactions, such as asset acquisitions, transfers, and disposals. This feature enhances operational efficiency by enabling the handling of large volumes of assets simultaneously.

10. Robust End-to-End Audit Trail:

NetAsset provides a robust audit trail that tracks every action taken on an asset from acquisition to disposal. This comprehensive history ensures full accountability, transparency, and compliance with auditing and regulatory requirements.

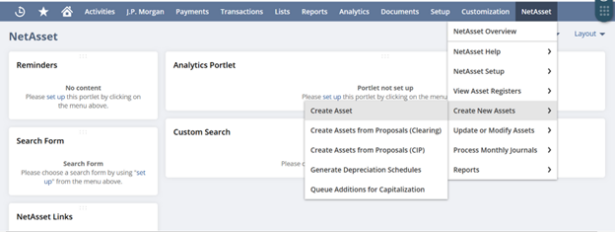

How to Manage NetAssets in NetSuite

Effective management of NetAssets in NetSuite involves setting up and maintaining your asset records, applying appropriate depreciation methods, and leveraging reporting features. Here’s how to get started:

1. Set Up Asset Records

Before tracking NetAssets, you need to establish asset records for each of your company’s assets. NetSuite allows you to create detailed records that capture all the important information related to each asset, including:

- Asset Type (e.g., vehicle, machinery, property)

- Purchase Date and Cost

- Expected Useful Life

- Depreciation Method

- Asset Location (for physical assets)

2. Depreciation Management

NetSuite enables you to apply different depreciation methods depending on the asset type and your accounting policies. Common methods include:

- Straight-Line Depreciation: Spreads the cost of the asset evenly over its useful life.

- Declining Balance Depreciation: Accelerates depreciation in the earlier years of the asset’s life.

- Units of Production Depreciation: Ties depreciation to usage, like hours of operation or units produced.

By automating depreciation calculations, NetSuite reduces the chances of manual errors and ensures consistent asset management.

3. Track Asset Changes

As assets are bought, sold, or transferred, NetSuite ensures these changes are reflected immediately in your records. For instance, if an asset is sold or transferred, NetSuite will automatically adjust the asset’s value and depreciation.

4. Monitor Asset Performance

NetSuite’s reporting features allow you to analyze your asset performance and NetAsset value in real time. Use the platform’s built-in reports, such as:

- Balance Sheet Reports: View your assets, liabilities, and equity at any given time.

- Fixed Asset Reports: Track the depreciation and book value of your assets.

- Custom Reports: Design reports tailored to your company’s unique asset structure and financial goals.

5. Integrate with Other Modules

NetSuite’s seamless integration with other modules, such as procurement, accounts payable, and inventory management, allows you to track asset acquisition, maintenance, and disposal in one unified system.

Why choose Netasset in Netsuite

- Seamless Integration: NetAsset integrates directly with NetSuite, ensuring centralized data management across financials and assets. This reduces manual input and enhances consistency.

- Automated Depreciation: Automatically calculates depreciation and posts entries, saving time and minimizing errors in financial reporting.

- Real-Time Reporting: Provides up-to-date insights into asset value, usage, and status, helping businesses make informed decisions.

- Compliance: Ensures compliance with accounting standards like GAAP and IFRS, keeping asset management and financial reporting in line with regulations.

- Scalability: As your business grows, NetAsset easily scales to manage more assets across locations and departments.

- Efficiency: Simplifies asset lifecycle management from acquisition to disposal, streamlining processes and improving operational efficiency.

- User-Friendly: With an intuitive interface, NetAsset makes asset tracking and management simple for users, requiring minimal training.

Conclusion

By choosing NetAsset within NetSuite, businesses gain better control over their assets while enhancing financial visibility, reducing manual work, ensuring compliance, and improving operational efficiency.

RSMUS.com

RSMUS.com